Indirect Cost Toolkit for

Continuum of Care (CoC)

and Emergency Solutions

Grants (ESG) Programs

Released March 2021

This toolkit is current as of November 2019 and does not include

recent changes to the final Uniform Administrative Requirements

U.S. Department of Housing and Urban Development (HUD)

This resource is prepared by technical assistance providers and intended

only to provide guidance. The contents of this document, except when based

on statutory or regulatory authority or law, do not have the force and effect

of law and are not meant to bind the public in any way. This document is

intended only to provide clarity to the public regarding existing requirements

under the law or agency policies.

Contents

1. Introduction _________________________________________ 1

1.1 About This Toolkit 1

1.2 How to Use This Toolkit 3

2. What are direct and indirect costs? _______________________ 4

2.1 Examples of Costs 6

2.2 Allowability of Costs 10

3. What are the options for the reimbursement of indirect costs? _ 12

3.1 The 10 Percent De Minimis Rate 12

3.1.1 Eligibility Criteria for the 10 Percent De Minimis Rate 13

3.1.2 Modified Total Direct Cost (MTDC) for the 10 Percent De Minimis Rate 14

3.2 Indirect Cost Rate Agreement 22

3.3 Cost Allocation Plan 24

3.4 Allowable Cost Allocation Methods 25

3.4.1 Simplified Allocation Method 26

3.4.2 Multiple Rate Allocation Method 28

3.4.3 Direct Allocation Method 29

4. Which option is best for my organization? _________________ 31

4.1 Considerations for Selecting an Indirect Cost Rate Option 31

4.2 Pros and Cons of Different Indirect Cost Rate Methods 32

4.3 Steps for Choosing an Indirect Rate Methodology 35

5. How are indirect cost reimbursement options calculated? _____ 36

5.1 Calculate and Use the 10 Percent De Minimis Rate 36

5.1.1 ESG De Minimis Rate Indirect Cost Calculation Example 37

5.1.2 CoC De Minimis Rate Indirect Cost Calculation Examples 38

5.2 Negotiate and Use an Indirect Cost Rate 40

5.2.1 Submission of Proposal 41

5.2.2 Approval of Proposal 43

5.2.3 Disputes 43

5.3 Prepare and Use a Cost Allocation Plan 43

6. Frequently asked questions ____________________________ 45

7. Definitions _________________________________________ 50

Indirect Cost Toolkit for CoC and ESG Programs Page 1

1. Introduction

1.1 About This Toolkit

This Toolkit has been developed to assist recipients and subrecipients under

the Continuum of Care (CoC) and Emergency Solutions Grants (ESG)

programs to better understand indirect costs—such as facility or

administrative costs—and how they can be calculated and charged under

these programs. Recipients can use this Toolkit to make an informed

decision concerning the best method for computing and seeking

reimbursement for indirect costs under ESG and CoC program grants. Please

note that CoC program grants include all awards made under the Youth

Homelessness Demonstration Program (YHDP) and can be used relative to

those awards.

In 2014, the United States Office of Management and Budget (OMB)

released final regulations on indirect costs under the Uniform Administrative

Requirements, Cost Principles, and Audit Requirements for Federal Awards

(2 Code of Federal Regulations [CFR] Part 200), also referred to as the

Uniform Administrative Guidance. These regulations explain that a recipient

or subrecipient’s indirect costs are legitimate expenses that may need to be

reimbursed for the organization to be sustainable and effective.

Non-federal entities administering federal funds are not required to seek

recovery and reimbursement for indirect costs related to their federal

awards. However, when non-federal entities decide to seek reimbursement

for indirect costs, the Uniform Administrative Guidance requires pass-

through entities (that is, the direct recipients of federal funds, or

“grantees”—typically states and local governments) and all federal agencies

to reimburse a recipient’s or subrecipient’s indirect costs.

All federal pass-through entities (recipients or grantees) are also required to

ensure that all subrecipients of federal funds document and use one of the

methods allowed under 2 CFR §200 for determining indirect cost rates (2

CFR §200.331(a)(1)(xiii)) as part of the sub-awarding of federal funds.

There are several methods for determining, allocating, and charging indirect

costs. These methods are the subject of this Toolkit. In particular, this

Indirect Cost Toolkit for CoC and ESG Programs Page 2

Toolkit helps ESG and CoC recipients and subrecipients understand the

requirements for the different ways they can charge the grant for indirect

costs for each of their programs.

This Toolkit does not replace the regulations contained in 2 CFR Part §200,

24 CFR §576 (ESG), 24 CFR §578 (CoC), and subsequent amendments,

notices, and any other applicable federal, state, and local laws and

ordinances; it simply details requirements for indirect cost reimbursement

under ESG and CoC programs. It also does not replace guidance and

regulations that govern federal awards and allocations issued prior to the

effective date of 2 CFR §200 (as found in 24 CFR §84 and §85). Recipients

and subrecipients should always refer to applicable regulations and their

grant agreements, and work with their local HUD Field Office to determine

what is allowable under their program and how indirect costs can be

reimbursed.

Uniform Administrative Requirements, Cost Principles, and Audit

Requirements for Federal Awards (“Uniform Administrative Guidance”):

► OMB issued final guidance on December 26, 2013 which became effective

December 26, 2014. Generally, this means that:

• 2014 Grant Year and subsequent grant year ESG Awards and on are

covered by 2 CFR §200.

•

2015 Grant Year and subsequent grant year CoC Awards and on are covered

by 2 CFR §200. (Note: this later effective date for CoC Awards was a result

of the procurement cycle of CoC Awards and their underlying appropriation

dates.)

► Regulations are found at 2 CFR §200

, and resources on the Uniform Administrative

Guidance are found on the Council on Financial Assistance Reform website.

► For more information about effective dates and HUD’s Transition Rules, review

Notice SD-2015-01: Transition to 2 CFR §200, specifically “General Transition

Rules” on page 15, and Notice CPD 16-04: Additional Transition and

Implementation Guidance.

Indirect Cost Toolkit for CoC and ESG Programs Page 3

1.2 How to Use This Toolkit

This Toolkit is organized into the following sections:

1) Introduction

2) What are direct and indirect costs?

3) What are the options for the reimbursement of indirect costs?

4) Which option is best for my organization?

5) How are indirect cost reimbursement options calculated?

6) Frequently Asked Questions

7) Definitions

This document contains general information regarding the treatment of

direct and indirect costs. The determination and allocation of direct and

indirect costs at the program and agency levels is dependent on multiple

factors, such as the size of the organization, the nature of its programs, the

complexity of its structure, and the organization’s overall approach to

financial management. Given this, the Toolkit cannot and does not address

every possible situation or question that the reader might have. In fact, the

document purposely does not include details of how to implement direct and

indirect cost allocation methods in a program or organization. In all cases,

HUD encourages recipients and subrecipients to develop cost allocation

methods, policies, and procedures in consultation with an accountancy

professional familiar with federal cost principles.

Indirect Cost Toolkit for CoC and ESG Programs Page 4

2. What are direct and indirect costs?

Before exploring the methods available through the Uniform Administrative

Guidance for recovering indirect costs, let’s first take a quick look at what

we mean by direct and indirect costs.

The Uniform Administrative

Guidance (2 CFR §200.413)

defines direct costs as

“those costs that can be

identified specifically with a

particular final cost

objective.” For ESG and CoC

programs, most expenses

are direct costs and are

exclusively used for that program (e.g., case manager salary, rental

assistance for clients, purchase of food for shelter meals).

In contrast, indirect costs (2 CFR §200.56) are costs “incurred for a common

or joint purpose benefiting more than one cost objective, and not readily

assignable to the cost objectives specifically benefitted.” These costs are

shared by more than one program.

Understanding the distinction between direct and indirect costs is essential

to this entire resource. In general, most, if not all, costs incurred by an

organization performing activities under the CoC or ESG programs will be

direct program costs. That is, in most or all cases, a dollar spent can directly

be identified as being spent on a program objective or activity. A dollar

spent would only be indirect if it cannot be easily associated with a particular

CoC or ESG activity. For example, if an organization had only one source of

funding, a single ESG grant, then 100 percent of its expenses would be

direct, because all costs are solely and clearly tied to an ESG award and

related activities. On the other hand, if an organization had more than one

funding source and had multiple programs in its portfolio, then some costs—

such as administrative costs and overhead costs like facility rental and

utilities—will be hard to tie to a single funding source and activity, and are

thus shared or indirect costs.

Cost objective means a program,

function, activity, award,

organizational subdivision, contract, or

work unit for which cost data are

desired and for which a provision is

made to accumulate and measure the

cost of processes, products, jobs,

capital projects, etc.

Indirect Cost Toolkit for CoC and ESG Programs Page 5

When costs are shared and thus likely indirect, the Uniform Administrative

Guidance (2 CFR §200.414) further classifies indirect costs as being limited

to administrative and facilities costs (A&F). The Guidance defines facilities as

“depreciation on buildings, equipment and capital improvement, interest on

debt associated with certain buildings, equipment and capital improvements,

and operations and maintenance expenses.” It defines administrative as

“general administration and general expenses such as the director’s office,

accounting, and personnel.” Indirect costs will fall into one of these two

buckets: administrative or facilities. Under the Uniform Administrative

Guidance, all indirect costs are either facilities costs or administrative costs.

It is important to pause here and add some important qualifications to the

broad discussion in this document, especially around the use of the terms

direct and indirect costs and facilities and administrative costs. There is no

one-size-fits-all use of any of these terms. In fact, a key takeaway from the

Uniform Administrative Guidance in 2 CFR §200 regarding these terms is

that the federal government recognizes a wide diversity of organization

types and structures, ranging from the smallest nonprofit to large nonprofit

conglomerates (such as hospital groups or multi-state organizations like the

American Red Cross) and local and state governments. The federal

government allows for a diversity of cost accounting methods in response to

the diversity of organizational types and structures.

Given this, care should be taken with the terminology in this document. For

example, it is the case that a program cost that is charged as a direct

program cost by one organization may be—with complete legitimacy—

charged as an indirect program cost by another organization, based on the

organizations using different, but sanctioned, methods for allocating and

charging costs and depending on how their program funding is structured. It

is also the case that, though 2 CFR §200 discusses cost types such as

facilities and administrative as general categories, particular federal

programs such as the CoC or ESG programs will have their own definitions of

what costs are allowable within these particular cost categories.

Therefore, this Toolkit aims to provide broad information about these

indirect and direct costs, focusing on the various cost accounting methods

available to determine how such costs will be categorized and treated. Our

objective is to broadly present the various methods available for direct and

Indirect Cost Toolkit for CoC and ESG Programs Page 6

indirect cost allocation that allow non-federal entities to recover indirect

costs through their grant awards, with particular attention on the de minimis

method that was new with the issuance of 2 CFR §200.

2.1 Examples of Costs

Administrative costs are typically recovered by non-federal entities as an

eligible activity on their grant. Both the CoC (CoC, 24 CFR §578.59) and the

ESG (ESG, 24 CFR §576.108) programs allow “project administrative costs”

as an eligible activity. Program regulations include specifics for each

program regarding eligible program administrative costs. Any CoC or ESG

program administration costs charged to an award will need to be eligible

under the particular program’s regulations. The CoC program caps project

administrative costs at 10 percent of awarded funds, and the ESG program

caps project administrative costs at 7.5 percent. As long as CoC and ESG

recipients are charging administrative costs under this eligible activity (as

defined by each program), CoC and ESG providers are already recuperating

at least some of their potentially recoverable indirect costs.

Though CoC and ESG regulations define eligible administrative activities and

set caps under each program, it can be challenging sometimes to determine

the line between when a cost is administrative and when it should be directly

charged to a particular activity. For example, a program director’s time and

office overhead (space, supplies, equipment, etc.) may fit in either category.

If a program director spends time compiling annual reports, working on

program budgets, and engaging in similar administrative activities, that time

(and the associated share of overhead facilities costs) would be

administrative and, if the position was responsible for multiple programs,

then such costs would be shared (and, thus, likely treated as indirect). But,

if that same program director also spent time (say, in their office) providing

direct supervision and oversight to program staff or working on program

policies, procedures, and programmatic documentation, then that would not

be an administrative cost but a direct program activity cost.

The costs that fall under facilities can present a similar challenge for non-

federal entities. For example, an organization may own or lease a single

facility where they engage in both administrative and direct program

delivery activities. Furthermore, they may have equipment such as copiers,

Indirect Cost Toolkit for CoC and ESG Programs Page 7

internet and phone systems, and furniture that are shared by both

administrative and direct program functions. Finally, the facility may have

only a single account for services such as electricity, internet and phone

service, and security.

Given the complexity of sorting out direct and indirect costs and determining

how to categorize personnel and overhead costs into administrative and

facilities categories, organizations can easily make common errors of

conflating different types of costs. This may unnecessarily limit their

opportunities to have legitimate program costs reimbursed as part of a CoC

or ESG award. Consider, for example, a program that provides ESG rental

assistance in the form of rent payments to property owners. The

organization rents a single office building for its administration and direct

program staff. There are frontline persons who work with participating

households, determine program eligibility and levels of assistance, and

approve units for rental assistance. There is also a program director who

supervises the staff and manages the budget and reporting, and finance

personnel who handle payroll and manage payments to vendors and

landlords. There are supplies, utilities, and equipment that are purchased or

leased to support the entire operation. Finally, the organization has Housing

Opportunities for Persons With AIDS (HOPWA) funding to perform similar

activities, and the same staff manage that program.

Which expenses are direct? Which are indirect? The organization buys

equipment (e.g., desks, chairs, phones, binders) in bulk and office cleaning

services that are shared by all parts of the organization. According to the

definition of facilities costs above, these would all be facilities costs and thus

likely are indirect costs. They are all not easily assigned to a single function

at the organization (such as administration, HOPWA, or ESG only). Since all

indirect costs are either administrative or facilities costs, does that mean

that the organization must cover these costs under the 7.5 percent ESG

admin cap (or the similar 7 percent HOPWA admin cap)? Similarly, for the

program director, do all of his or her costs fall under administration? How

about the shared cost of leasing the building?

