INEQUALITY: CAUSES AND CONSEQUENCES

INTERNATIONAL MONETARY FUND 1

June 2015

SDN/15/13

I M F S T A F F D I S C

U S S I ON N O T

E

Causes and Consequences

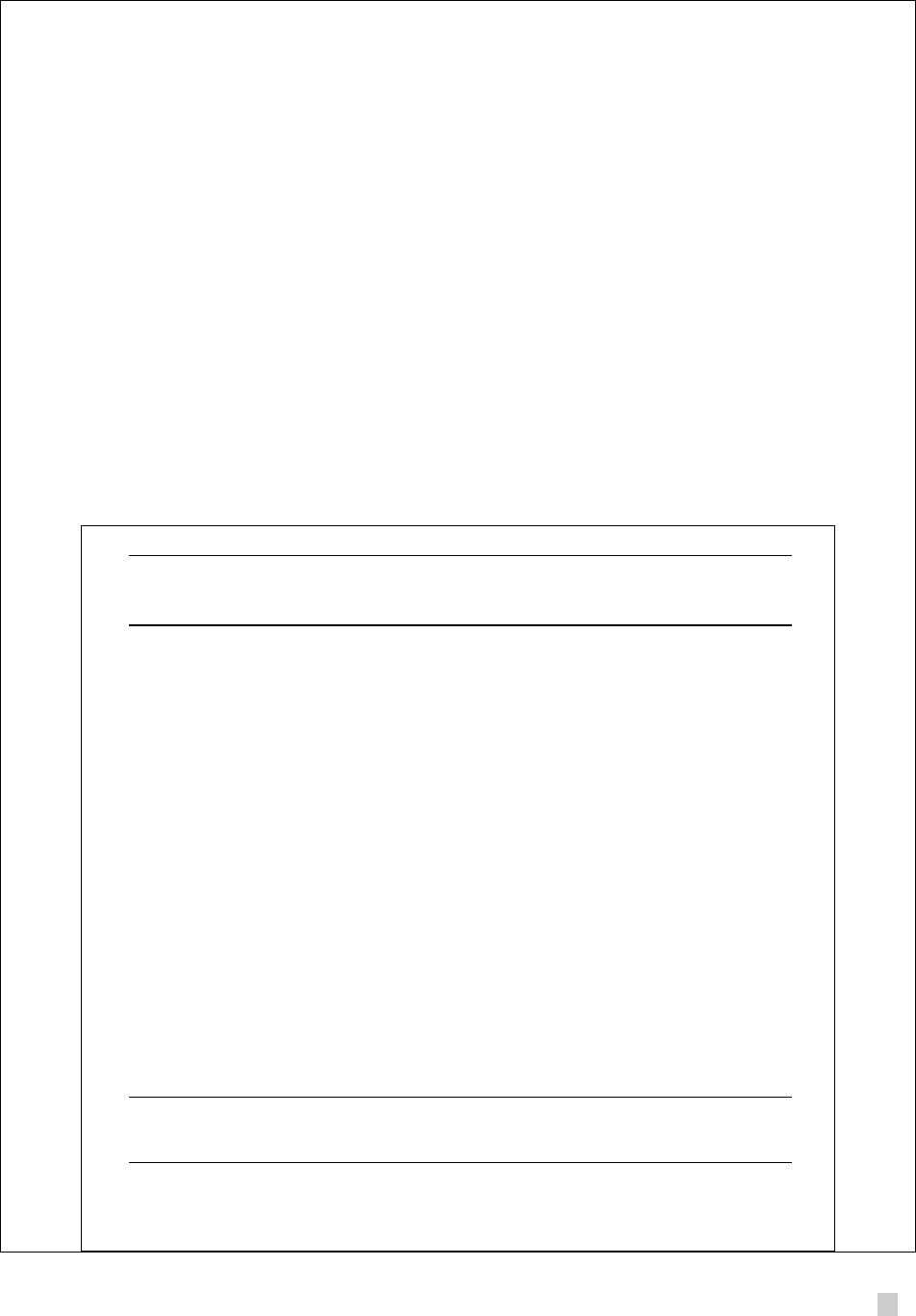

of Income Inequality:

A Global Perspective

Era Dabla-Norris, Kalpana Kochhar, Nujin

Suphaphiphat, Frantisek Ricka, Evridiki Tsounta

I N T E R N A T I O N A L M O N E T A R Y F U N D

CAUSES AND CONSEQUENCE OF INEQUALITY

2 INTERNATIONAL MONETARY FUND

INTERNATIONAL MONETARY FUND

Strategy, Policy, and Review Department

Causes and Consequences of Income Inequality: A Global Perspective

Prepared by Era Dabla-Norris, Kalpana Kochhar, Frantisek Ricka,

Nujin Suphaphiphat, and Evridiki Tsounta

(with contributions from Preya Sharma and Veronique Salins)

1

Authorized for distribution by Siddharh Tiwari

June 2015

JEL Classification Numbers: D63, D31, 015, H23,

Keywords: Inequality, Gini coefficient, cross-country analysis

Author’s E-mail Addresses: [email protected]

1

Frank Wallace and Zhongxia Zhang provided excellent research assistance. We also thank Ricardo

Reinoso and Christiana Weekes for editorial assistance.

DISCLAIMER: This Staff Discussion Note represents the views of the authors and does

not necessarily represent IMF views or IMF policy. The views expressed herein should

be attributed to the authors and not to the IMF, its Executive Board, or its

management. Staff Discussion Notes are published to elicit comments and to further

debate.

