250 E Street SW

Washington, D.C. 20525

202-606-5000/ 800-942-2677

Indirect Cost Guidance

Office of Audit and Debt Resolution (OADR)

February 2024

1

Contents

1.0

Background and Purpose ................................................................................................................... 2

2.0

Distinguishing Direct from Indirect Costs .......................................................................................... 3

3.0

Options for Calculating Indirect Costs (choose, A, B, or C) .............................................................. 3

4.0

Negotiating an Indirect Cost Rate ...................................................................................................... 5

5.0

Who is my Cognizant Agency for Indirect Costs? ............................................................................. 5

6.0

Steps to Submit Indirect Cost Rate Proposal to AmeriCorps ........................................................... 7

7.0

Requesting a Federally Negotiated Indirect Cost Rate Extension ................................................... 8

8.0

ICRP Submission, Review and Approval Process Summary ............................................................. 9

9.0

Key References to Trainings and Resources: ................................................................................. 10

Attachment 1. Indirect Cost Proposal Checklist for Non-profit and Commercial Organizations.......... 11

Attachment 2. Indirect Cost Rate Proposal Checklist for State Workforce Agencies ............................ 12

Attachment 3. Sample: Cost Policy Statement ......................................................................................... 13

2

1.0

Background and Purpose

This guide is designed to provide AmeriCorps applicants and grantees with the

foundational knowledge necessary to effectively manage, and consistently allocate and

apply indirect costs associated with AmeriCorps awards. AmeriCorps Office of Inspector

General has identified a need for better controls and procedures on how to charge indirect

costs to Federal awards. This resource aims to foster transparency, efficiency and

accountability around indirect costs by identifying:

the different types of indirect cost rates

available to AmeriCorps applicants;

the conditions under which those costs can be claimed;

the steps involved in submitting an indirect cost rate proposal;

the process by which AmeriCorps negotiates and approves indirect cost rate

proposals.

The

guidance outlined in this document is rooted in Federal statutes, regulations, and other

applicable standards. Recognizing the complexity of those standards and the critical nature

of accurately determining and applying indirect cost rates, this guidance has been

prepared to serve as one-stop-shop to equip grantees with the relevant resources,

knowledge, and tools necessary to navigate the complexities of indirect costs, ensuring

consistency, and compliance with Federal regulations.

In addition to the information outlined in this resource, AmeriCorps applicants and

grantees are encouraged to visit our Grantees and Sponsors webpage for resources,

including eGrants instructions, grant terms and conditions, pre-award requirements,

financial reporting requirements, and training and technical assistance.

Any outstanding questions concerning indirect cost rates can be directed to

[email protected]. AmeriCorps’ Office of Audit and Debt Resolution

(OADR), which is responsible in administering the negotiant and approval of indirect cost

rate proposals and extensions, actively manages that inbox.

3

2.0

Distinguishing Direct from Indirect Costs

According to 2 CFR 200.413, Direct Costs are “costs that can be identified specifically with a

particular final cost objective, such as a federal award, or other internally or externally funded

activity, or that can be directly assigned to such activities relatively easily with a high degree

of accuracy.” In other words, direct costs are costs that are readily allocable to a particular

project. They can include costs such as program staff salaries, volunteer stipends, member

living allowances, uniforms, and member gear. They are directly allocated to the project and

tracked.

Indirect costs are the hidden costs that support a project. They include general expenses for

the organization’s administration that are incurred for common or joint objectives, and not

readily identifiable to a specific project or cost objective. Typically, indirect costs are the

expenses of doing business and include costs such as administrative salaries and wages;

accounting and auditing services; rent, leases, and mortgages; basic office supplies and

equipment; building maintenance and utilities; and Directors and Officers Insurance. The

Uniform Guidance classifies indirect costs into two broad categories: The first category,

“Facilities,” is defined as depreciation on buildings, equipment, and capital improvement;

interest on debt associated with certain buildings, equipment, and capital improvements;

and operations and maintenance expenses. The second category, which is more applicable

for AmeriCorps grants and often used interchangeably with indirect costs in eGrants, is

“Administration.” These costs are defined as general administration and general expenses

such as the director's office, accounting, personnel, and all other types of expenditures not

listed specifically under one of the subcategories of Facilities. However, the Uniform

Guidance notes that it is not possible to specify the types of cost which may be classified as

indirect (Facilities and Administration) in all situations. Identification with a Federal award

rather than the nature of the goods and services involved is the determining factor in

distinguishing indirect (Facilities and Administration) costs of Federal awards.

It is imperative to note that any item of cost incurred, either as a direct or an indirect (F&A)

cost, be treated consistently across similar circumstances, to avoid possible double charging

of Federal awards. A cost may not be assigned to a federal award as a direct cost if any other

cost incurred for the same purpose in like circumstances has been allocated to the Federal

award as an indirect cost.