Unfortunately, many organizations conflate all shared or indirect costs with

administrative costs and try to shoehorn costs that may be shared (including

personnel, like the program director, or facilities costs, like office rental and

Indirect Cost Toolkit for CoC and ESG Programs Page 8

equipment) into the single bucket of administrative costs. As we have seen,

the program director performs both administrative tasks (reporting,

budgeting, and signing invoices and mileage sheets) and direct program

tasks (supervising employees, reviewing and discussing client files, and

reviewing client-related documentation); the latter should not be considered

administrative but rather direct program costs. Similarly, a computer

purchased for someone in accounting would be an administrative cost, but a

computer purchased for use by a caseworker in the rental assistance

program would be a direct cost. The same would be true with the renting

and maintenance of the organization’s office space; some portion would be

administrative, but some portion should be charged directly to the ESG and

HOPWA awards, using some proportionate means of determining the

allocation of these costs among different areas and departments.

These examples demonstrate how some costs can fall into the gray area

where they could be classified either as direct or indirect costs. Every

organization will need to determine the method best suited for classifying

and recovering these costs, should codify its method for classifying costs in a

set of written financial policies and procedures, and should consistently apply

this method across all programs. It is crucial that no cost be allocated and

charged more than once, so every expense will need to be clearly classified

as either direct or indirect and booked and charged accordingly.

This brief journey through direct, indirect, administrative, and facilities costs

leads us to the point of this Toolkit and frames the discussions that follow.

Let’s summarize:

► Direct costs can easily be assigned to a cost objective and directly

charged on an award (assuming eligibility of costs).

► Indirect costs are not easily assigned to a single cost objective, usually

because it is paid for by multiple sources (like the program director

above), or it is used to support multiple programs (like the office

building above).

► All indirect costs will either be administrative or facilities costs.

► However, administrative and facilities costs may not necessarily be

indirect (e.g., only the HOPWA caseworker is issued a cellphone and

thus this equipment cost is not a shared cost).

Indirect Cost Toolkit for CoC and ESG Programs Page 9

► Not all shared and indirect costs are administrative, and the

administrative category should not be forced to carry all shared and

indirect costs (like the program director and the ESG-/HOPWA-related

equipment).

► Finally, every organization will need a plan that is tailored to its

structure and activities that explains:

• How it will determine which costs are direct and indirect;

• How it will allocate shared costs among different departments,

including administrative functions and direct programs; and

• How it will charge (recover) all eligible and allowable direct and

indirect costs from the federal government or its awardees and

make sure that it does not short-change itself unnecessarily.

This plan mentioned above is a cost allocation plan. Cost allocation plans are

among the bedrocks for successfully managing an organization, especially

one that spends federal funds. This plan will serve as a roadmap for the

organization and its funders to

understand how it spends and

manages revenue. It will be the

foundation for the organization to

adequately charge its program costs to

HUD and the federal government.

The good news is that, as mentioned above, the federal government

recognizes the diversity of organization types and structures. 2 CFR §200

and its appendices lay out several options or methods for cost allocation.

These methods are the focus of this document. Furthermore, CoC and ESG

recipients and subrecipients are likely already using one of the allowed

methods of calculating and charging indirect costs, as described in Section 3

below, even if not as part of an explicit cost allocation plan or to a full

extent. For example, if a provider prorates a phone bill and charges it to a

direct CoC or ESG activity, or if they charge a portion of their cost of leasing

office space for case managers directly to an activity, then they are already

recovering indirect facilities costs using the “Direct Allocation Method”

described in 3.4.3 below and treating those shared costs as direct costs.

If a cost only exists for

one award, then it should

be treated as a direct

cost.

Indirect Cost Toolkit for CoC and ESG Programs Page 10

2.2 Allowability of Costs

An additional consideration for both direct and indirect costs is their

allowability under 2 CFR 200, Subpart E.

What makes a cost allowable? Generally, for costs to be allowable, they

must be:

► 200.403(a) Reasonable and necessary

► 200.403(b) Conforming to limitations or exclusions

► 200.403(c) Consistent with policies and procedures

► 200.403(d) Accorded consistent treatment

► 200.403(e) Determined in accordance with GAAP

► 200.403(f) Not included as match or cost-share

► 200.403(g) Adequately documented

What makes a cost unallowable? 2 CFR, Part 200 identifies expressly

unallowable costs. Common unallowable costs include:

► 200.421 Advertising and public relations

► 200.423 Alcoholic beverages

► 200.426 Bad debts

► 200.434 Contributions and donations

► 200.438 Entertainment costs

► 200.441 Fines, penalties, damages, and other settlements

► 200.442 Fundraising and investment management costs

► 200.445 Goods or services for personal use

► 200.449 Interest

► 200.450 Lobbying

► 200.451 Losses on other awards or contracts

► 200.455 Organization costs

► 200.467 Selling and marketing costs

► 200.470 Taxes (including Value Added Tax)

Indirect Cost Toolkit for CoC and ESG Programs Page 11

Once a cost has been determined to be allowable, it must be allocable to

federal awards consistent with 2 CFR §200.405(a); that is, it must be a cost

that is allowed under a particular program’s implementing regulations (24

CFR §576 for the ESG program and 24 CFR §578 for the CoC program).

Finally, the cost must also be an eligible cost in the grant award and

agreement under which a recipient or subrecipient operates. A cost may not

be charged to a federal award with the purpose of overcoming shortages or

avoiding restrictions imposed by federal statutes, regulations, or terms and

conditions of the federal awards (see 2 CFR §200.405(c)).

Indirect Cost Toolkit for CoC and ESG Programs Page 12

3. What are the options for the

reimbursement of indirect costs?

There are three options for requesting reimbursement of indirect costs:

► Option 1: The 10 Percent De Minimis Rate

► Option 2: Negotiated Indirect Cost Rate Agreement

► Option 3: Cost Allocation Plan

Option 1 is a new option under the Uniform Administrative Guidance

(authorized in 2 CFR §200.414(f)). Options 2 and 3 have existed for federal

awards for numerous years. Although we will discuss Options 2 and 3, this

Toolkit will primarily focus on providing organizations with information on

the use of, potential benefits of, and requirements of Option 1: the 10

percent de minimis rate. For the CoC program, FY2015 grants and beyond

are eligible for the 10 percent de minimis rate and held to the Uniform

Administrative Guidance outlined under 2 CFR §200; for the ESG program,

FY2014 grants and beyond are eligible and held to this Guidance.

3.1 The 10 Percent De Minimis Rate

The 10 percent de minimis rate is an indirect cost instrument implemented

under the revised 2 CFR §200. This rate was implemented in part to allow

organizations—primarily smaller organizations—to recover some of their

indirect costs on federal awards without having to go through the rigorous

and time-consuming process of negotiating an indirect cost rate with a

federal cognizant agency.

Many small recipients and subrecipients do not

have the financial resources to engage the

necessary accounting and finance personnel to

assist them with preparing an indirect cost rate

proposal for negotiations. They also often do not

have the resources to maintain their financial

management system to track costs consistent

with their proposed indirect rate cost structure,

once in place.

Indirect Cost Toolkit for CoC and ESG Programs Page 13

Under the Uniform Administrative Guidance, eligible organizations can claim

up to 10 percent of their Modified Total Direct Costs (MTDC) as indirect costs

without having to negotiate an indirect cost rate agreement.

For many recipients, this is the first time they will be able to charge any

portion of their indirect costs to federal awards.

Direct award recipients with subrecipients must allow the subrecipient to

elect the 10 percent de minimis rate. These requirements are included in the

subrecipient monitoring and management section of the Uniform Guidance,

section 2 CFR §200.331(a)(4).

3.1.1 Eligibility Criteria for the 10 Percent De Minimis Rate

2 CFR §200.414(f) allows grant

recipients and subrecipients to elect

a 10 percent de minimis rate based

on the MTDC if they meet the

following criteria:

1. The recipient or subrecipient

does not currently have and

has never received a negotiated indirect cost rate;

2. The recipient or subrecipient is not a state, local government, or

Indian tribe receiving more than $35M in direct federal funding (these

entities are not eligible for de minimis because of 2 CFR §200

Appendix VII D(1)b1));

3. The recipient or subrecipient will be using the rate indefinitely and

consistently for all federal awards until such time the entity chooses to

negotiate a rate; and

4. The de minimis will be based on the MTDC and comply with 2 CFR

§200.403 factors affecting allowability of cost.

A more detailed discussion on the calculation of the 10 percent de minimis

rate can be found in Section 5.

You must meet ALL of the

criteria listed here, in order to

be eligible to use the 10

percent de minimis rate.

Indirect Cost Toolkit for CoC and ESG Programs Page 14

3.1.2 Modified Total Direct Cost (MTDC) for the 10 Percent

De Minimis Rate

Recipients and subrecipients electing the 10 percent de minimis rate must

use the MTDC as the base for this rate. According to 2 CFR §200.68, the

MTDC is composed of “[a]ll direct salaries and wages, applicable fringe

benefits, materials and supplies, services, travel, sub-awards and sub-

contracts up to the first $25,000 of each sub-award or sub-contract

(regardless of the period of performances under the award).”

All costs used to comprise an MTDC base (used for calculating de minimis)

must be identified specifically to a funded program or be directly assigned to

such activities easily and accurately. Costs must also be allowable under

program regulations, necessary and reasonable for the performance of the

federal award, and consistent with policies and procedures that apply

uniformly to both federal and non-federal activities of the grantee (2 CFR

§200.403). Once the MTDC base has been determined, the de minimis rate

of 10 percent is applied to that base, deriving total de minimis indirect costs.

The calculation of the de minimis rate is described in more detail below.

The following pages reflect how costs can generally be included or excluded

from the computation of the MTDC base for the 10 percent de minimis rate.

Keep in mind that the actual calculation of the MTDC may vary based on the

unique features of each activity or program.

To aid understanding, the following tables are included in this document:

► Summary List of MTDC Inclusions and Exclusions (page 15)

► Sample Breakout of ESG Expenses for MTDC Inclusions and Exclusions

(page 16)

► Sample Breakout of CoC Expenses for MTDC Inclusions and Exclusions

(page 19)

Recipients and subrecipients are encouraged to reach out to their local HUD

Field Office or use the Ask A Question (AAQ) form on the HUD Exchange with

questions about their specific grant or for more information.