INEQUALITY: CAUSES AND CONSEQUENCES

INTERNATIONAL MONETARY FUND 3

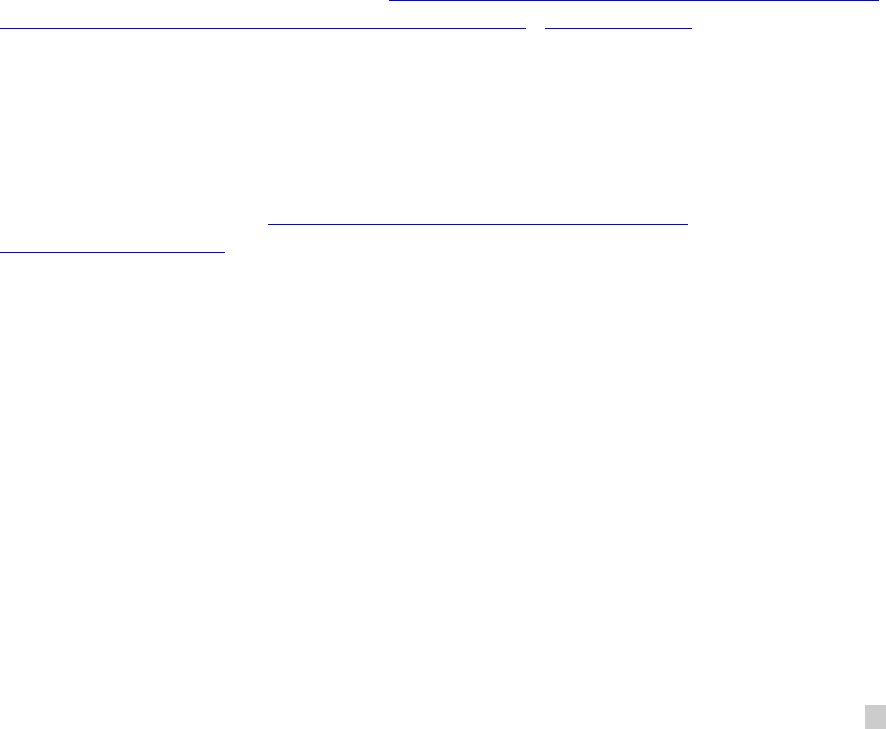

CONTENTS

EXECUTIVE SUMMARY _________________________________________________________________________________ 4

II. MACROECONOMIC CONSEQUENCES: WHY WE CARE ____________________________________________ 6

III. STYLIZED FACTS: WHAT DO WE KNOW ABOUT INEQUALITY OF OUTCOMES AND

OPPORTUNITIES? _______________________________________________________________________________________ 9

IV. INEQUALITY DRIVERS ____________________________________________________________________________ 18

A. Factors Driving Higher Income Inequality ___________________________________________________________ 18

B. Empirical Analysis ___________________________________________________________________________________ 22

V. POLICY DISCUSSION AND FINAL REMARKS _____________________________________________________ 30

ANNEX I. DEFINITIONS AND SOURCES OF VARIABLES ____________________________________________ 33

FIGURES

1. Income Inequality and Social Mobility ________________________________________________________________ 8

2. Global Inequality and Distribution of Income _______________________________________________________ 10

3. Change in Net Gini Index, 1990–2012 _______________________________________________________________ 11

4. Change in Gross Gini and Income Decile ____________________________________________________________ 12

5. Top 1% Income Share _______________________________________________________________________________ 13

6. Estimated Corporate Profits _________________________________________________________________________ 13

7. Change in Income Share, 1990–2009 ________________________________________________________________ 13

8. Disconnect: Real Average Wage and Productivity ___________________________________________________ 14

9. Poverty Rates by Regions ___________________________________________________________________________ 15

10. Top 1% and Bottom 90% Wealth Distribution, 1980–2010 ________________________________________ 15

11. Wealth and Income Inequality in Advanced and Emerging Market Economies, 2000 _____________ 16

12. Inequalities in Health by Quintile, 2010–12 ________________________________________________________ 17

13. Education Gini and Outcomes by Income Decile __________________________________________________ 17

14. Financial Inclusion in Advanced and Developing Countries _______________________________________ 18

15. Technological Progress and Skill Premium in OECD Countries ____________________________________ 19

16. Trade and Financial Openness _____________________________________________________________________ 20

17. Union Rate by Country Group _____________________________________________________________________ 21

18. Change in Top Tax Rate and Top 1 Percent Income Share ________________________________________ 22

19. Impact of Change in Financial Deepening on Inequality ___________________________________________ 23

20. Decomposition of the Change in Market (Gross) Income Inequality ______________________________ 27

21. Change in Income Share of the Bottom 10 Percent and Middle Decile ____________________________ 28

TABLES

1. Regression Results of Growth Drivers _________________________________________________________________ 7

2. Regression Results of Inequality Drivers ____________________________________________________________ 25

3. Regression Results on Determinants of Poverty Change ____________________________________________ 29

BOXES

1. Assessing the Drivers of Income Inequality Around the World _____________________________________ 24

2. Drivers of Poverty ___________________________________________________________________________________ 29

References ____________________________________________________________________________________________ 34

CAUSES AND CONSEQUENCE OF INEQUALITY

4 INTERNATIONAL MONETARY FUND

EXECUTIVE SUMMAR

Y

“We should measure the health of our society not at its apex, but at its base.” Andrew Jackson

Widening income inequality is the defining challenge of our time. In advanced economies, the gap

between the rich and poor is at its highest level in decades. Inequality trends have been more mixed

in emerging markets and developing countries (EMDCs), with some countries experiencing declining

inequality, but pervasive inequities in access to education, health care, and finance remain. Not

surprisingly then, the extent of inequality, its drivers, and what to do about it have become some of

the most hotly debated issues by policymakers and researchers alike. Against this background, the

objective of this paper is two-fold.

First, we show why policymakers need to focus on the poor and the middle class. Earlier IMF work

has shown that income inequality matters for growth and its sustainability. Our analysis suggests

that the income distribution itself matters for growth as well. Specifically, if the income share of the

top 20 percent (the rich) increases, then GDP growth actually declines over the medium term,

suggesting that the benefits do not trickle down. In contrast, an increase in the income share of the

bottom 20 percent (the poor) is associated with higher GDP growth. The poor and the middle class

matter the most for growth via a number of interrelated economic, social, and political channels.