3.0

Options for Calculating Indirect Costs (choose, A, B, or C)

Based on qualifying factors, applicants may either use a Federally approved indirect cost

rate or a 10 percent de minimis rate of modified total direct costs or may claim certain costs

directly. 2 CFR 200.4133 states that local governments, and Indian Tribes may use previously

approved indirect cost allocation plans. All methods must be applied consistently across all

federal awards. Applicants that have a federal negotiated indirect cost rate, or that will be

using the 10% de minimis rate, must enter that information in the Organization section in

eGrants. However, per statute and regardless of the option used, no more than five percent

of federal funds awarded by AmeriCorps may be used to recover indirect costs on

AmeriCorps State and National grants.

4

Applicants choose one of three methods to calculate allowable administrative costs – a

CNCS-fixed percentage rate method, a federally approved indirect cost rate method, or a

de minimis method. Regardless of the option chosen, the CNCS share of administrative

costs is limited to 5% of the total CNCS funds actually expended under this grant, per

section 121(d) of the National and Community Service Act of 1990, as amended and

AmeriCorps’ regulations at 45 CFR 2521.95 and 2540.110.

A. CNCS-Fixed Percentage Method Five/Ten Percent Fixed Administrative Costs Option

(Applicable ASN Applicants/Grantees Only):

The CNCS-fixed percentage rate method allows you to charge administrative costs up to a

cap without a federally approved indirect cost rate and without documentation supporting

the allocation. If you choose the CNCS-fixed percentage rate method (Section III.A. in

eGrants), you may charge, for administrative costs, a fixed 5% of the total of the CNCS funds

expended. To charge this fixed 5%, the grantee match for administrative costs may not

exceed 10% of all direct cost expenditures.

B. Federally Approved Indirect Cost Rate:

If you have a federally approved indirect cost rate, this method must be used, and the

rate will constitute documentation of your administrative costs, not to exceed the 5%

maximum federal share payable by AmeriCorps. Specify the Cost Type for which your

organization has current documentation on file, i.e., Provisional, Predetermined, Fixed, or

Final indirect cost (IDC) rate. Supply your approved IDC rate (percentage) and the base

upon which this rate is calculated (direct salaries, salaries, and fringe benefits, etc.).

AmeriCorps does not restrict the overall indirect cost rate claimed. It is at your discretion

whether or not to claim your entire IDC rate to calculate administrative costs. If you choose

to claim a lower rate, please include this rate in the Rate Claimed field.

C. De Minimis Rate of 10% of Modified Total Direct Costs:

Organizations who do not currently have a federally negotiated indirect cost rate (except

for those non-federal entities described in Appendix VII to Part 200—States and Local

Government and Indian Tribe Indirect Cost Proposals, paragraph (d)(1)(B)) and who receive

less than $35 million in direct federal funding may indefinitely use a de minimis rate of 10%

of modified total direct costs (MTDC). Additional information regarding what is included in

MTDC, and use of this option can be found at 2 CFR 200.414(f) and 200.68. If you elect to

use this option, you must use it consistently across all federal awards.

Per 45 CFR 75.2,

Modified Total Direct Cost

(MTDC) means all direct salaries and wages,

applicable fringe benefits, materials and supplies, services, travel, and up to the first

$25,000 of each subaward (regardless of the period of performance of the subawards

under the award). MTDC excludes equipment, capital expenditures, charges for patient

care, rental costs, tuition remission, scholarships and fellowships, participant support costs

and the portion of each subaward in excess of $25,000. Other items may only be excluded

when necessary to avoid a serious inequity in the distribution of indirect costs, and with the

approval of the cognizant agency for indirect costs.