Indirect Cost Toolkit for CoC and ESG Programs Page 15

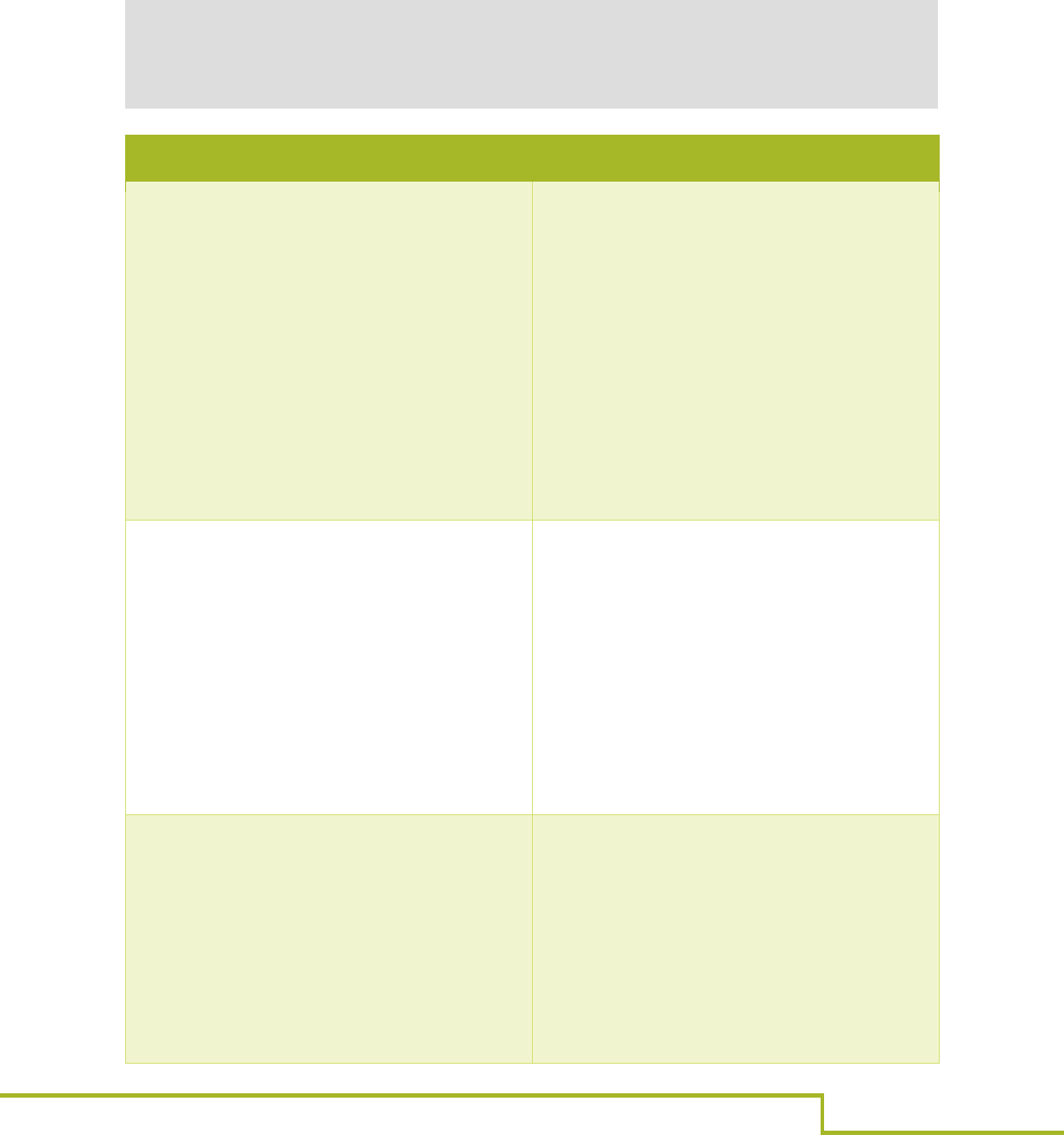

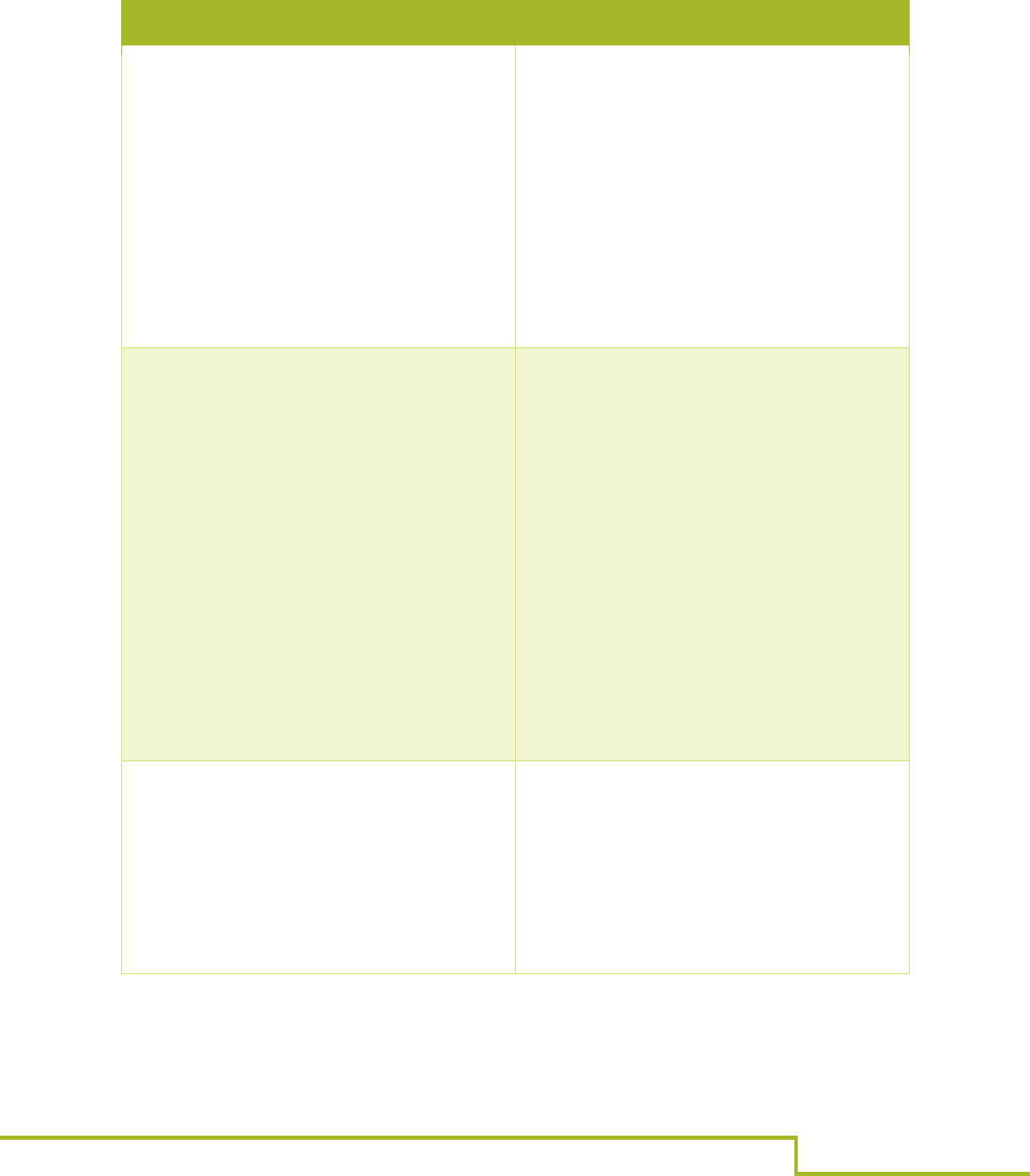

Table 1: Basis of Modified Total Direct Costs for 10 Percent De Minimis Rate

(2 CFR §200.68)

Included

► All direct salaries and wages, applicable fringe benefits,

materials and supplies, services, travel, and subawards

► Subawards and subcontracts up to the first $25,000 of each

subaward or subcontract (regardless of the period of

performance of the subawards and subcontracts under the

award)

Excluded

► Equipment

► Capital expenditures

► Charges for patient care

► Rental costs

► Tuition remission

► Scholarships and fellowships

► Participant support costs

► Portion of each subaward and subcontract in excess of

$25,000

► Other items may only be excluded when necessary to avoid a

serious inequity in the distribution of indirect costs, and with

the approval of the cognizant agency for indirect costs

Indirect Cost Toolkit for CoC and ESG Programs Page 16

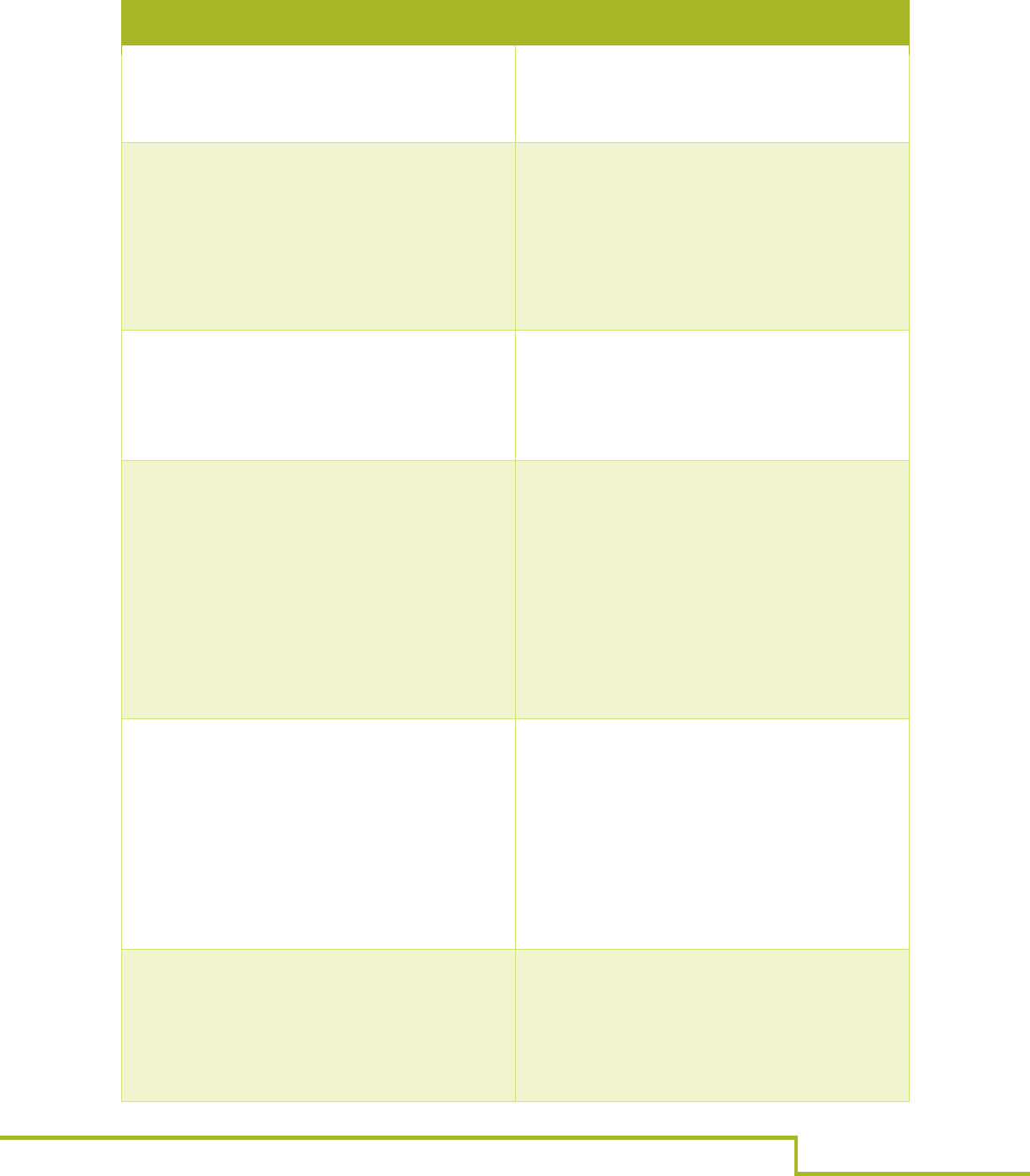

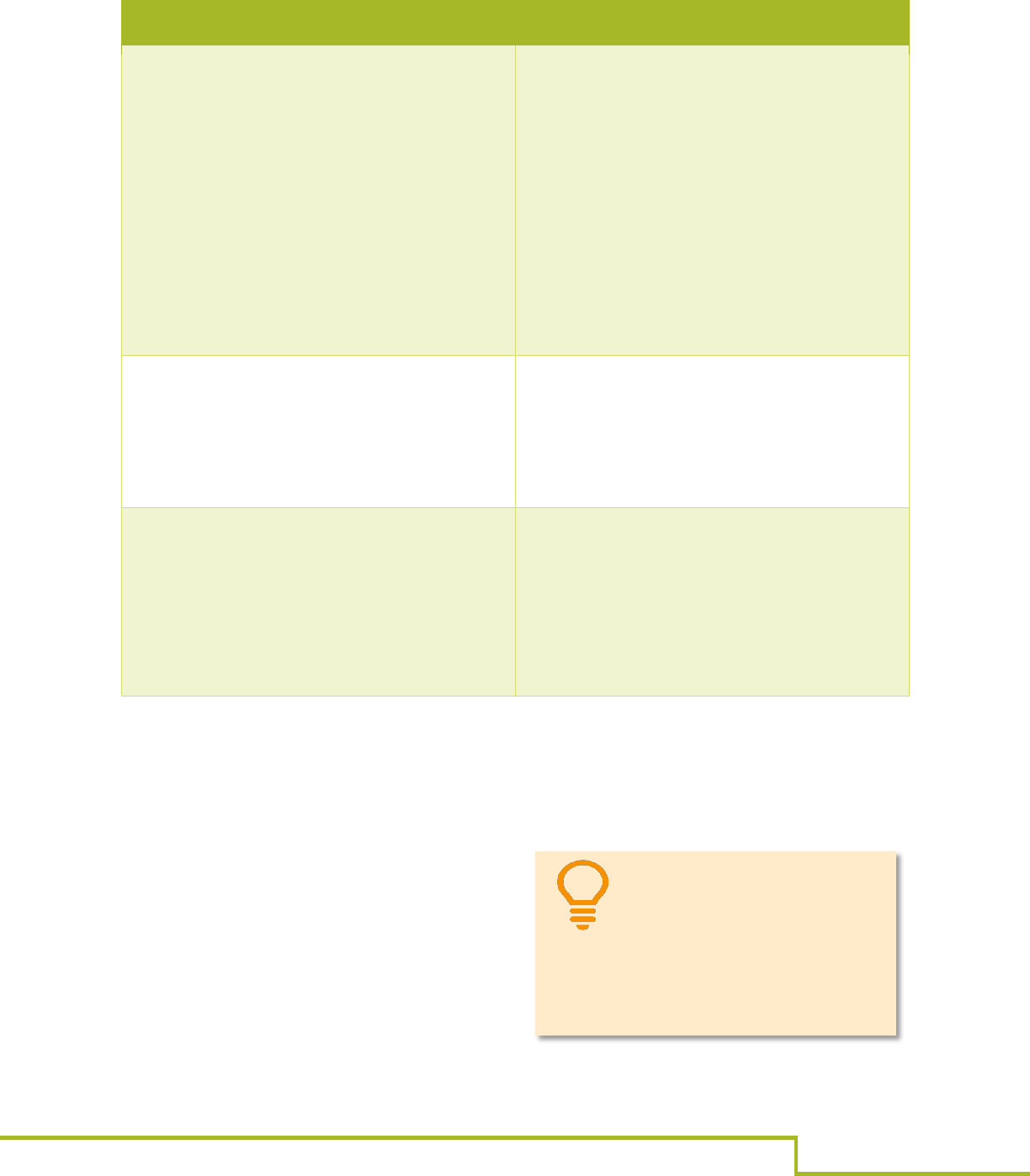

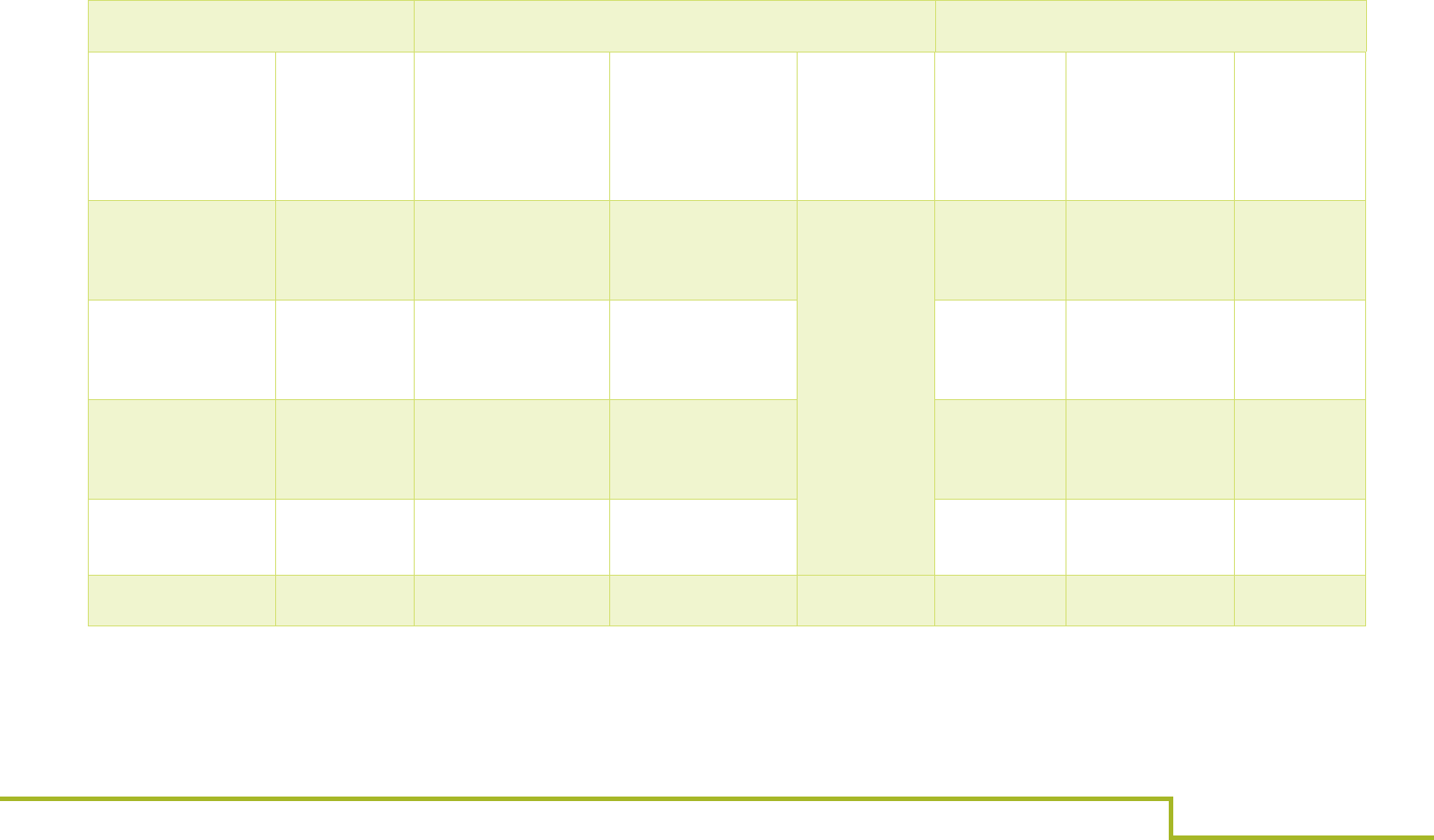

Table 2: Sample Breakout of Emergency Solutions Grants (ESG)

Components for Modified Total Direct Costs for 10 Percent De Minimis Rate

Included in MTDC Base

Excluded from MTDC Base

Overview

Included are all direct salaries and

wages, applicable fringe benefits,

materials and supplies, services, and

travel associated with eligible activities

under the ESG program, except where

excluded, and the first $25,000 of each

subawards and subcontracts

(regardless of the period of

performance of the subawards and

subcontracts under the award).