Second, we investigate what explains the divergent trends in inequality developments across

advanced economies and EMDCs, with a particular focus on the poor and the middle class. While

most existing studies have focused on advanced countries and looked at the drivers of the Gini

coefficient and the income of the rich, this study explores a more diverse group of countries and

pays particular attention to the income shares of the poor and the middle class—the main engines

of growth. Our analysis suggests that

Technological progress and the resulting rise in the skill premium (positives for growth and

productivity) and the decline of some labor market institutions have contributed to inequality in

both advanced economies and EMDCs. Globalization has played a smaller but reinforcing role.

Interestingly, we find that rising skill premium is associated with widening income disparities in

advanced countries, while financial deepening is associated with rising inequality in EMDCs,

suggesting scope for policies that promote financial inclusion.

Policies that focus on the poor and the middle class can mitigate inequality. Irrespective of the

level of economic development, better access to education and health care and well-targeted

social policies, while ensuring that labor market institutions do not excessively penalize the poor,

can help raise the income share for the poor and the middle class.

There is no one-size-fits-all approach to tackling inequality. The nature of appropriate policies

depends on the underlying drivers and country-specific policy and institutional settings. In

advanced economies, policies should focus on reforms to increase human capital and skills,

coupled with making tax systems more progressive. In EMDCs, ensuring financial deepening is

accompanied with greater financial inclusion and creating incentives for lowering informality

would be important. More generally, complementarities between growth and income equality

objectives suggest that policies aimed at raising average living standards can also influence the

distribution of income and ensure a more inclusive prosperity.

INEQUALITY: CAUSES AND CONSEQUENCES

INTERNATIONAL MONETARY FUND 5

I. CONTEXT

1. Rising inequality is a widespread concern. Inequality within most advanced and emerging

markets and developing countries (EMDCs) has increased, a phenomenon that has received

considerable attention—President Obama called widening income inequality the “defining challenge

of our time.” A recent Pew Research Center (PRC 2014) survey found that the gap between the rich

and the poor is considered a major challenge by more than 60 percent of respondents worldwide,

and Pope Francis has spoken out against the “economy of exclusion.” Indeed, the PRC survey found

that while education and working hard were seen as important for getting ahead, knowing the right

persons and belonging to a wealthy family were also critical, suggesting potential major hurdles to

social mobility. Not surprisingly then, the extent of inequality, its drivers, and what to do about it

have become some of the most hotly debated issues by policymakers and researchers alike.

2. Why it matters. Equality, like fairness, is an important value in most societies. Irrespective of

ideology, culture, and religion, people care about inequality. Inequality can be a signal of lack of

income mobility and opportunity―a reflection of persistent disadvantage for particular segments of

the society. Widening inequality also has significant implications for growth and macroeconomic

stability, it can concentrate political and decision making power in the hands of a few, lead to a

suboptimal use of human resources, cause investment-reducing political and economic instability,

and raise crisis risk. The economic and social fallout from the global financial crisis and the resultant

headwinds to global growth and employment have heightened the attention to rising income

inequality.

3. This note. The objective of the note is two-fold. First, it shows why policymakers need to

focus on the poor and the middle class. Building on earlier IMF work which has shown that income

inequality matters for growth, we show that the income distribution itself matters for growth as well.

In particular, our findings suggest that raising the income share of the poor and ensuring that there

is no hollowing-out of the middle class is good for growth through a number of interrelated

economic, social, and political channels. Second, we investigate what explains the divergent trends in

inequality developments across advanced economies and EMDCs, with a particular focus on the

poor and the middle class. In that context, we are filling a gap in the literature since existing studies

typically focus only on advanced economies or a smaller sample of EMDCs. This approach allows us

to suggest policy implications depending on the underlying drivers, and country-specific policy and

institutional settings.

4. Roadmap. Section II provides an overview of the macroeconomic implications of high

inequality of outcomes and opportunities and shows why policymakers’ focus on the income shares

of poor and the middle class can prove growth-enhancing. Section III provides a rich documentation

of recent trends in both monetary and nonmonetary indicators of inequality across advanced

economies and EMDCs, while Section IV investigates the drivers of the rise in inequality, including

from an empirical perspective. Section V concludes and discusses policy implications.

