Indirect Cost Policy

Page 2 of 7

Revised IDC Policy February 2017 For external use IDC Policy and Guidance February 2017

Effective 2/1/2017

Indirect Cost Guidance

Philosophy

T

he Bill & Melinda Gates Foundation tackles critical problems primarily affecting the world’s poor and

disadvantaged, and supports strong and effective partner organizations to do the same. We believe that

good stewardship means maximizing our resources, including grant funding and staff time, while

building strong partnerships based on trust.

W

e aim to structure grants in a way that makes sense from a financial perspective while also funding

partners for the cost of delivering results efficiently, supported by open and honest dialogue about the

resources required. As grant proposals are developed, we try to gain a complete and accurate

understanding of the total cost to execute the project efficiently and effectively. However, there may be

circumstances when our views of direct and indirect costs may not align with those of our partners,

including other funders.

O

ur expectation is that grantees’ executive and board leadership are continually evaluating how to

“right size” their organizations’ overhead cost to operate efficiently and effectively.

W

e welcome partners to contact the foundation if they have questions about this policy. Our finance

team can help clarify appropriate treatment of costs under the foundation’s policy.

Definitions

The spirit of this policy is to pay for expenses that are directly attributable to project outcomes and

outputs as direct costs and expenses associated with general running of the business as indirect costs.

Greater specificity on each category is described below.

D

irect Costs

Direct costs are the expenses required to execute a grant that are directly attributable and can be

reasonably allocated to the project. Program staff salaries, travel expenses, materials, and consultants

required to execute the grant are examples. Costs that would not be incurred if the grant did not exist

are often indicative of direct costs.

Indirect Costs

Indirect costs are general overhead and administration expenses that support the entire operations of a

grantee and that may be shared across projects. Examples include facilities expenses, e.g. rent, utilities,

equipment for the grantee’s headquarters, and associated information systems and support and

administrative staff such as HR, general finance, accounting, IT, and legal. Additional examples and detail

are included in Annex A. Expenses that would be incurred regardless of whether the grant is funded are

often indicative of indirect costs. While these costs may not be directly attributable to a project, they

are real and necessary to operate as an organization.

I

ndirect Cost Rate

Indirect Cost Rate = Budgeted Indirect costs/ Budgeted Total Direct Costs (e.g. personnel, sub‐awards,

supplies, equipment, etc.)

Page 3 of 7

Revised IDC Policy February 2017 For external use IDC Policy and Guidance February 2017

The indirect cost rate proposed in the budget should not exceed the grantee’s organizational rate (when

defined by the same terms.)

While the definitions above are general guidance for all grants, the requirements and activities of each

project should be considered when determining direct and indirect costs. We review budget

assumptions and cost categorizations on a grant by grant basis, and treatment of specific costs in one

grant should not be considered precedent‐setting for other grants.

Maximum Indirect Cost Rates

Indirect cost rates for grants are subject to the following limitations:

•

The rates provided above are the maximum rates allowed under the foundation’s policy. A

grantee or

contractor with an actual indirect cost rate lower than the maximum rate provided

above should not increase

the funding request to the maximum allowed. The intent is to

sufficiently fund actual costs, not to generate financial surpluses for grantees.

•

The indirect cost rate awarded in a grant budget may vary up to the maximum percentages

depending on factors including, but not limited to, the type of project, level of administrative effort

required, cost structure of the grantee, overall grant size, and extent of sub‐awards or commodity

purchases.

o

Example 1: A primary grantee will receive grant funds that will be largely sub‐granted to

other organizations. The foundation may limit indirect costs the primary grantee receives

on the sub‐granted funds depending on the level of effort required to manage the sub‐

awards. The overall effective indirect cost rate awarded to the primary grantee may

therefore be less than the maximum allowable rate.

o

Example 2: A material portion of a project budget is allocated for commodity purchases. A

lower overall effective indirect cost rate may be negotiated to remove commodity cost

from the indirect cost calculation.

o

Example 3: A NGO grantee has an organizational actual indirect cost rate of 8%, i.e., for

every $1,000 in direct costs, it has $80 in indirect costs. Rather than defaulting to the

maximum rate of 15% in the grant proposal, 8% should be proposed in the grant budget.