Overview

Excluded are all equipment, capital

expenditures, charges for patient care,

rental costs, tuition remission,

scholarships and fellowships,

participant support costs, and the

portion of each subaward in excess of

$25,000.

Other items may only be excluded

when necessary to avoid a serious

inequity in the distribution of indirect

costs, and with the approval of the

cognizant agency for indirect costs.

Emergency Shelter Essential

Services

► Case management

► Childcare

► Education services

► Employment assistance and job

training

► Legal services

► Life skills training

► Transportation

Emergency Shelter Essential

Services

► Education, employment assistance,

job training, tuition, scholarships,

and fellowships

► Outpatient health services

► Mental health services

► Substance abuse treatment

services

► Motor vehicle transportation

Emergency Shelter Operations

► Maintenance

► Security

► Food

Emergency Shelter Operations

► Rent

► Insurance

► Utilities

► Fuel

► Equipment

► Furnishings

► Hotel/motel vouchers

Note: The sample costs listed below for the MTDC base are presented for example purposes only.

The list is not comprehensive and is not related to eligibility or direct cost reimbursement.

Calculation of the MTDC base will vary greatly by situation. Review 2 CFR §200 and HUD Transition

Notices/Regulations to calculate your MTDC base and consult with your local HUD Field Office.

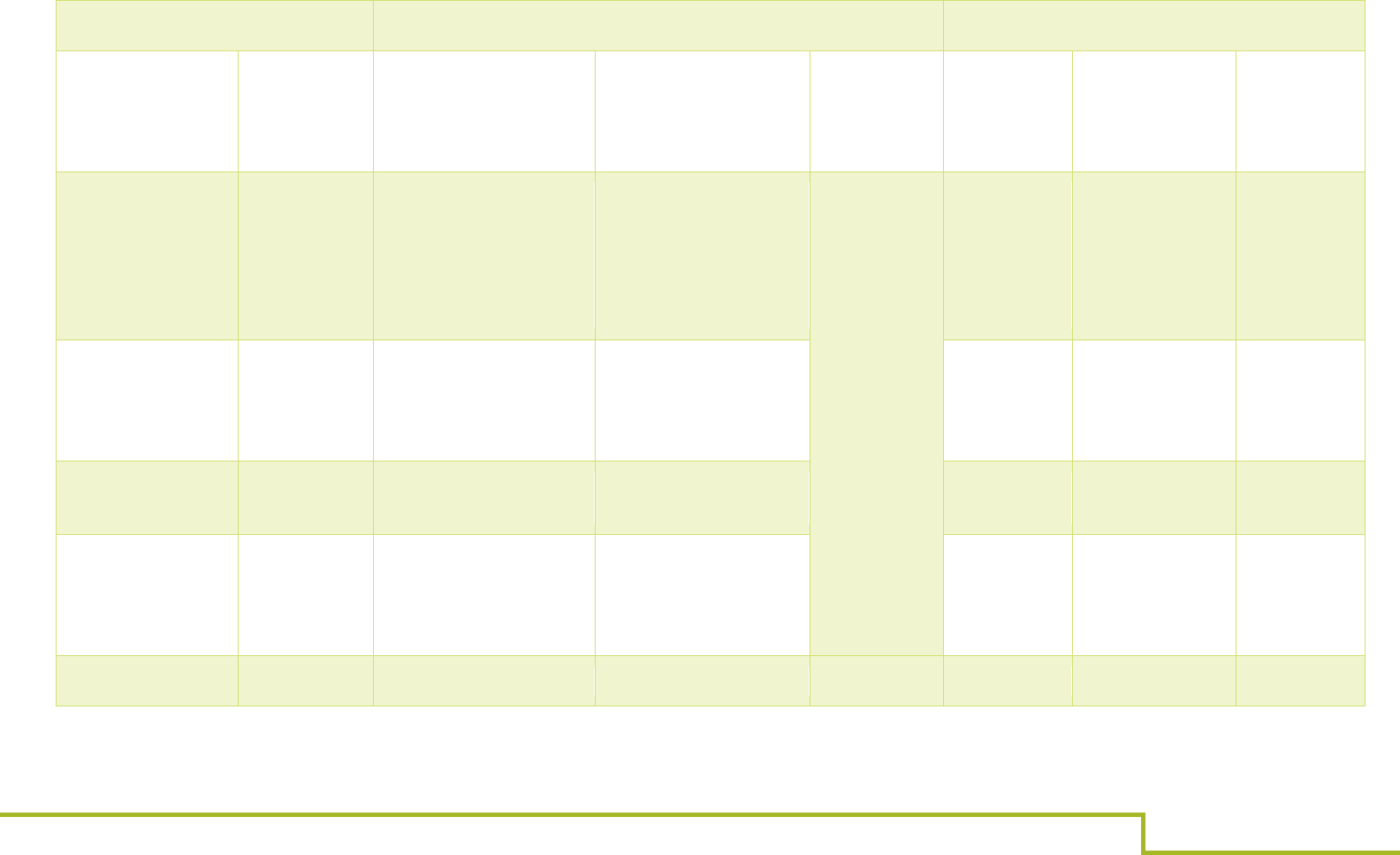

Indirect Cost Toolkit for CoC and ESG Programs Page 17

Included in MTDC Base

Excluded from MTDC Base

Emergency Shelter Renovation

► No costs included

Emergency Shelter Renovation

► All costs excluded for renovation or

conversion of a building

Uniform Relocation Assistance and

Real Property Acquisition Policies

Act (URA)

► No costs included

Uniform Relocation Assistance and

Real Property Acquisition Policies

Act (URA)

► All costs excluded (e.g., financial

and rental assistance associated

with relocation assistance through

the URA)

Street Outreach Essential Services

► Engagement

► Case management

► Transportation

Street Outreach Essential Services

► Emergency health services

► Emergency mental health services

► Motor vehicle transportation

Rapid Rehousing & Homelessness

Prevention Financial Assistance

Costs

► Service delivery (e.g., processing

payments)

Rapid Rehousing & Homelessness

Prevention Financial Assistance

Costs

► Rental application fees

► Security deposits

► Last month’s rent

► Utility deposits

► Utility payments

► Moving costs

Rapid Rehousing & Homelessness

Prevention Services Costs

► Housing search and placement

► Housing stability case management

► Legal services

► Mediation

► Credit repair (e.g., credit

counseling)

Rapid Rehousing & Homelessness

Prevention Services Costs

► Rent, utilities, and equipment

Rapid Rehousing & Homelessness

Prevention Rental Assistance

► Service delivery (e.g., processing

payments)

Rapid Rehousing & Homelessness

Prevention Rental Assistance

► Short-term rental assistance

► Medium-term rental assistance

► Rental arrears

Indirect Cost Toolkit for CoC and ESG Programs Page 18

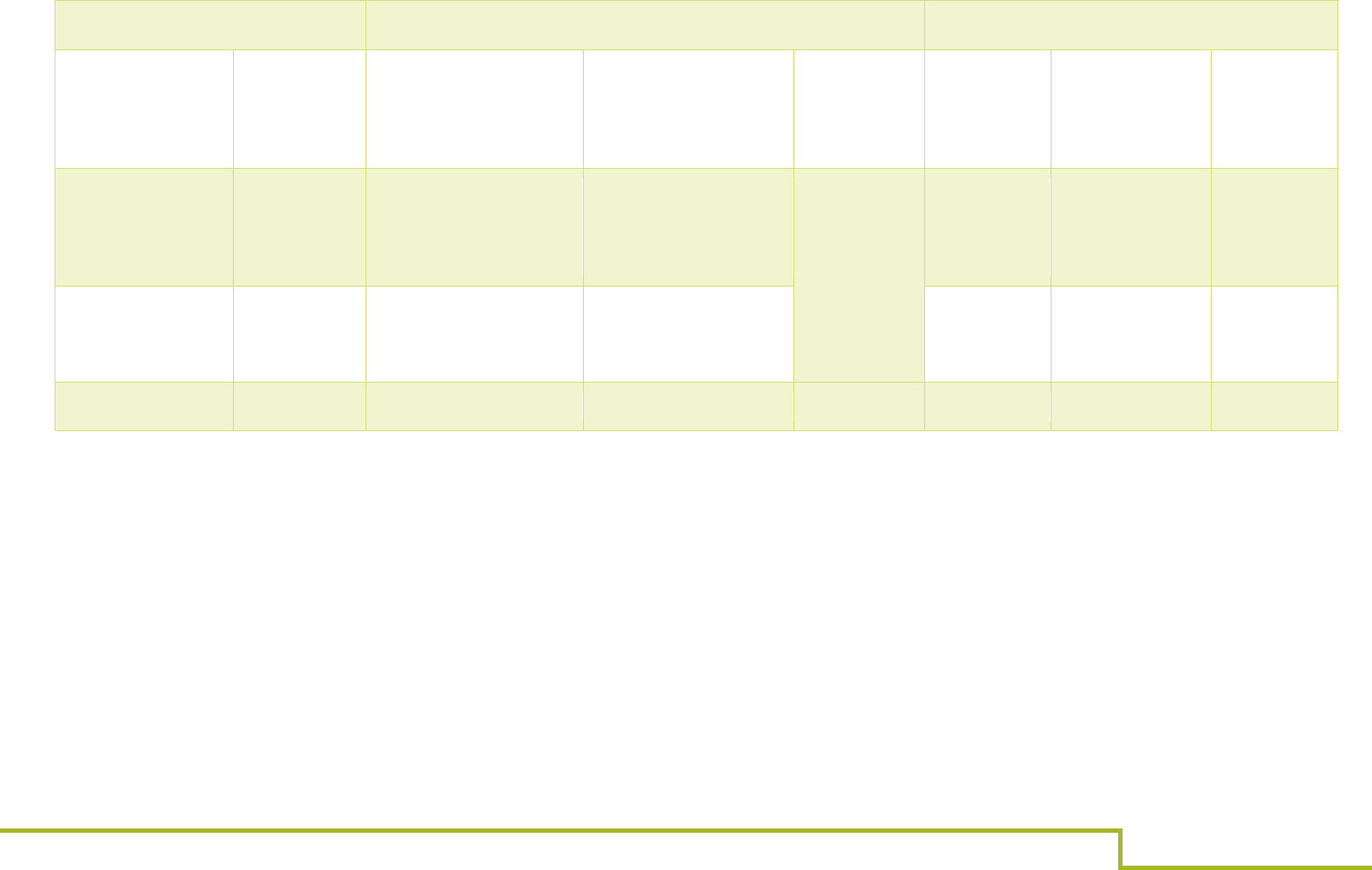

Included in MTDC Base

Excluded from MTDC Base

Homeless Management

Information System (HMIS) or

comparable database if

subrecipient is a victim service

provider

► HMIS data collection and

contribution activities (e.g., staff

operations, training, conducting

intake)

► HMIS Lead agency activities

► Victim service provider or legal

service provider activities

Homeless Management

Information System (HMIS) or

comparable database if

subrecipient is a victim service

provider

► All HMIS equipment (e.g.,

hardware, software licenses, office

equipment, office space)