5

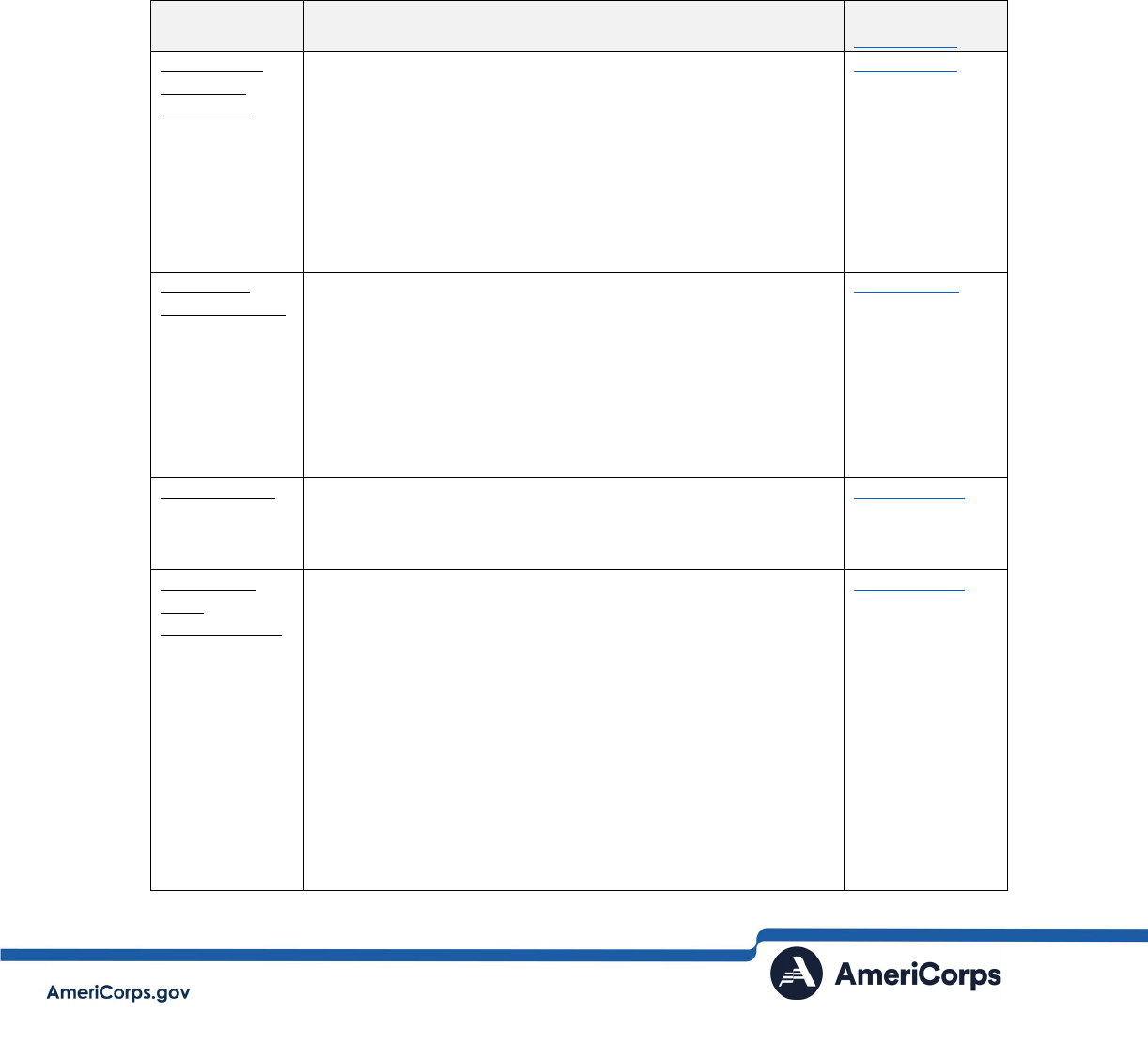

Options for Calculating Indirect Costs Summary Matrix:

A: B: C:

CNCS-Fixed Federally Approved De Minimis Rate

Percentage

Indirect Cost Rate

(5/10% Fixed

Method)

Eligibility Rules

AmeriCorps State Organization has Organization does

and National only, a negotiated indirect not currently have a

per 45 CFR §2521.95

cost rate agreement NICRA and receives

(NICRA) less than $35M in direct

from cognizant

federal funding

.

federal agency

.

Must use for all federal

Must use this rate grants

Maximum Budgeted 5% of direct CNCS Total indirect 10% of Modified Total

Amount

costs in CNCS Share costs calculation is Direct Costs (MTDC) as

(less is (Total CNCS share of based on agreement, defined in 2 CFR

allowable and direct costs x 0.0526) of which no more §200.1.

should and 10% of all direct than 5% of

be explained)

costs in direct CNCS costs

No more than 5% of

Grantee Share (total can be in

direct CNCS costs can

direct costs x 0.10) *

CNCS Share (total

be in CNCS Share (total

CNCS share of direct

CNCS share of direct

costs x 0.0526) for

costs x 0.0526) for

ASN and VGF

ASN and VGF

grantees*

grantees*

4.0

Negotiating an Indirect Cost Rate

Applicants that choose to pursue a federally negotiated rate must negotiate an indirect cost

rate with their cognizant Federal agency. The cognizant Federal agency is the agency that

provides the largest amount of direct Federal funds to the organization. See Section 5.0 for

additional cognizant agency details. It is the responsibility of the applicant or grantee to

obtain a final negotiated rate for each year indirect costs are claimed. Applicants must

submit an indirect cost rate proposal immediately after receiving notification that a federal

award will be made but in no event, later than three months after the effective date of the

Federal award. AmeriCorps negotiates indirect cost rates only with direct grantees.

Subrecipients must negotiate their rates with their primary award recipients. Organizations

that have previously established an indirect cost rate must submit their subsequent proposal

within six months after the close of the organization’s fiscal year unless the organization has

been approved for an indirect cost rate extension.

5.0

Who is my Cognizant Agency for Indirect Costs?

Cognizant agency for indirect costs means the Federal agency responsible for reviewing,

negotiating, and approving indirect cost proposals on behalf of all Federal agencies. The

cognizant agency for indirect cost is not necessarily the same as the cognizant agency for

audit.

6

Each organization is assigned or derived to a single cognizant agency which acts on behalf

of all federal agencies by reviewing and accepting indirect cost rates. Once established, a

cognizant agency will typically remain cognizant for up to a period of 5 years unless

circumstances change, such as a shift in the source of the majority of direct funding in

which case the designation of the cognizant agency could potentially be reevaluated.