•

Maximum Indirect Cost Rates and limitations apply to both the primary applicant

organization and any sub‐grantees. Each respective organization may receive indirect costs

UP TO the rate applicable to their

organization type.

o

Example: If a U.S. university is the primary grantee and has an international nonprofit

organization sub‐grantee, the U.S. university is eligible to receive up to a 10% indirect cost

rate, while the international organization is eligible to receive up to a 15% rate.

Page 4 of 7

Revised IDC Policy February 2017 For external use IDC Policy and Guidance February 2017

•

We seek consistency across funding mechanisms and thus we reserve the right to apply

this philosophy and principles to contracts.

•

For profit entities may propose indirect costs as a percentage from 0% up to 15% to the

extent that adequate explanation of the cost is provided.

•

We reserve the right to request substantiation of any grantee’s indirect cost rate.

Page 5 of 7

Revised IDC Policy February 2017 For external use IDC Policy and Guidance February 2017

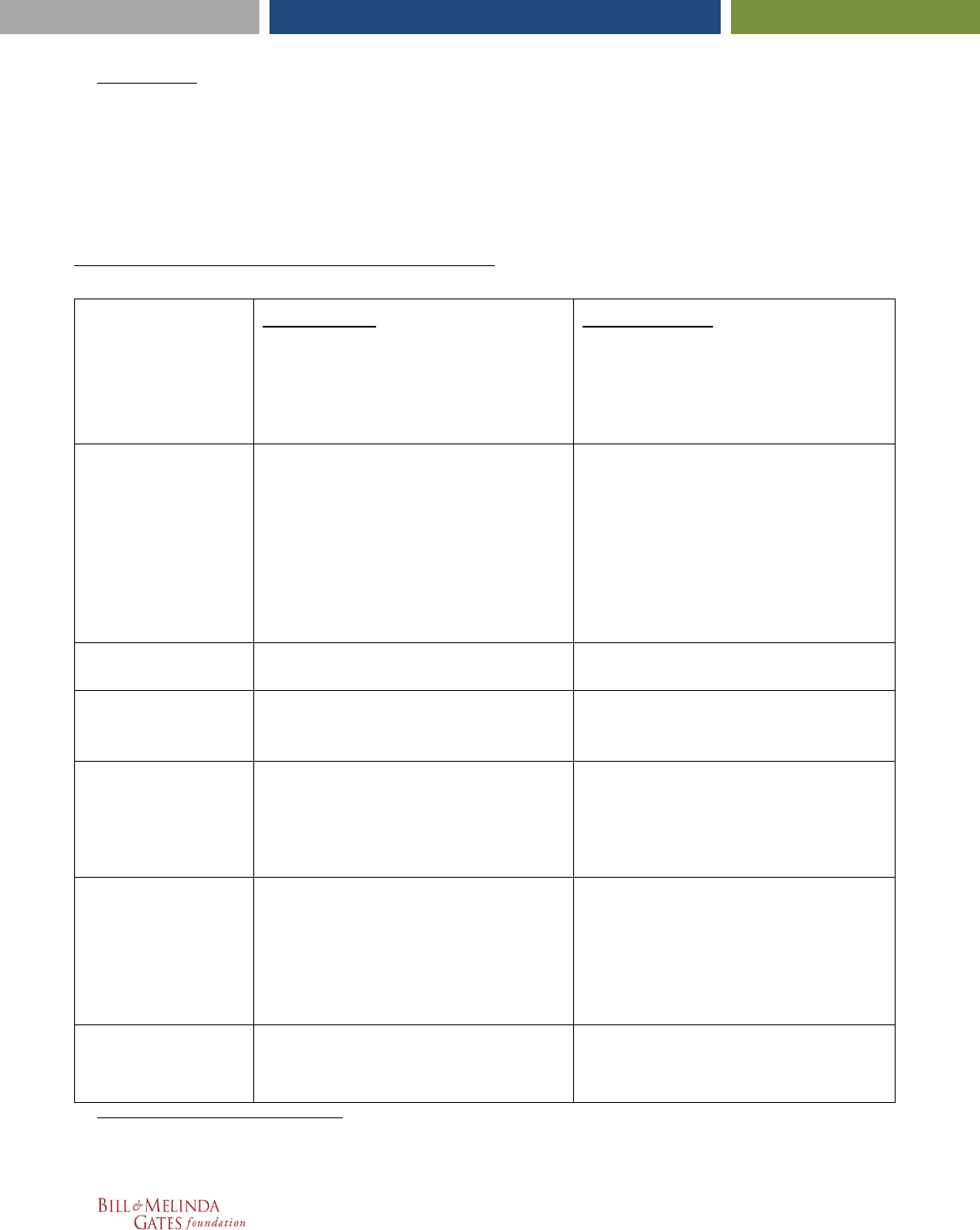

APPENDIX A:

The following is a list of common direct and indirect costs. We recognize that there are categories

of cost that can be considered either direct or indirect depending on grantee accounting practices

and the nature of the cost relative to the project purpose.

It is the responsibility of grantees to submit proposal materials that allow us to understand the link

between project outcomes and direct costs. We also expect that grant proposals speak to what is

covered by the requested indirect cost rate.

EXAMPLES OF COMMON DIRECT AND INDIRECT COSTS

DIRECT COSTS:

The following may be included as direct

costs if DIRECTLY ATTRIBUTABLE and

REASONABLY ALLOCABLE to and

specifically required to execute the

project

INDIRECT COSTS:

The following may be included as

indirect costs if REASONABLY

ALLOCABLE the project and not

included as a direct cost

Personnel

• Salaries and wages of employees

working directly on the project.

• Fringe benefits of employees

These costs should be substantiated by time

keeping and/or an allocation methodology, and

can include directly attributable and allocable

project management and support, project legal

or accounting functions (substantiated by

timekeeping)

• Personnel cost of general

management and administrative

support personnel, such as executive

management (CEO, COO, CFO, etc.)