► Participant fees

Administration

► General management, oversight,

and coordination

► Training

► Preparing and amending ESG and

homelessness-related sections of

the Consolidated Plan

► Environmental review

Administration

► Rent, utilities, and equipment

Indirect Cost Toolkit for CoC and ESG Programs Page 19

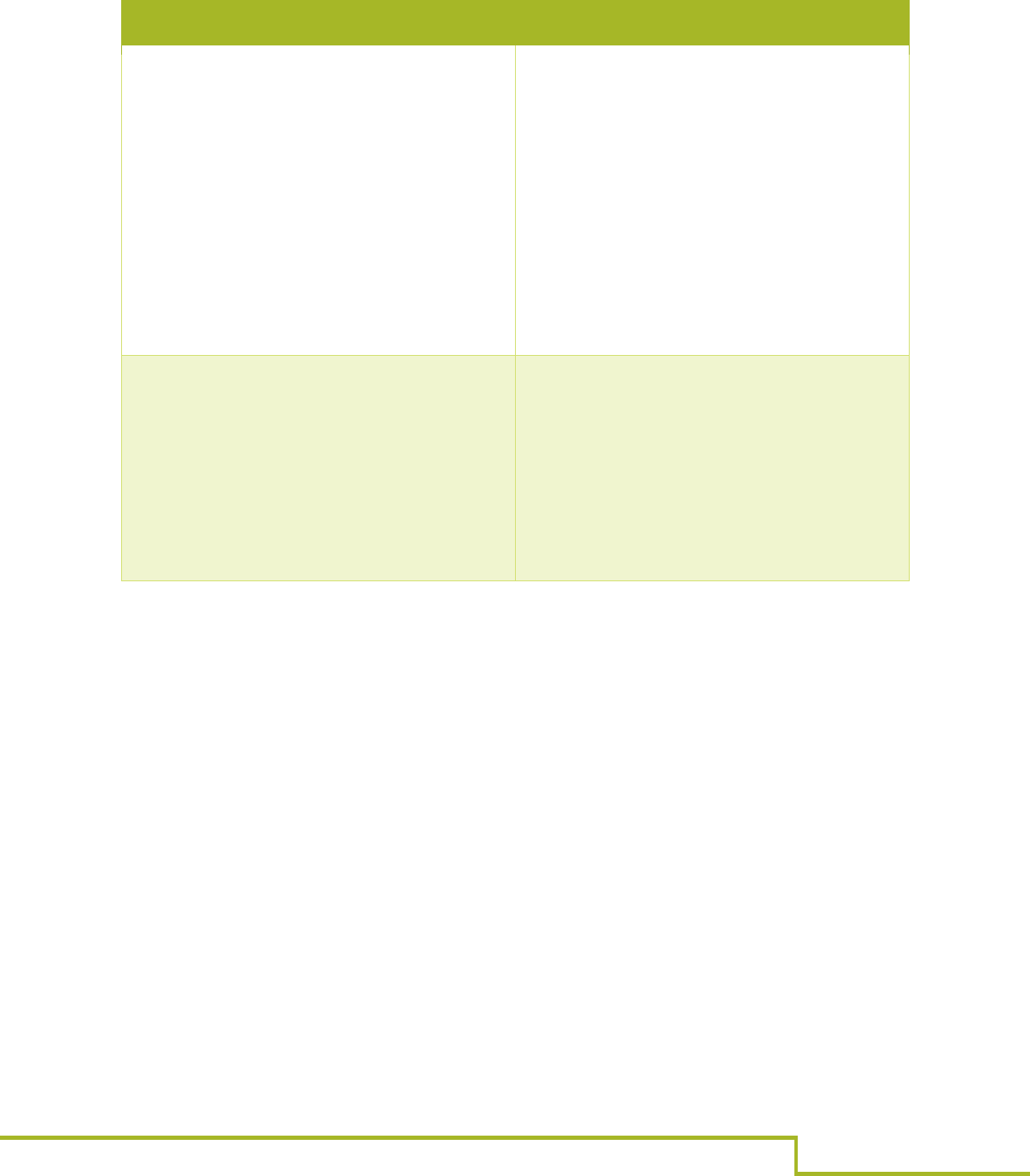

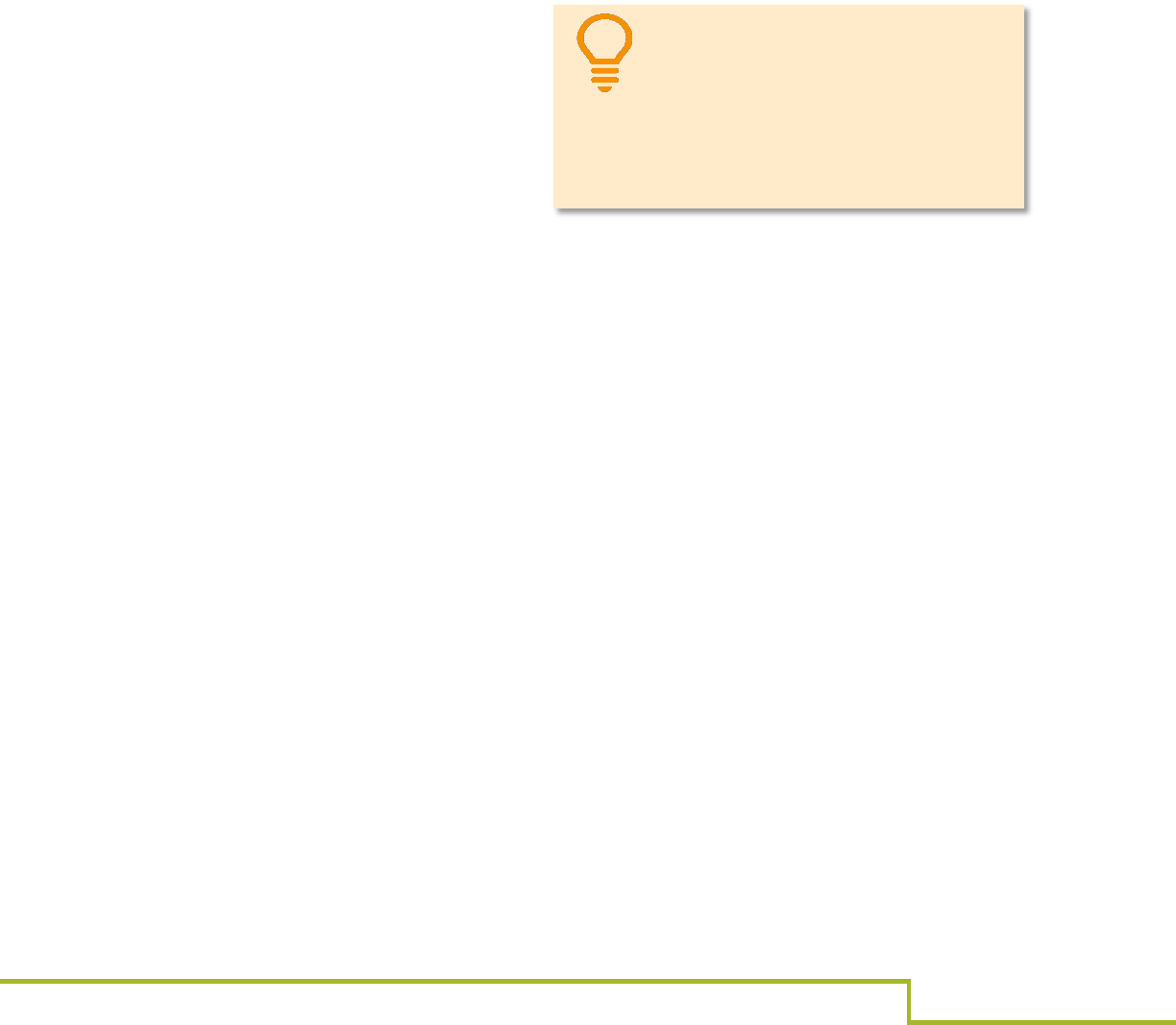

Table 3: Sample Breakout of Continuum of Care (CoC) Components for

Modified Total Direct Costs for 10 Percent De Minimis Rate

Included in MTDC Base

Excluded from MTDC Base

Overview

Included are all direct salaries and

wages, applicable fringe benefits,

materials and supplies, services, and

travel associated with eligible activities

under the CoC program, except where

excluded, and the first $25,000 of each

subaward and subcontract (regardless

of the period of performance of the

subawards and subcontracts under the

award).

Overview

Excluded are all equipment, capital

expenditures, charges for patient care,

rental costs, tuition remission,

scholarships and fellowships,

participant support costs, and the

portion of each subaward in excess of

$25,000.

Other items may only be excluded

when necessary to avoid a serious

inequity in the distribution of indirect

costs and with the approval of the

cognizant agency for indirect costs.

Acquisition, Rehabilitation, New

Construction

► No costs included

Acquisition, Rehabilitation, New

Construction

► All costs excluded (e.g., capital

expenditures, building, land,

equipment)

Leasing

► Service delivery (e.g., processing

payments)

► Inspections for rental assistance

and leasing (HQS, lead, etc.)

Leasing

► Rent

► Utilities

► Security deposits

► Property damage

Note: The sample costs listed below for the MTDC base are presented for example purposes only.

The list is not comprehensive and is not related to eligibility or direct cost reimbursement.

Calculation of the MTDC base will vary greatly by situation. Review 2 CFR §200 and HUD Transition

Notices/Regulations to calculate your MTDC base and consult with your local HUD Field Office.

Indirect Cost Toolkit for CoC and ESG Programs Page 20

Included in MTDC Base

Excluded from MTDC Base

Rental Assistance

► Service delivery (e.g., processing

payments)

► Inspections for rental assistance

and leasing (HQS, lead, etc.)

Rental Assistance

► Short-term rental assistance

► Medium-term rental assistance

► Long-term rental assistance

► Security deposits

► Property damage

► Other rental costs associated with

tenant-, sponsor-, and project-

based rental assistance such as

rental application fees, late

charges, and releasing fees

Supportive Services

► Annual assessment of service

needs

► Case management

► Education services

► Employment assistance and job

training

► Housing search and counseling

services

► Legal services

► Life skills training

► Outreach services

► Transportation

► Other costs associated with the

direct provision of services

Supportive Services

► Childcare

► Moving costs

► Education, employment assistance,

job training, tuition, scholarships,

and fellowships

► Food

► Mental health services

► Outpatient health services

► Substance abuse treatment

services

► Motor vehicle transportation

► Utility deposits

Operating

► Maintenance and repair of housing

► Building security personnel

Operating

► Property tax and insurance

► Replacement reserve account

► Utilities

► Furniture

► Equipment

► Property damage

Indirect Cost Toolkit for CoC and ESG Programs Page 21

Included in MTDC Base

Excluded from MTDC Base

Homeless Management

Information System (HMIS) or

comparable database if

subrecipient is a victim service

provider

► HMIS data collection and

contribution activities (e.g., staff

operations, training, conducting

intake)

► HMIS Lead agency activities

► Victim service provider or legal

service provider activities

Homeless Management

Information System (HMIS) or

comparable database if

subrecipient is a victim service

provider

► All HMIS equipment (e.g.,

hardware, software licenses, office

equipment, office space, utilities)

► Participant fees

Administrative Costs

► General management, oversight,

and coordination

► Trainings

► Environmental reviews

Administrative Costs

► Rent, utilities, and equipment

Relocation: Uniform Relocation

Assistance and Real Property

Acquisition Policies Act (URA)

► No costs included

Relocation: Uniform Relocation

Assistance and Real Property

Acquisition Policies Act (URA)

► All costs excluded (e.g., financial

and rental assistance associated

with relocation assistance through

the URA)

In order to include eligible direct activity costs in the MTDC base, recipients

and subrecipients must maintain detailed accounting records clearly

separating salaries, wages, fringe benefits, and service and consultant costs.

Furthermore, recipients and

subrecipients must track costs by

element for each eligible component

activity. For example, organizations

must maintain detailed accounting

records clearly separating salaries,

wages, fringe benefits, and service

and consultant costs for each eligible activity (e.g., supportive services,

Document individual costs

such as staff salaries, wages,

fringe benefits, service costs,

etc. for each eligible activity

to include them in the MTDC

base.

Indirect Cost Toolkit for CoC and ESG Programs Page 22

operating costs, project administrative costs). If costs are grouped (totaled)

under eligible activities, they cannot be included in the MTDC base. When

costs are grouped as total costs for eligible activities, there is not adequate

information to identify the allowable and excludable costs for the purpose of

determining the MTDC base and calculating the de minimis rate.

Recipients and subrecipients must maintain adequate documentation to

support the costs included in the MTDC base consistent with the 2 CFR

§200.333 retention requirements, which state:

Financial records, supporting documents, statistical records, and all

other non-federal entity records pertinent to a federal award must be

retained for a period of three years from the date of submission of the

final expenditure report or, for federal awards that are renewed

quarterly or annually, from the date of the submission of the quarterly

or annual financial report, respectively, as reported to the federal

awarding agency or pass-through entity in the case of a subrecipient.

(2 CFR §200.333).

3.2 Indirect Cost Rate Agreement

Recipients and subrecipients that expend federal

funds and allocate and claim indirect costs may

negotiate their own unique indirect cost rate with

their cognizant federal agency (2 CFR §200.19).

In this Toolkit, a basic overview of this approach

is provided. However, negotiated indirect cost

rates are unique to each agency; organizations

are encouraged to work with an accounting

professional knowledgeable about federal cost

principles to develop an indirect cost rate proposal.

A negotiated indirect cost rate is a ratio, expressed as a percentage, used

for allocating a fair share of the general, administration, and facility

expenses that are shared between programs (i.e., not charged as direct

expenses to any given program) to each individual program. Specifically,

this negotiated rate will be the ratio of the indirect costs to a direct cost base

(MTDC).

Indirect Cost Toolkit for CoC and ESG Programs Page 23

The cognizant agency is generally defined as the federal agency that

provides the largest amount of direct federal funds to the organization.

When the cognizant agency approves an indirect cost rate, the rate becomes

applicable to other federal funds to determine the amount of indirect costs

that apply to other grants and contracts awarded to the recipient. Nonprofit

recipients and subrecipients are required to follow the regulations contained

in 2 CFR §200, Appendix IV-Indirect (F&A), Cost Identification and

Assignment and Rate Determination for Nonprofit Organizations (in

particular, Section B.5 and Section C).

It is the recipient or subrecipient’s responsibility to make sure it has a valid

final negotiated rate for each year that indirect costs are claimed, and that it

renews its negotiated rate every three years as required.

Recipients or subrecipients would submit an indirect cost rate proposal in

order to:

1. Establish a provisional rate to charge estimated indirect costs to an

award; and

2. Establish a final indirect cost rate based on a prior fiscal year.

An indirect cost rate negotiation agreement is a document that formalizes

the indirect cost rate negotiation process. This document typically contains:

► The type of rate negotiated;

► The effective period(s) of the rate;

► The location to which the rate is applicable; and

► The program(s) to which the rate(s) are applicable.

An indirect cost rate negotiation agreement also provides information on the

base used to distribute indirect costs and the treatment of fringe benefits

and paid absences. The negotiation agreement must be signed by both the

organization’s authorized representative and the agency’s indirect cost

coordinator or authorized representative.

Indirect Cost Toolkit for CoC and ESG Programs Page 24

3.3 Cost Allocation Plan

Cost allocation plans (2 CFR §200.27) are used by non-federal entities to

determine the method by which the entity or organization will allocate direct

and indirect costs, and when program activities are sponsored by federal

funds either directly from a cognizant agency or a pass-through entity.

Cost allocation plans:

► Are often the only way to determine the total cost of operating

programs;

► Allow an organization to

ensure that it is

recovering all allowable

costs incurred by the

organization; and

► Can provide valuable

management data to an

organization regarding funding levels and time spent on activities

(when time and effort reporting is also employed).