Indirect cost rates approved by cognizant agencies are acceptable by all Federal agencies,

unless otherwise stipulated by Federal statute, or regulation, or agency head or delegate,

in accordance with 2 C.F.R. § 200.414(c)(1). OMB is responsible for assigning federal

agencies to serve as cognizant agencies to review and accept indirect cost rates for

organizations receiving financial awards. OMB’s Office of Federal Financial Management

has been tasked with this responsibility. The chart below helps organizations determine

who their cognizant agency for indirect costs is.

Entity Type Cognizant Agency for Indirect Costs

Reference

2 CFR 200

Institutions

of Higher

Education

(IHEs)

Cost negotiation cognizance is assigned to the Department

of Health and Human Services (HHS) or the Department of

Defense's Office of Naval Research (DOD), normally

depending on which of the two agencies (HHS or DOD)

provides more funds directly to the educational institution

for the most recent three years. In cases where neither HHS

nor DOD provides Federal funding directly to an

educational institution, the cognizant agency for indirect

costs assignment must default to HHS.

Appendix III

Paragraph C.11

Nonprofit

organizations

Unless different arrangements are agreed to by the Federal

agencies concerned, the Federal agency with the largest

dollar value of Federal awards directly funded to an

organization will be designated as the cognizant agency for

indirect costs for the negotiation and approval of the

indirect cost rates. Non-profit organizations must develop

and submit a new indirect cost proposal to AmeriCorps no

later than six months prior to the expiration of their current

rate.

Appendix IV

Paragraph C.2.a

Indian tribes Each Indian tribal government desiring reimbursement of

indirect costs must submit its indirect cost proposal to the

Department of the Interior (its cognizant agency for indirect

costs).

Appendix VII

Paragraph. D.1.c

States and

local

governments

The cognizant agency responsible for review and approval

is the Federal agency with the largest dollar value of total

Federal awards with a governmental unit. All departments

or agencies of the governmental unit desiring to claim

indirect costs under Federal awards must prepare an

indirect cost rate proposal and related documentation to

support those costs and retain the documentation for audit.

Departments or agencies receiving less than $35 million

are not required to submit an Indirect Cost Rate Proposal to

its cognizant agency unless required by the cognizant

agency. However, a governmental department or agency

unit that receives more than $35 million in direct Federal

funding must submit its indirect cost rate proposal to its

cognizant agency for indirect costs.

Appendix VII

Paragraph D.1

7

6.0

Steps to Submit Indirect Cost Rate Proposal to AmeriCorps

The Indirect Cost Rate Proposal (ICRP) consists of the documentation prepared by an

organization to substantiate its request for the establishment of an indirect cost rate, as

described in Appendixes to Part 200 of the Uniform Administrative Requirements, Cost

Principles, and Audit Requirements for Federal Awards (Appendix IV to 2 C.F.R. Part 200—

Indirect (F&A) Costs Identification and Assignment, and Rate Determination for Nonprofit

Organizations through Appendix VII to Part 200—States and Local Government and Indian

Tribe Indirect Cost Proposals).

The ICRP package normally includes the proposal, related audited financial statements,

and other detailed supporting documents (e.g., general ledger, trial balance, etc.) For

organizations seeking a negotiated rate from AmeriCorps, submission requirements vary

depending on the type of rate an organization chooses to negotiate. Negotiated indirect

cost rates approved by AmeriCorps are normally valid for one year.

ICRPs must be submitted no later than six months prior to the current rate’s expiration date

when request a new rate. Your organization can seek prior approval from AmeriCorps, by

submitting a request to [email protected], to use the rate proposed in

your ICRP as your provisional rate until AmeriCorps has notified you of the accepted rate.

Note that AmeriCorps will review all ICRPs against the provisions codified in 2 CFR 200

Subpart E.

An indirect cost proposal checklist has been provided via attachments 1, 2, and 3 to assist

organizations interested in pursuing an indirect rate. Further, the key procedures for

pursuing a federally negotiated indirect rate when AmeriCorps is the designated

cognizant agency have been outlined below.

1. Grantees prepare and submit an indirect cost rate proposal to AmeriCorps via the

indirect cost rate mailbox maintained by OADR

2. Propos

als must be prepared in accordance with 2 CFR Part 200.414.

3. OADR v

erifies that AmeriCorps is the cognizant agency for indirect costs for the

applicant and reviews the indirect cost proposal for completeness.

4. OADR

initiates negotiation process through its partnering Federal agency, the

Department of Veterans Affairs, Office of Budget Oversight (VA/OBO), to verify the

proposed rate.

5. VA/OBO completes the ICRP final review within the established timelines. VA/OBO

typically completes final validation of ICRPs within three months of receipt of the

ICRP package.

6. Upon V

A/OBO’s validation of the rate, OADR submits a draft of the NICRA to the

applicant for their review.

8

7. Follow

ing the applicant’s review of the NICRA, OADR formally issues the NICRA.