or central operational functions

(Accounting, HR, IT, Legal, etc.)

Travel

• Travel expenses for trips directly

needed to deliver the project

• Travel not directly related to the

project

Consultants

• Contracted staff working directly on

the project

• Contracted staff for general

administrative functions, such as

accounting or audits

Equipment

• Costs for equipment directly used by

the project (can include

purchase/replacement, operation,

maintenance; to be pro‐rated in case

of partial use)

• Costs for equipment or depreciation

on equipment

1

incurred by central

operational functions

Other Direct Costs

• Allocable facilities, utilities and

communications expenses that are

required to execute the project, such

as field clinics, laboratories, project

office costs

•

Project‐specific supplies

• Costs for facilities, utilities and

communications associated with

central operational functions such as

university headquarters, U.S. office of

an international NGO, back office of a

biotech firm

Sub-awards

• Grants or contracts with other

organizations that directly contribute

to the project outcomes

• Outsourced general operating

activities, such as accounting, audits,

IT support

1

If depreciation is included in the indirect cost pool, the acquisition cost used for computing depreciation must exclude any

portion of the cost donated by the foundation or another funder.

Page 6 of 7

Revised IDC Policy February 2017 For external use IDC Policy and Guidance February 2017

APPENDIX B: Frequently Asked Questions (FAQs)

•

Question: What has changed in the 2017 policy update? The rates still look the same.

Answer: While the maximum indirect cost rate percentages have not changed, we have adjusted

the costs that can be considered direct to better reflect the cost of achieving project outcomes,

specifically in the areas of facilities and project support.

•

Question: When will these changes take effect?

Answer: The IDC policy will take effect on February 1, 2017 and all new grants made from

that date forward will be affected by the new policy.

•

Question: Why doesn’t the foundation match my institution’s Negotiated Indirect

Cost Rate Agreement

(NICRA) rate with the U.S. government or other funding

organizations?

Answer: The foundation’s position is that whenever possible,

specifically allocable costs should be

identified as direct costs, including those for dedicated ongoing project

management and support.