In a cost allocation plan, direct and indirect costs are allocated to each cost

objective.

There are three acceptable methods to calculate the indirect cost rate in a

cost allocation plan:

► Simplified allocation method

► Multiple rate allocation method

► Direct allocation method

See section 3.4 for more information on the implementation of these

methods. See also 2 CFR §200 Appendix V (state and local governments)

and Appendix IV, B.2-4 (nonprofits) for guidance regarding cost allocation

plans.

The purpose of a cost allocation

plan is to summarize, in writing,

the methods and procedures that

an organization will use to allocate

costs to various programs, grants,

contracts, and agreements.

Indirect Cost Toolkit for CoC and ESG Programs Page 25

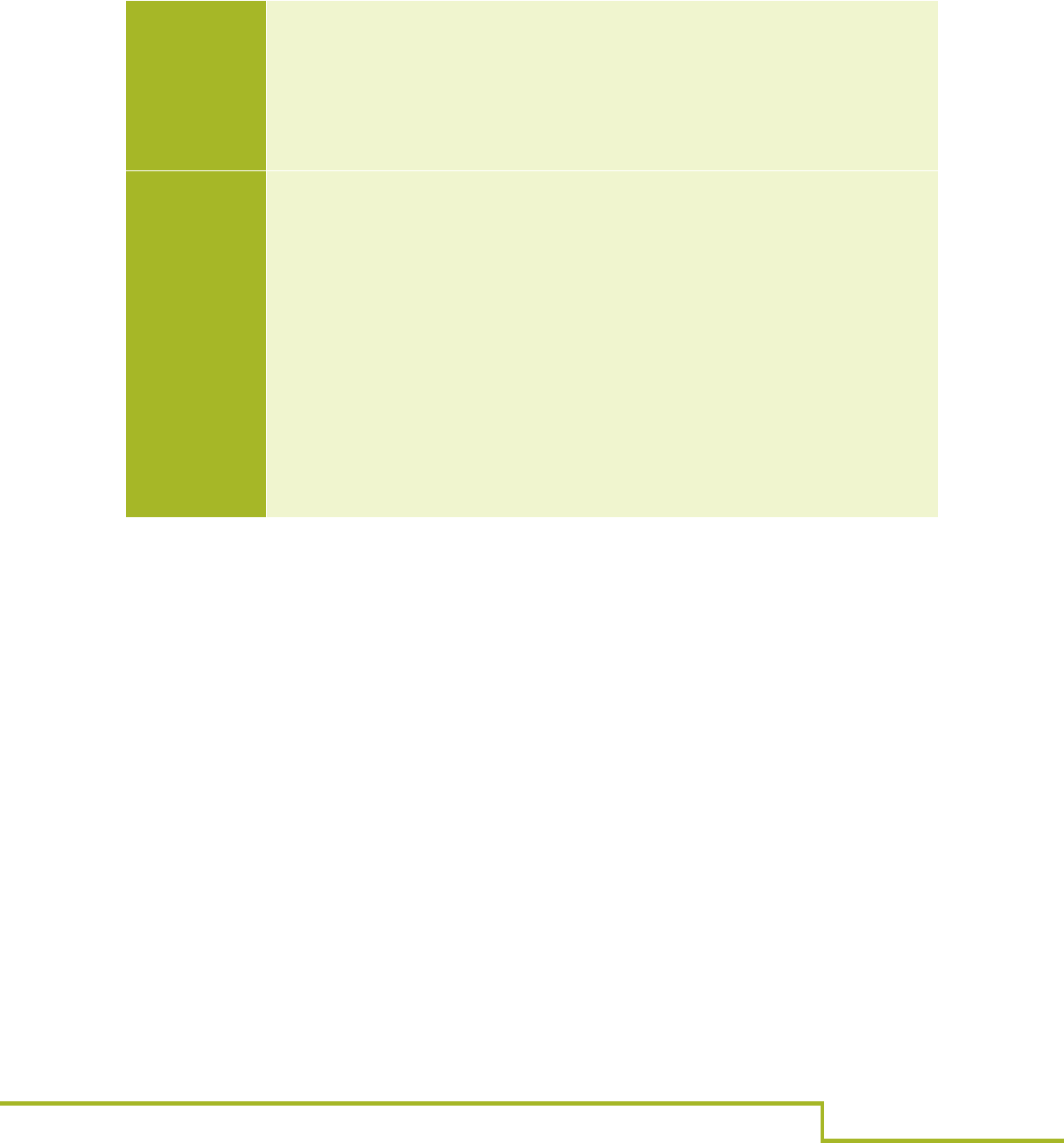

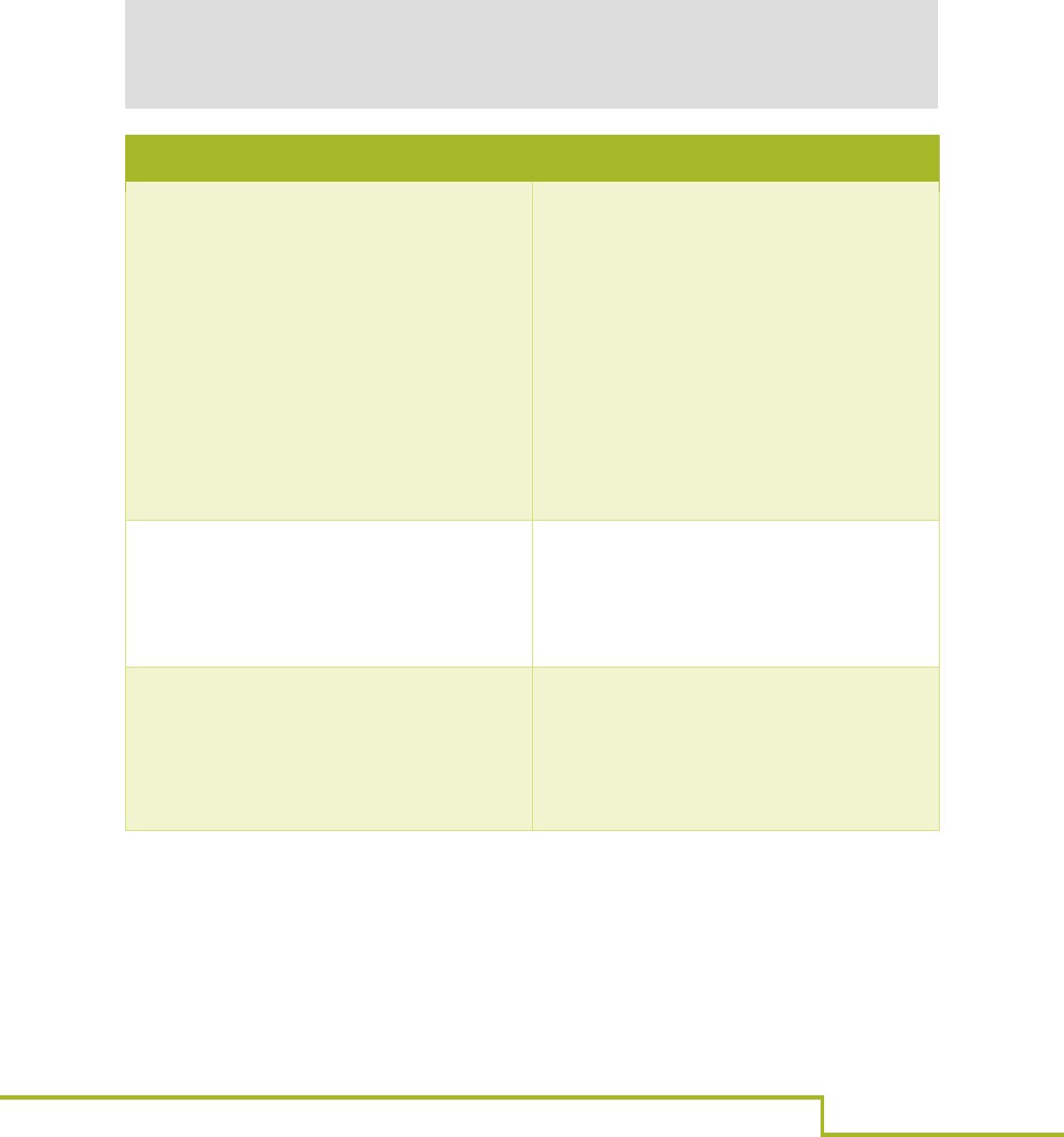

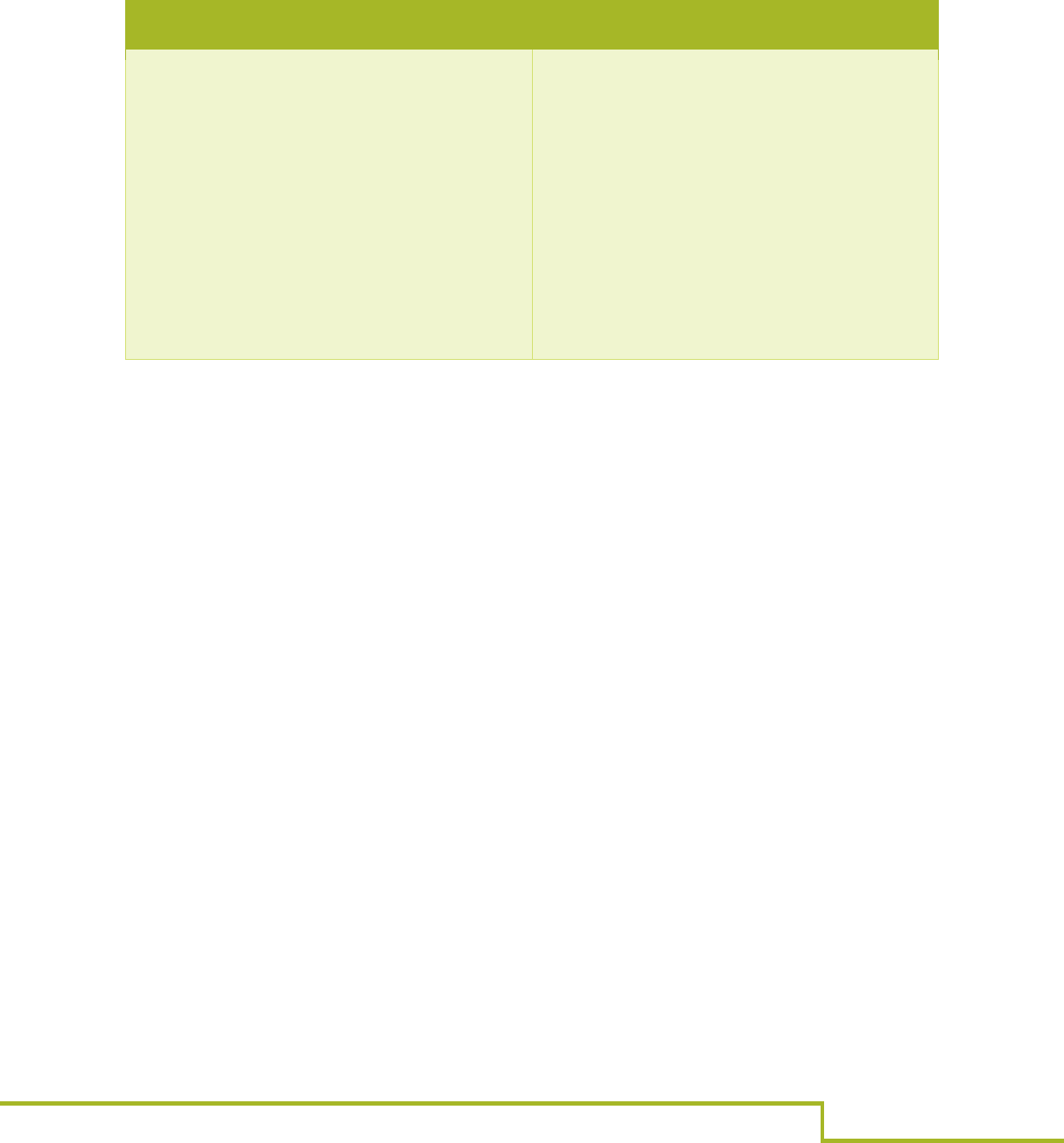

Table 4: What is the Difference Between Cost Allocation and Cost

Reimbursement?

Cost Allocation

Cost Reimbursement

Cost allocation is the measurement of

allowable costs that are then allocated

based on benefits received by each

program or agency.

The cost principles provide the

methods for determining a federal

program’s share of both direct and

indirect costs. They have no authority

over the actual payment of the costs.

The payment is governed by the terms

of the grant document or the

legislation authorizing the program.

Cost reimbursement is the process

where federal dollars are used to

reimburse grantee organizations for

allowable costs.

Use grant language, cost limitations,

and legislative constraints as

guidelines in the payment process.

3.4 Allowable Cost Allocation Methods

Organizations that choose to develop either an indirect cost rate agreement

or a cost allocation plan have several allowable methods for allocating costs.

Because organizations vary in structure, purpose, and complexity, particular

methods may be more appropriate for particular entities or organizations.

There are three acceptable methods to calculate the indirect cost rate:

► Simplified Allocation Method

► Multiple Rate Allocation Method

► Direct Allocation Method

Indirect Cost Toolkit for CoC and ESG Programs Page 26

Table 5: Overview of Allowable Cost Allocation Methods

Simplified Allocation

Method

Multiple Rate

Allocation Method

Direct Allocation

Method

The organization has

only a single function.

All programs benefit

about equally from

shared costs. The

payment is governed by

the terms of the grant

document or the

legislation authorizing

the program.

Federal awards are not

material.

All programs do not

benefit equally from

shared costs.

Preferred method for

state and local

government agencies.

Indirect costs are pooled

and allocated to direct

cost objectives based on

various distribution

bases.

All costs are charged

directly to programs,

except for general

administration.

Preferred method used

by most nonprofit

organizations.

Various bases are

selected to “directly

allocate” costs to

programs (for example,

space allocated based on

square footage

occupied).

The following sections provide a more detailed analysis of each method.

3.4.1 Simplified Allocation Method

For small recipients or subrecipients (including some nonprofits) where

indirect costs are related to one primary activity such as administration, it

may be necessary to have only one indirect cost rate. In this case, the

simplified allocation method is used.