8. The

applicant inputs their indirect cost rate information into the AmeriCorps online

grants management system and performs any necessary adjustments based on the

rate agreement issued by VA/OBO. For instructions on how to enter indirect cost

rate information into an eGrants account, refer to eGrants Indirect Cost Rate (IDCR)

User Instructions.

9. Ap

plicants are required to perform all necessary adjustments to their internal

accounting records, FFRs, and other financial reports, including repaying any

indirect costs billed to the award that exceeded the final rate agreement issued by

AmeriCorps’ Office of Audit and Debt Resolution.

7.0

Requesting a Federally Negotiated Indirect Cost Rate Extension

Organizations that have a current federally negotiated cost rate may apply for a one-

time extension of that rate agreement for a period of up to four years. Extension

requests are subject to the review and approval of the cognizant agency for indirect

costs. If the extension is granted the organization may not request a rate review until the

extension period ends. At the end of the extension period, the organization must re-

apply to negotiate a rate. If AmeriCorps is your cognizant agency for indirect cost

negotiation, and you would like to request an extension, your organization should

prepare an extension request, per the requirements below, and submit your request to

[email protected]. See steps under Section 6.0 on how to submit your

indirect cost rate proposal. If AmeriCorps is not your cognizant agency for indirect cost

negotiation, and you would like to request an extension, you should contact your Grants

Officer at your cognizant agency for more information.

Extension Request Requirements

AmeriCorps will consider extension requests from organizations that have held an

indirect cost rate through AmeriCorps for at least three years. AmeriCorps can only

consider extensions of final or predetermined rates (not provisional or fixed). The

extension request must include the following:

1. A written request on organizational letterhead for an extension of the current

indirect cost rate agreement. The written request must indicate the rate and

fiscal periods requested in the extension (1-4 years). It must be signed by the

authorized representative for your organization.

2. A copy of the indirect cost rate agreement for which your organization is seeking

an extension. The rate agreement must be current (i.e., not expired).

Criteria for Evaluation for Extension Requests

Each extension request will be assessed based on consistency of the rate over the

last three years, timeliness of previous submissions, delinquent debts, and fiscal

findings identified through compliance monitoring, single audits, and OIG audits.