Please see Appendix A for examples of direct and indirect costs. Please note that

our

categorization differs from the U.S. government’s instructions to treat project management and

support

expenses as indirect costs. The foundation funds these costs as direct costs onto which is

added up to 15% for indirect costs which are not directly attributable to the project.

•

Question: Why are headquarters facilities typically not classified as direct costs?

Answer: Headquarters rent and other centralized facilities costs are part of doing business for an

organization and therefore are not

specifically attributable to a project or activity. These facility

expenses of the organization should be

categorized as indirect costs. In some cases, we are

willing to cover the facility expenses associated with directly attributable personnel that sit in

the same headquarters facility but directly support the project funded by the foundation’s grant.

Facility expenses more than this allocation are considered indirect and are subject to the indirect

rate limitations of the primary grantee noted in the Indirect Cost Policy

•

Question: How does the calculation of indirect costs work for the primary grantee and

the sub‐grantee?

Answer: The primary grantee receives indirect cost allowances on the total budget which

includes its direct internal costs and sub‐granted or sub‐contracted costs. The ‘sub‐granted’ or

‘sub‐contracted’ funds would also include direct

costs and indirect costs to that respective

institution. The calculation may look as follows:

Grant to University ABC:

ABC direct internal costs (personnel, supplies, travel, etc.) ‐> 5.85M

Sub‐granted costs to non‐profit organization XYZ ‐> $1.15M

•

Includes direct sub‐grantee costs ‐ $1.0M

•

Includes indirect cost allowance to sub‐grantee (15%) ‐ $150k

Total direct costs to non‐profit organization ABC ‐> $7.0M

Page 7 of 7

Revised IDC Policy February 2017 For external use IDC Policy and Guidance February 2017

Indirect cost allowance to primary grantee (10%) ‐> $700k

Total grant award -> $7.7M

•

Question: Why are indirect costs not provided to other foundations and government

agencies?

Answer: As a foundation based in the U.S., we generally must ensure that our funds are used for

charitable

purposes. When the foundation makes a grant or enters into a contract with a U.S.

public charity, the

organization’s status as a charity by the U.S. government is based on an

assessment of the organization’s

mission and activities to confirm the funds will be used for

charitable purposes.

Government entities are typically funded

by the citizens of the country for various agencies (e.g.

Ministry of Health, Finance, Agriculture, etc.) Government entities are benefiting the

communities of which the citizens are a part. Therefore, our policy is to fund the program‐specific

costs related to our project or activity, but the

administrative and general operations costs of the

government agency should be funded by the respective

country’s budgetary funding. Similar

logic applies to private foundations.

•

Question: Why do U.S. universities receive a lower rate than international universities?

Answer: The foundation has an important relationship with university grantees to perform

valuable work

projects, including but not limited to discovery research, vaccine development,

and clinical trials. The

foundation’s policy considers that U.S. universities should request a

limited amount of indirect costs from

private funders. In the U.S., indirect costs recoveries are

negotiated with federal funding agencies because most U.S. funded research is performed on

university campuses. Therefore, the foundation’s policy

is to provide a rate of up to 10% to U.S.

universities to allow for additional administrative and overhead costs of the

institution to be

funded by other sources.

•

Question: How do I determine if a cost is direct or indirect if it is not clear?

Answer: The key differentiating factor should be whether the cost is required and allocable to

the project to meet its objectives. Here are several examples to help illustrate the distinction:

o

An audit function could be considered indirect if it is organizational internal audit

performing routine activities. However, if extra due diligence is required for new sub‐

awards on a particular project, the audit function to carry that out may be considered

direct.

o

An organization can have accountants that manage the central organizational costs and

some that are assigned exclusively or on a percentage basis to specific projects. In this

case, the former would be considered indirect and the latter direct.

o

A local NGO has a headquarters in the capital city which also houses project‐specific staff

for work done in that region. In this case, the portion of the office that houses the

headquarters functions would be considered indirect and the space dedicated to specific

projects could be considered direct if incrementally needed to achieve project objectives.