As indicated in 2 CFR §200 Appendix IV, B.2, the simplified method is

applied when an organization’s major functions all benefit from its indirect

costs to approximately the same degree. In this method, all indirect costs

are grouped together in one pool and then allocated to each grant or

program by applying the derived rate to all direct program costs. Capital

expenditures and other distorting costs, such as subawards for $25,000 or

more, are excluded from both the indirect and direct cost pools.

The simplified allocation method may be accomplished by:

► Separating the organization’s total costs for the base period as either

direct or indirect (less excluded costs); and

Indirect Cost Toolkit for CoC and ESG Programs Page 27

► Dividing the total allowable indirect costs (net of applicable credits) by

an equitable distribution base.

Figure 1: Simplified Allocation Method

Facilities +

Administrative

Costs (less

excluded items)

Total Direct

Costs (less

excluded

items)

Simplified

Indirect

Cost Rate

When separating the organization’s total costs into direct cost and indirect

cost categories, the organization must exclude capital expenditures and

unallowable costs (as defined in the Uniform Administrative Guidance).

Organizations may incur costs that are unallowable and pay for those costs

through non-federal funds.

The CoC program interim rule identifies eligible costs that may be

reimbursed as direct costs to the program; even though they are eligible

under the CoC program, 2 CFR §200 identifies some costs that are referred

to as direct costs in 24 CFR §200.413(e) that are nonetheless unallowable as

CoC costs.

Indirect Cost Toolkit for CoC and ESG Programs Page 28

3.4.2 Multiple Rate Allocation Method

When a recipient or subrecipient’s indirect costs benefit different functions to

different degrees, then indirect costs are grouped into pools based on

functional groups (e.g., “Housing Services” and “Health Care Services”) that

best reflect the differing relative benefit of each group from shared costs.

This method essentially calculates different indirect rates for significantly

different functional centers within an organization. It is most suitable for

very large organizations with separate divisions that perform substantially

different functions.

This allocation methodology must consider:

► A base best suited for assigning the pool of costs to programs in

accordance with benefits derived;

► If a traceable cause-and-effect relationship exists between the cost

pool being allocated and the programs to which it is applied; and

► If the allocation is logical and reasonable.

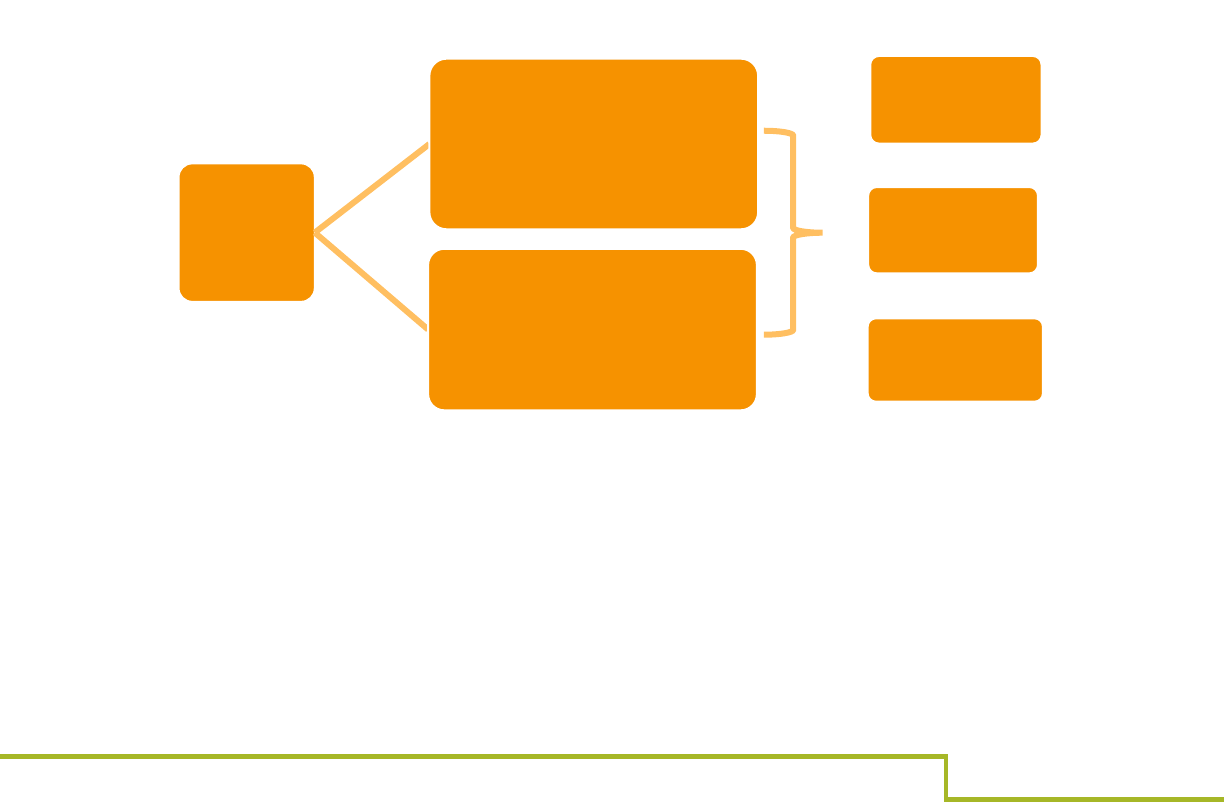

As illustrated in Figure 2: Multiple Rate Allocation Method, total indirect costs

are grouped into separate pools for facilities and administrative (F&A) costs.

Then, based on the separate benefits of these costs to the functional groups,

indirect cost rates are derived for each functional group, dividing the F&A

costs for each functional area by that area’s MTDC base.

Total

Indirect

Costs

Administrative Indirect

Costs

(determined and pooled

separately for each

functional group)

Rate for

Functional

Group A

Rate for

Functional

Group B

Facilities Indirect Costs

(determined and pooled

separately for each

functional group)

Rate for

Functional

Group C

Figure 2: Multiple Rate Allocation Method

Indirect Cost Toolkit for CoC and ESG Programs Page 29

Per 2 CFR §200 B.3.b of Appendix IV, each functional cost group must

constitute a pool of expenses that are of like character in terms of functions,

and in terms of the allocation base which best measures the relative benefits

provided to each function. The costs in the common pool are distributed to

individual programs included in that function by use of a single indirect cost

rate. Indirect costs must be distributed to applicable federal awards and

other benefiting activities within each major function using the MTDC base

allocation method. A separate indirect cost rate is determined for each

separate functional area.

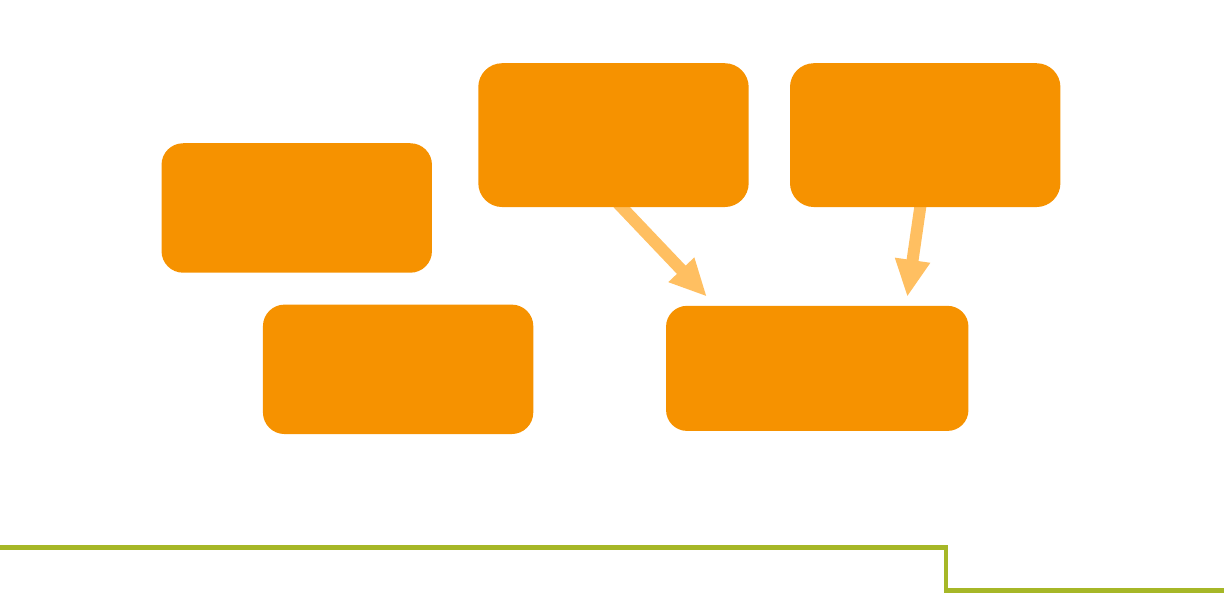

3.4.3 Direct Allocation Method

2 CFR §200 Appendix IV, B.4 describes the Direct Allocation Method. In this

method, all costs are treated as direct costs, except for general

administrative and other general costs.

Organizations applying this method generally separate their costs into three

basic categories: (i) general administration, (ii) fundraising, and (iii) other

direct functions (including projects performed under federal awards). Joint

costs—such as depreciation, rental costs, operation and maintenance of

facilities, telephone expenses, and the like—are prorated individually as

direct costs to each category and to each federal award or other activity

using a base most appropriate to the cost being prorated.

Total Direct Costs,

Charged to Eligible

Grant Activities

Administrative

(Charged as

“Administration”)

Fundraising Costs

(not reimbursable)

Direct

Grant/Program

Costs

Facilities Costs

(prorated and

charged to grant

activities)

Figure 3: Illustration of Direct Allocation Method

Indirect Cost Toolkit for CoC and ESG Programs Page 30

The Direct Allocation Method is acceptable, provided that each shared

facilities cost is prorated using a base that accurately measures the benefits

provided to each federal award or other activity. The bases must be

established in accordance with reasonable criteria, supported by current

data, and approved by the cognizant agency.

Administrative costs are charged as “Administration” costs, as allowed and

defined under the particular federal program. Facilities costs (including

equipment and supplies) are prorated using a rational basis (such as percent

of organizational budget or percent of square footage used by the program),

and then are applied to the relevant eligible grant activity.

Indirect Cost Toolkit for CoC and ESG Programs Page 31

4. Which option is best for my

organization?

To review, we have discussed three primary methods for computing and

charging indirect costs:

► 10 Percent De Minimis Rate

► Indirect Cost Rate Agreement

► Cost Allocation Plan

Both the indirect cost rate agreement and cost allocation plan approaches

use one of three different methods to determine and allocate indirect costs:

► Simplified Allocation Method

► Multiple Allocation Base Method

► Direct Allocation Method

These options are established in order to offer organizations flexibility in

identifying and implementing the method that best suits their organization’s

structure and activities.

4.1 Considerations for Selecting an Indirect Cost

Rate Option

Indirect cost allocation methods can be complicated to understand and

implement but can ultimately provide an organization with a more effective

and efficient cost allocation approach.

Consider the following organizational factors in selecting a rate

methodology:

► Amount of federal funding

► Variety of federal funding sources

► Size of the organization and diversity of its major functions

► Types of shared (indirect) costs

► Types and variety of programs

► Degree of programmatic and functional variation

► Availability of allocation statistics in organization’s accounting system

► Capacity of organization’s accounting system to track degree of detail

Indirect Cost Toolkit for CoC and ESG Programs Page 32

No matter which approach is selected, it is important to remember these key

considerations:

► Always clearly and thoroughly document your process and

justifications for decisions made.

► Ensure that you store all records received from HUD and your

cognizant federal agency for the appropriate number of years required

under the applicable recordkeeping requirements.

► Review organizational policy and procedure documents to confirm that

your organization’s indirect cost and cost allocation policies are spelled

out and accurate.

► Ensure that whatever approach is taken, it is applied uniformly across

all grants and programs and with all funders.

A local certified public accountant (CPA) can help organizations determine

which rate methodology is best suited for their organization and can support

the organization through the whole process of rate determination.

Organizations typically cannot select and implement a negotiated indirect

cost rate without the assistance of a CPA or accountant, particularly one who

is familiar with federal cost principles and the Uniform Administrative

Guidance. Recipients and subrecipients are ultimately responsible for

ensuring compliance with applicable regulations and policies.

4.2 Pros and Cons of Different Indirect Cost Rate

Methods

Table 6 reflects the potential pros and cons for each of the options for

consideration.

Indirect Cost Toolkit for CoC and ESG Programs Page 33

Table 6: Pros and Cons of Different Indirect Cost Rate Methods

Option

Pros

Cons

Option 1:

10 Percent

De Minimis Rate

► Allows eligible

recipients and

subrecipients that

historically could not

charge any indirect

costs to now recover

some indirect costs.

► Does not require

submission of a detailed

indirect cost proposal.

► Immediately eligible, no

time delays.

► No pre-negotiation.

► Easy computation using

the MTDC.

► Does not require an in-

depth knowledge of

cost accounting.

► Must meet the eligibility requirements (see

section 3.1.1).

► Indirect costs are limited to 10 percent.

► Certain eligible activity component costs are

unallowable for computation of the MTDC

(see Table 1).

► Must track salaries, wages, fringe benefits,

service contracts, and consultants

separately and not as an aggregated

program activity cost.

Option 2:

Indirect Cost Rate Agreement

► Allows recipients and

subrecipients to charge

for more indirect costs

based on the actual

indirect cost rate.

► All federal agencies

must accept the

negotiated rates if

indirect costs can be

charged to grant.

► Recipients can request

an increase in the rate

based on submission

and approval of an

updated incurred cost

approval.

► Must prepare and submit an indirect cost

plan.

► Appropriate federal cognizant agency must

be identified.

► Review and negotiation of the indirect rate

agreement usually takes an extended

amount of time.

► Requires experienced and knowledgeable

staff to prepare proposal.

► Must maintain an accounting system to

properly accumulate cost by pool.

► Rates must be renegotiated every three

years.

Indirect Cost Toolkit for CoC and ESG Programs Page 34

Option

Pros

Cons

Option 3:

Cost Allocation Plan

► Ensures that all costs

are charged and paid

for all grants and

agencies.

► Recognizes the actual

costs for each program

or grant.