9

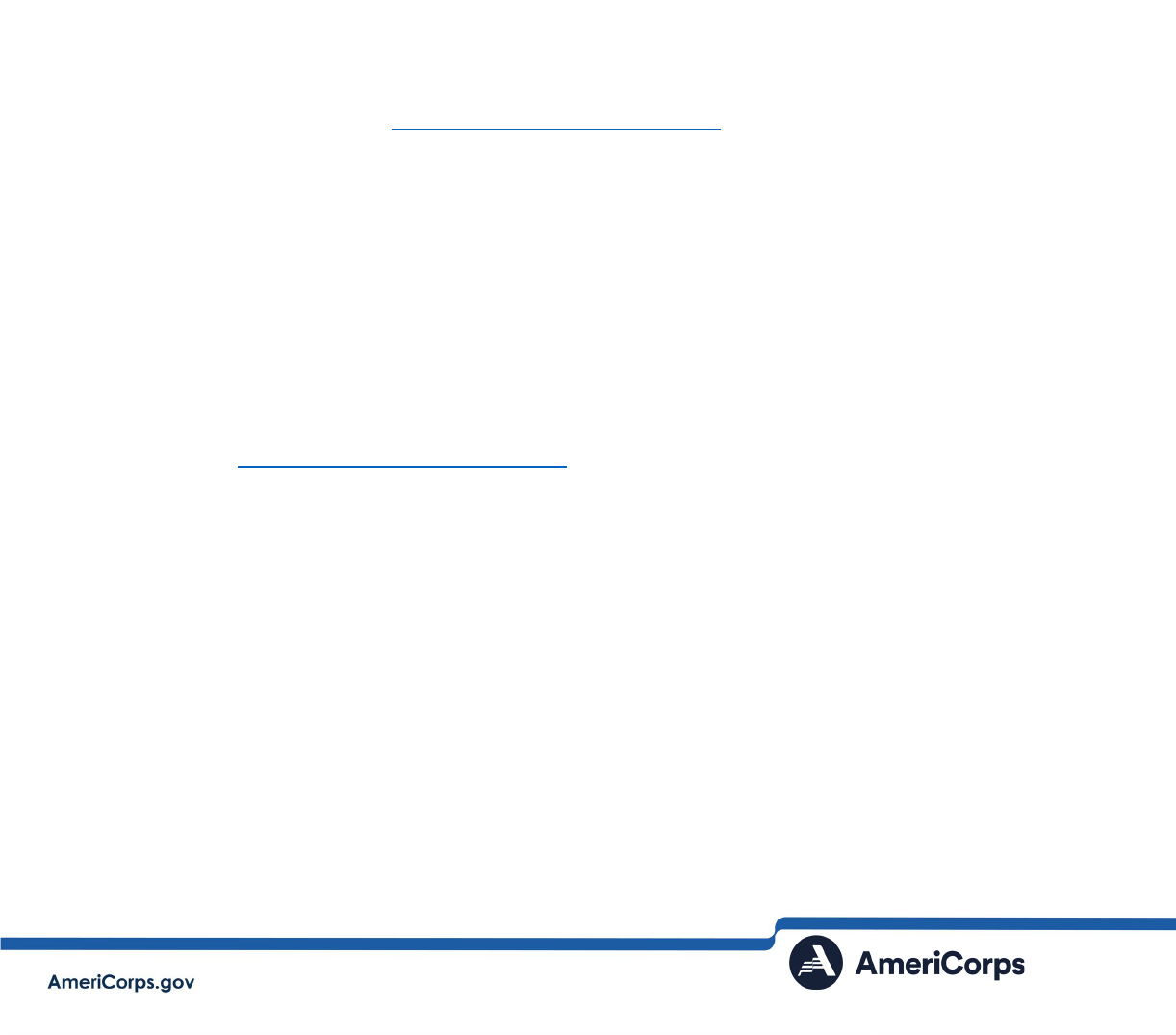

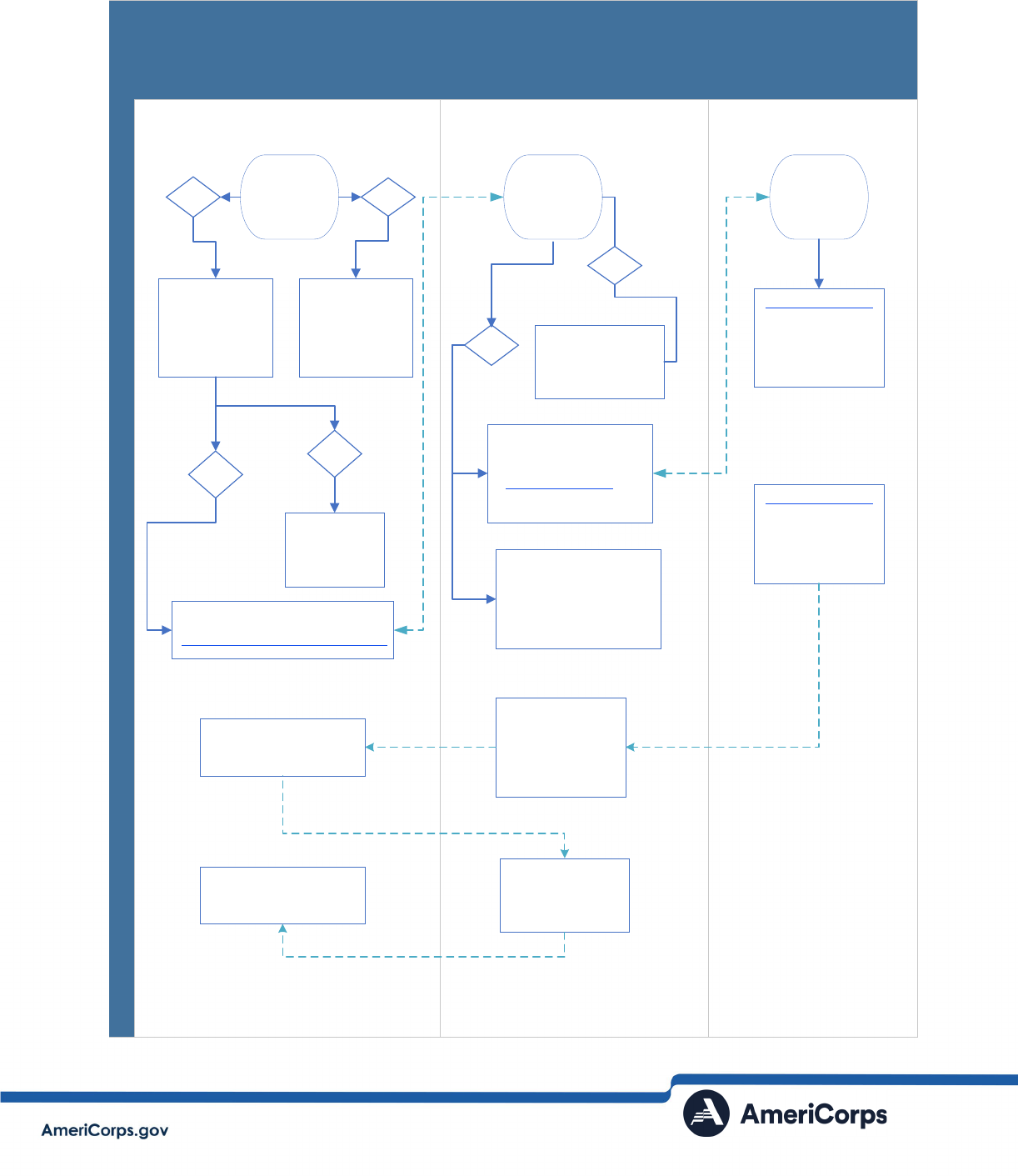

8.0

ICRP Submission, Review and Approval Process Summary

AMERICORPS (OADR)Applicant/Grantee VA/OBO

Phase

Ready to

Negotiate or

Extend Indirect

Cost Rate?