► Must prepare and submit a cost allocation

plan and cost policy.

► Can be complex.

► Requires experienced and knowledgeable

staff to prepare cost plan and policy

statement.

► Must maintain an accounting system to

properly accumulate all costs and the

corresponding cost allocation methodology.

► Time-consuming for review and approval by

the federal cognizant agency or pass-

through entity.

Indirect Cost Toolkit for CoC and ESG Programs Page 35

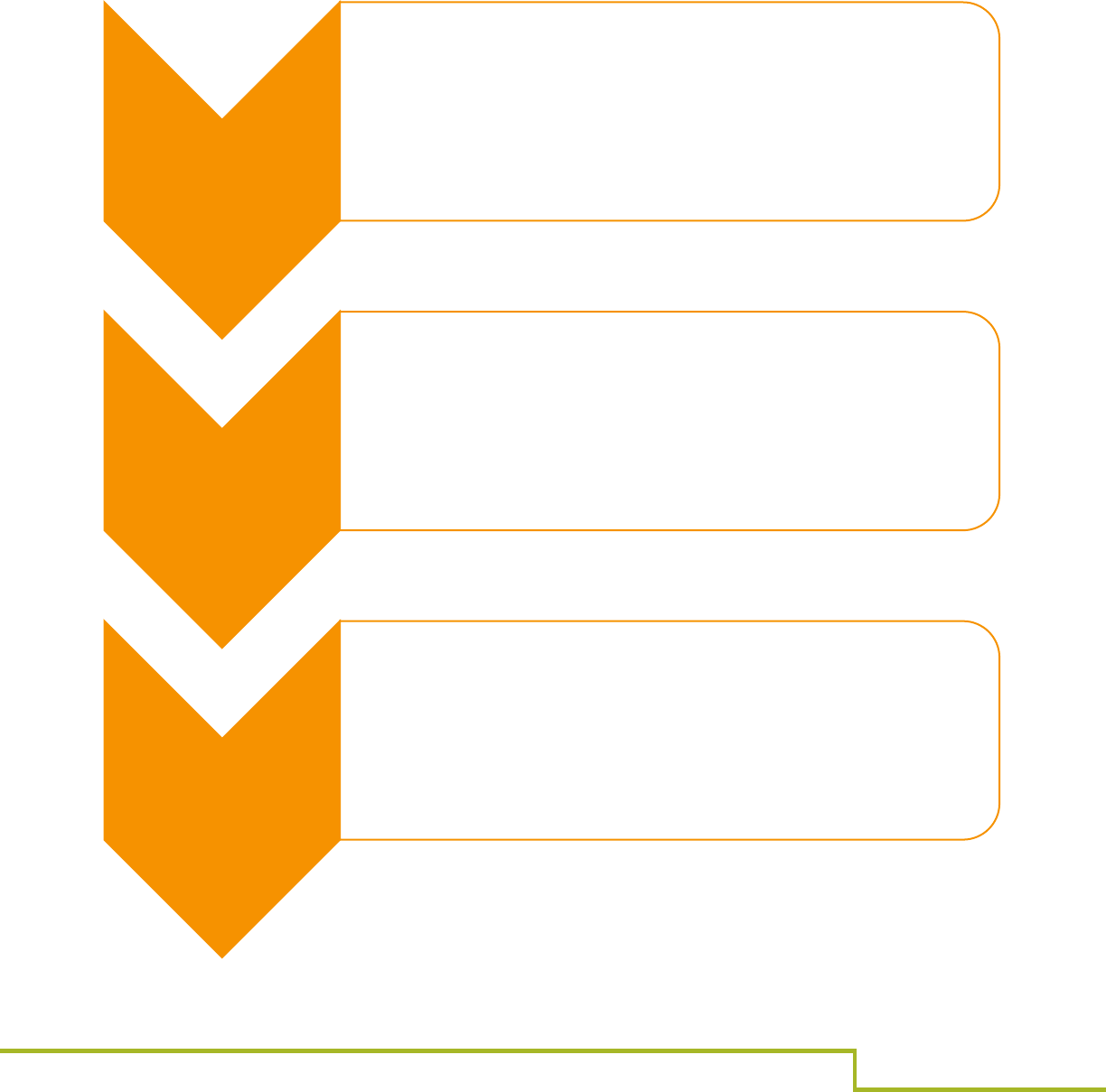

4.3 Steps for Choosing an Indirect Rate

Methodology

To determine the best method for computing and charging indirect costs, a

recipient entity should consider using the following steps:

Conduct an

Organizational

Review

•Prepare a formal organizational chart providing relevant

information explaining the various parts of the organization.

•Highlight where there are direct, indirect (administrative and

facilities), and unallowable federal costs.

Review

Federal and

Non-Federal

Funding

•Prepare a list of all funded programs in detail and identify the

specific direct costs by program.

•Clearly delineate between federal and non-federal funding

sources.

Review the

Accounting

Structure

•Review agency administrative and fiscal policies, including

internal controls.

•Review the materials collected in the previous steps and

determine if costs are charged as direct or indirect. Are they

charged by funding source (program or grant) and are they

consistent with the approved program budgets?

•If necessary, determine changes to ensure the accounting

structure is consistent with the selected indirect cost method.

Indirect Cost Toolkit for CoC and ESG Programs Page 36

5. How are indirect cost reimbursement

options calculated?

Having laid out the various acceptable methods

for determining indirect costs, let’s conclude with

a brief primer on how these methods may be

applied in practice. All federal award recipients

claiming indirect costs under federal awards

should prepare an indirect cost rate proposal and

related documentation to support those costs,

regardless of the method used.

For all methods, recipients and subrecipients must maintain and operate

financial management systems that meet or exceed the federal requirements

for funds control and accountability, as established by the applicable

regulations in 2 CFR 200, Subpart D.

5.1 Calculate and Use the 10 Percent De Minimis

Rate

First, determine the MTDC base by taking the total direct costs and

subtracting out any excluded items (see Section 3.1.2 Modified Total Direct

Cost).

200,000 (Total Direct Costs)

– 20,000 (Equipment)

– 10,000 (Subaward in Excess of $25,000)

= 170,000 Modified Total Direct Cost (MTDC)

Then, we can calculate the indirect rate, as described below.

170,000 Modified Total Direct Cost (MTDC)

x 10 Percent De Minimis Rate

= 17,000 Indirect Cost Rate

For additional examples of indirect cost calculations using the 10 percent de

minimis rate under the ESG and CoC programs, please review the following

pages.

Indirect Cost Toolkit for CoC and ESG Programs Page 37

5.1.1 ESG De Minimis Rate Indirect Cost Calculation Example

Proposed Grant Amounts

Calculations for Indirect Cost

Adjusted Budget Details

Item

Total

Expense

Of these

expenses,

what is

excluded

from MTDC?

Of these

expenses,

what is

included in

MTDC?

Rate

(de

minimis)

Indirect

Cost by

Budget

Line

Adjusted

Direct Cost

by Budget

Line

Total

Expense

Shelter Staff

Salaries and

Fringe

$100,000

$0

$100,000

x 10% =

$10,000

$90,000

$100,000

Shelter

Renovation

Costs

$35,000

$35,000

$0

$0

$35,000

$35,000

Street Outreach

Salaries and

Fringe

$25,000

$0

$25,000

$2,500

$22,500

$25,000

Purchase of

Outreach Van

$15,000

$15,000

$0

$0

$15,000

$15,000

Total:

$175,000

$50,000

$125,000

Total:

$12,500

$162,500

$175,000

Indirect Cost Toolkit for CoC and ESG Programs Page 38

5.1.2 CoC De Minimis Rate Indirect Cost Calculation Examples

Example 1

Proposed Grant Amounts

Calculations for Indirect Cost

Adjusted Budget Details

Item

Total

Expense

Of these

expenses, what

is excluded from

MTDC?

Of these

expenses, what

is included in

MTDC?

Rate

(de

minimis)

Indirect

Cost by

Budget

Line

Adjusted

Direct Cost

by Budget

Line

Total

Expense

Rapid

Rehousing

Supportive

Service Staff

Salaries and

Fringe

$50,000

$0

$50,000

x 10% =

$5,000

$45,000

$50,000

Rapid

Rehousing

Rental

Assistance

$85,000

$85,000

$0

$0

$85,000

$85,000

Subaward for

Legal Services

$50,000

$25,000

$25,000

$2,500

$47,500

$50,000

Administration

Staff Salaries

(e.g. fiscal and

HR personnel)

$15,000

$0

$15,000

$1,500

$13,500

$15,000

Total:

$200,000

$110,000

$90,000

Total:

$9,000

$191,000

$200,000

Indirect Cost Toolkit for CoC and ESG Programs Page 39

Example 2

Proposed Grant Amounts

Calculations for Indirect Cost

Adjusted Budget Details

Item

Total

Expense

Of these

expenses, what

is excluded from

MTDC?

Of these

expenses, what

is included in

MTDC?

Rate

(de

minimis)

Indirect

Cost by

Budget

Line

Adjusted

Direct Cost

by Budget

Line

Total

Expense

Case

Management

Salaries and

Fringe

$25,000

$0

$25,000

x 10% =

$10,000

$15,000

$25,000

Leasing Costs

(Building Rent

and Utilities)

$50,000

$50,000

$0

$0

$50,000

$50,000

Total:

$75,000

$50,000

$25,000

Total:

$10,000

$65,000

$75,000

Indirect Cost Toolkit for CoC and ESG Programs Page 40

5.2 Negotiate and Use an Indirect Cost Rate

Both governmental and nonprofit entities that are recipients of federal

awards can negotiate indirect cost rates with their cognizant agency for use

across all federal awards and agencies. The “cognizant agency” is the

federal agency that provides the highest dollar value annually in awards to

an organization. It is important to note, however, that there is separate

guidance for state and local (non-federal) governmental entities and for

nonprofits regarding negotiated indirect cost rates. For non-federal

government entities, relevant guidance is found in 2 CFR §200 Appendix

VII.D. For nonprofits, it is found in 2 CFR §200 Appendix IV.C.

A key difference is that, for non-federal governmental entities with annual

federal income over $35 million, a negotiated indirect cost rate is required.

For nonprofit entities, there is no threshold requirement for negotiated rates.

The following applies to federal recipients

negotiating an indirect cost rate proposal:

► Non-federal governmental recipients

receiving less than $35 million in direct

federal funding are not required to negotiate

an indirect cost rate with their cognizant

federal agency, though they can do so. They

must, nonetheless, develop and maintain an

indirect cost proposal and related

documentation for audit requirements using one of the allowable

allocation methodologies specified in 2 CFR §200. The proposal and

documentation should be provided to the cognizant agency when

specifically requested.

► Non-federal governmental recipients receiving more than $35 million

in direct federal funding must submit an indirect cost proposal to their

cognizant agency for their indirect cost rate.

► Nonprofit entities, regardless of the size of federal awards, may (but

are not required to) apply for a negotiated indirect cost rate with their

cognizant agency.

Indirect Cost Toolkit for CoC and ESG Programs Page 41

Unless different arrangements are made by the agencies concerned, the

federal agency with the largest dollar value of awards will be designated as

the cognizant agency for the negotiation and approval of indirect cost rates.

Recipients electing to negotiate and use an indirect cost rate can charge

indirect costs to a grant or contract based only on a Negotiated Indirect Cost

Rate Agreement (NICRA) approved by the cognizant federal agency.

However, the approval of indirect costs by the cognizant agency is not

intended to identify the circumstances or dictate the extent of federal

participation in the financing of grants or contracts. Please note, the

Department of Health and Human Services (HHS) reviews and approves

negotiated indirect cost rate proposals on behalf of HUD. To request a new

rate or to have an existing rate extended, contact

HUDCPDIndirectCostRate[email protected].

5.2.1 Submission of Proposal

Each organization seeking to negotiate an indirect cost rate must submit an

indirect cost rate proposal with the following required information:

► Organization profile: The purpose is to gain an understanding of the

basic structure of the organization.

► Cost policy statement: The purpose is to establish a clear

understanding between the recipient organization and the federal

government as to what costs will be charged directly and what costs

will be charged indirectly. The cost policy statement includes the

following:

• Statement on general accounting policies

• Statements on each general ledger expense account (or cost

element) indicating which account is used to record direct or

indirect expenses

• Statement regarding which general ledger accounts include costs

allocated for more than one activity. As part of this statement,

describe the method used to allocate the cost (actual usage,

square feet, cost of space, volume, etc.)

• Statement on unallowable costs:

Accounting treatment of unallowable costs

Indirect Cost Toolkit for CoC and ESG Programs Page 42

Methods and controls in place to segregate unallowable

costs

Expense accounts the unallowable costs are charged to

► Indirect cost proposal preparation policies and procedures: Written

policies and procedures describing how the agency prepares the

annual indirect cost rate proposal.

► Financial reports for the year under review, including:

• A complete copy of audited financial statements

• Single audit report

► Indirect cost rate proposal, including:

• Indirect expenses by function and cost category

• Fund distribution of the direct cost base by function and cost

category

• Reconciliation between the proposal and financial reports for the

applicable years, with any differences explained

► Allocation of salaries and wages: Schedule of positions, functions, and

annual salaries of personnel charging time to an indirect function

(employees who charge 100 percent of their time to an indirect task

and who split time between direct and indirect tasks).

► Statement on employee benefits: Schedule showing the actual cost of

applicable fringe benefits.

► Identification and description of unusual factors that may affect the

proposed rates, or any memoranda of understanding or notice

agreements that may affect the proposed rates.

► Listing of federal awards that were active during the fiscal year.

► Completed lobbying certificate that verifies that the organization does

not include lobbying costs in indirect costs.

► A completed certificate of indirect cost: Negotiated agreement and

certifications signed by an organization representative who has the

ability to contractually bind the organization.

Indirect Cost Toolkit for CoC and ESG Programs Page 43

5.2.2 Approval of Proposal

The approval will be formalized by a rate agreement (NICRA) that includes

the following:

► The approved rate(s) and information

directly related to the use of the rates (e.g.,

type of rate, effective period, and

distribution base).

► The treatment of fringe benefits as either

direct or indirect costs, or an approved

fringe benefit rate.

► General terms and conditions.

► Special remarks (e.g., the composition of

the indirect cost pool).

5.2.3 Disputes

When HHS (acting on behalf of HUD for purposes of approving a rate) and a