See Section 3.0.

(Options for

Calculating

Indirect Costs)

No

Yes

Is AmeriCorps

the Cognizant

Agency for

Indirect Costs?

Grantee submits ICRP to OADR

IndirectCostRate@americorps.gov

See section 7.0

for guidance.

No

Yes

No

OADR follows-up

with applicant as

necessary

Yes

OADR Shares ICRP

package to VA/OBO

GPDICRP@va.gov for

validation

OADR provides applicant

with box.com link for any

additional/future

documentation uploads

Is the ICRP

Package

Complete and

Accurate?

VA/OBO

Initiates

Validation

GPDICRP@va.gov

Follows-up directly

with applicant for

any additional

information

GPDICRP@va.gov

confirms final

validation within

60-90 days with

OADR

OADR shares draft

NICRA to applicant

for review/

signature

Applicant returns signed

copy to OADR

OADR issues final

approved NICRA

Applicant files NICRA for

documentation

Indirect Cost Rate Proposal (ICRP) Submission, Review, and Approval Process Flowchart

10

9.0

Key References to Trainings and Resources:

Best Practices in Budget Development Training:

For each competition, AmeriCorps provides an overview of the function of AmeriCorps

budget, the budget management process, and the keys for submitting a compliant and

competitive AmeriCorps budget and budget narrative. Refer to Information Session

section of the Funding Opportunities Page under each respective funding opportunity

for relevant recorded trainings. These trainings also include other relevant topics

including sample budget narratives for cost reimbursement grant budget narrative and

planning grant budget narratives.

References to 2 CFR 200 (Uniform Guidance)

Title Part | Section

Subpart A - Acronyms and Definitions 200.0 – 200.1

Subpart B - Pre-Federal Award Requirements and Contents of

Federal Awards

200.100 – 200.113

Subpart C - Post Federal Award Requirements 200.200 – 200.216

Subpart D - Post Federal Award Requirements 200.300 – 200.346

Subpart E - Cost Principles 200.400 – 200.476

Subpart F - Audit Requirements 200.500 – 200.521

Full Text of Notice of Funding Opportunity Appendix I

Contract Provisions for Non-Fed

eral Entity Contracts Under

Federal Awards

Appendix II

Indirect (F&A) Costs Identification and Assignment, and Rate

De

termination for Institutions of Higher Education (IHEs)

Appendix III

Indirect (F&A) Costs Identification and Assignment, and Rate

Determination for Nonprofit Organizations

Appendix IV

State/Local Governmentwide Central Service Cost Allocation Plans Appendix V

Public Assistance Cost Allocation Plans Appendix VI

States and Local Government and Indian Tribe Indirect Cost

Prop

osals

Note* A

cost allocation plan explains which costs are determined

to be direct or indirect. Rather than being an indirect cost rate

itself, it explains why the entity classifies specific costs as direct or

indirect. The cost allocation plan also addresses direct costs that

may be shared among different programs. AmeriCorps does not

accept cost allocation plans from non-governmental entities as an

acceptable method for charging indirect costs unless such

alternative methodology has been approved in writing by the

cognizant agency for indirect costs.

Appendix VII

Nonprofit Organizations Exempted From Subpart E of Part 200 Append

ix VIII

Hospital Cost Principles Appendix IX

Data Collection Form (Form SF–SAC) Appendix X

Compliance Supplement Appendix XI

Award Term and Condition for Recipient Integrity and

Performance Matters

Appendix XII

11

Attachment 1. Indirect Cost Proposal Checklist for Non-profit and

Commercial Organizations

a.

Submit once unless changes are observed:

1a. Organizational chart,

1b. Nonprofits - Narrative explaining compliance with 2 CFR

§200.430(a)(1)(2) & (3) and the standards for documentation of

personnel expenses.

1c. Signed Cost Policy Statement.

b.

An indirect cost rate proposal(s) providing the following:

2a. Personnel Costs Worksheet, including fringe benefits breakdown.

2b. Allocation of Personnel Worksheet, providing indirect/direct time charges.

2c. Fringe Benefits Worksheet,

2d. Statement of Total Costs, supporting the indirect and direct costs

incurred by expense category, identified by Federal agency, specific

government grant, contract, and other non-government activities.

2e. Statement of Indirect Costs, including indirect cost pool(s), allocation

base(s), and indirect cost rate(s) proposed.

c.

Audited financial statements, if available. If audited financial statements are not

available, IRS Form 990 (non-profits) or compilation/review financial statements (for-

profits) for the final rate proposal. Approved budget for provisional proposal, if

needed. Note: The Statement of Total Costs (2d. above) must reconcile to Financial

Statements. If not, please provide a reconciliation statement.

d.

Certification that the indirect cost rate proposal was prepared in a manner

consistent with the applicable cost principles set forth in 2 CFR Part 200, Subpart E &

Appendix IV for non-profits, or the Federal Acquisition Regulation (Part 31) for

commercial organizations. The certifications should be signed by the

President/Executive Director, or Comptroller/ CFO.

e.

A listing of grants and contracts by Federal agency, subagency, program office

funding source, award amount, period of performance, and the indirect cost

(overhead) limitations (if any) applicable to each, such as, ceiling rates or amounts

restricted by administrative or statutory regulations, applicable to the period(s) of the

proposal(s). This listing must be supported with copies of the approved federal grants

or contracts notification awards (1

st

page).

12

Attachment 2. Indirect Cost Rate Proposal Checklist for State Workforce

Agencies

1. Submit once unless changes are observed:

____1a. Organizational chart,

____1b. Employee time sheet sample, providing for distribution of hours to

direct/indirect functions. Narrative explaining compliance with 2 CFR

§200.430(a)(1)(2) & (3) and the standards for documentation of personnel expenses.

____1c. Cost Policy Statement signed by a duly authorized official.

2.

An indirect cost rate proposal providing the following schedules:

____2a. Personnel Costs Worksheet, including fringe benefits breakdown. Agencies

may aggregate salary expense by department such as accounting, human

reso

urces, office of director, etc.

____2b. Allocation of Personnel Worksheet, providing indirect/direct time charges.

____2c. Fringe Benef

its Worksheet if fringes are not directly and indirectly identified.

____2d. Statement of Total Costs, segregated between the indirect and direct costs

incurred by line item of expense (salaries, fringes, rent, etc.), identified by Federal

agency, specific government grant, contract, and other non-Federal activities.

Note that the allocation base and the amount of indirect costs allocated to each

funding source should be identified.

____2e. Statement of Indirect Costs, including indirect line item of expenses,

allocation base, and indirect cost rate proposed.

3. ___

_ Financial statements (audited if available) for the applicable fiscal year. Note: The

Statement of Total Costs (2d. above) must reconcile to Financial Statements. If not, please

prov

ide a reconciliation statement.

4.

____A listing of grants and contracts by Federal agency, subagency, program office funding

source, total dollar amount, period of performance, and the indirect cost limitations (if any)

applicable to each, such as amounts restricted by administrative or statutory regulations,

applicable to the period(s) of the proposal(s). This listing should also be supported by the

approved Federal grant or contract notification award(s).

5. ___

_

A schedule listing any funding sources excluded from indirect cost allocation base and

the reason for the exclusion.

6. ___

_Copy of HHS approved SWCAP, if SWCAP costs are allocated to federal programs.

7.

___

_

Review letter of State Department of Finance approval of grantee’s ICRP submission

documents.

8._

___Signed and dated Certificate of Indirect Costs.

13

Attachment 3. Sample: Cost Policy Statement

1. General Accounting Policies

o Basis of Accounting — (A

ccrual, Cash or Modified Cash)

Fiscal Period — (Insert your 12-month fiscal year)

Allocation Basis — (Specify Simplified or Direct Allocation Basis)

Indirect Cost Rate Allocation Base — (Describe allocation base)

(Name of Agency) maintains adequate internal controls to ensure that no cost is charged

both directly and indirectly to Federal contracts or grants.

(Describe any other accounting policies utilized)

o

o

o

o

o

2. De

scription of Cost Allocation Methodology

o Salaries and Wages

1. Direct Costs — (General statement describing the criteria in which employees direct

charge their time, such as "The majority of the employees direct charge their salary

costs since their work is specifically identifiable to specific grants, contracts, or other

activities of the organization. The charges are supported by auditable labor

distribution reports which reflect the actual activities of employees".)

2. Indirect Costs — The following staff members charge 100% of their salary costs

indirectly.

List Appropriate Positions

3. Mixed Charges — The following employees may charge their salary costs to both

direct and indirect activities.

List Appropriate Positions

The distinction between direct and indirect is primarily based on functions

performed. For example, when the positions shown are performing functions that

are necessary and beneficial to all programs, they are indirect. When functions are

specific to one or more programs, they are direct because they do not benefit all

programs.

Auditable labor distribution records which reflect the actual activities of employees

are maintained to support the mix of direct/indirect charges.

4. Describe how release time (vacation, sick leave, holiday pay, etc.) is treated. Include

information on whether vacation time is accrued and charged to programs when

earned or charged when taken; whether allocated the same as the related salary cost

or some other methodology; and whether treated as a fringe benefit or same as

normal salary charges.

o Fringe Benefits. Describe all fringe benefits and whether a fringe benefit is tracked by the

agency's accounting system or whether a fringe benefit rate needs to be established:

Travel

O

ccupancy Expenses

Supplies and Materials

Communications

Photocopying and Printing

Outside Services

Depreciation and Use Allowances

Repairs and Maintenance

Charges allocated down from the State such as SWCAP costs.

Capital Items

Legal Fees

Audit Fees

Signature _________________________________ Date_______________________________