CAUSES AND CONSEQUENCE OF INEQUALITY

6 INTERNATIONAL MONETARY FUND

II. MACROECONOMIC CONSEQUENCES: WHY WE CARE

5. Outcomes and opportunities. The discourse on inequality often makes a distinction

between inequality of outcomes (as measured by income, wealth, or expenditure) and inequality of

opportunities―attributed to differences in circumstances beyond the individual’s control, such as

gender, ethnicity, location of birth, or family background. Inequality of outcomes arises from a

combination of differences in opportunities and individual’s efforts and talent. At the same time, it is

not easy to separate effort from opportunity, especially in an intergenerational context. For instance,

parental income, resulting from their own effort, determines the opportunity of their children to

obtain an education. It is in this spirit that Rawls (1971) argued that the distribution of opportunities

and of outcomes are equally important and informative to understand the nature and extent of

inequality around the world.

6. Is inequality a necessary evil? Some degree of inequality may not be a problem insofar as

it provides the incentives for people to excel, compete, save, and invest to move ahead in life. For

example, returns to education and differentiation in labor earnings can spur human capital

accumulation and economic growth, despite being associated with higher income inequality.

Inequality can also influence growth positively by providing incentives for innovation and

entrepreneurship (Lazear and Rosen 1981), and, perhaps especially relevant for developing

countries, by allowing at least a few individuals to accumulate the minimum needed to start

businesses and get a good education (Barro 2000).

7. Why is rising inequality a concern? High and sustained levels of inequality, especially

inequality of opportunity can entail large social costs. Entrenched inequality of outcomes can

significantly undermine individuals’ educational and occupational choices. Further, inequality of

outcomes does not generate the “right” incentives if it rests on rents (Stiglitz 2012). In that event,

individuals have an incentive to divert their efforts toward securing favored treatment and

protection, resulting in resource misallocation, corruption, and nepotism, with attendant adverse

social and economic consequences. In particular, citizens can lose confidence in institutions, eroding

social cohesion and confidence in the future.

8. Income distribution matters for growth. Previous IMF studies have found that income

inequality (as measured by the Gini coefficient, which is 0 when everybody has the same income and

1 when one person has all the income) negatively affects growth and its sustainability (Ostry, Berg,

and Tsangarides 2014; Berg and Ostry 2011). We build on this analysis by examining how

individuals’ income shares at various points in the distribution matter for growth drawing on a large

sample of advanced economies and EMDCs (Table 1).

2

A higher net Gini coefficient (a measure of

2

This analysis is based on a sample of 159 advanced, emerging, and developing economies for the period 1980–

2012 using a simple growth model (with time and country fixed effects) in which growth depends on initial income

(convergence hypothesis), lagged GDP growth, and inequality (as measured by net Gini or the income shares

accruing to various quintiles) estimated using system GMM. Augmenting this model with standard growth

determinants, such as human and physical capital, does not affect our main findings. See Annex for data sources.

INEQUALITY: CAUSES AND CONSEQUENCES

INTERNATIONAL MONETARY FUND 7

inequality that nets out taxes and transfers) is associated with lower output growth over the medium

term, consistent with previous findings. More importantly, we find an inverse relationship between

the income share accruing to the rich (top 20 percent) and economic growth. If the income share of

the top 20 percent increases by 1 percentage point, GDP growth is actually 0.08 percentage point

lower in the following five years, suggesting that the benefits do not trickle down. Instead, a similar

increase in the income share of the bottom 20 percent (the poor) is associated with 0.38 percentage

point higher growth. This positive relationship between disposable income shares and higher growth

continues to hold for the second and third quintiles (the middle class). This result survives a variety

of robustness checks, and is in line with recent findings for a smaller sample of advanced economies

(OECD 2014).

In the remainder of this section, we discuss potential channels for why higher income

shares for the poor and the middle class are growth-enhancing.

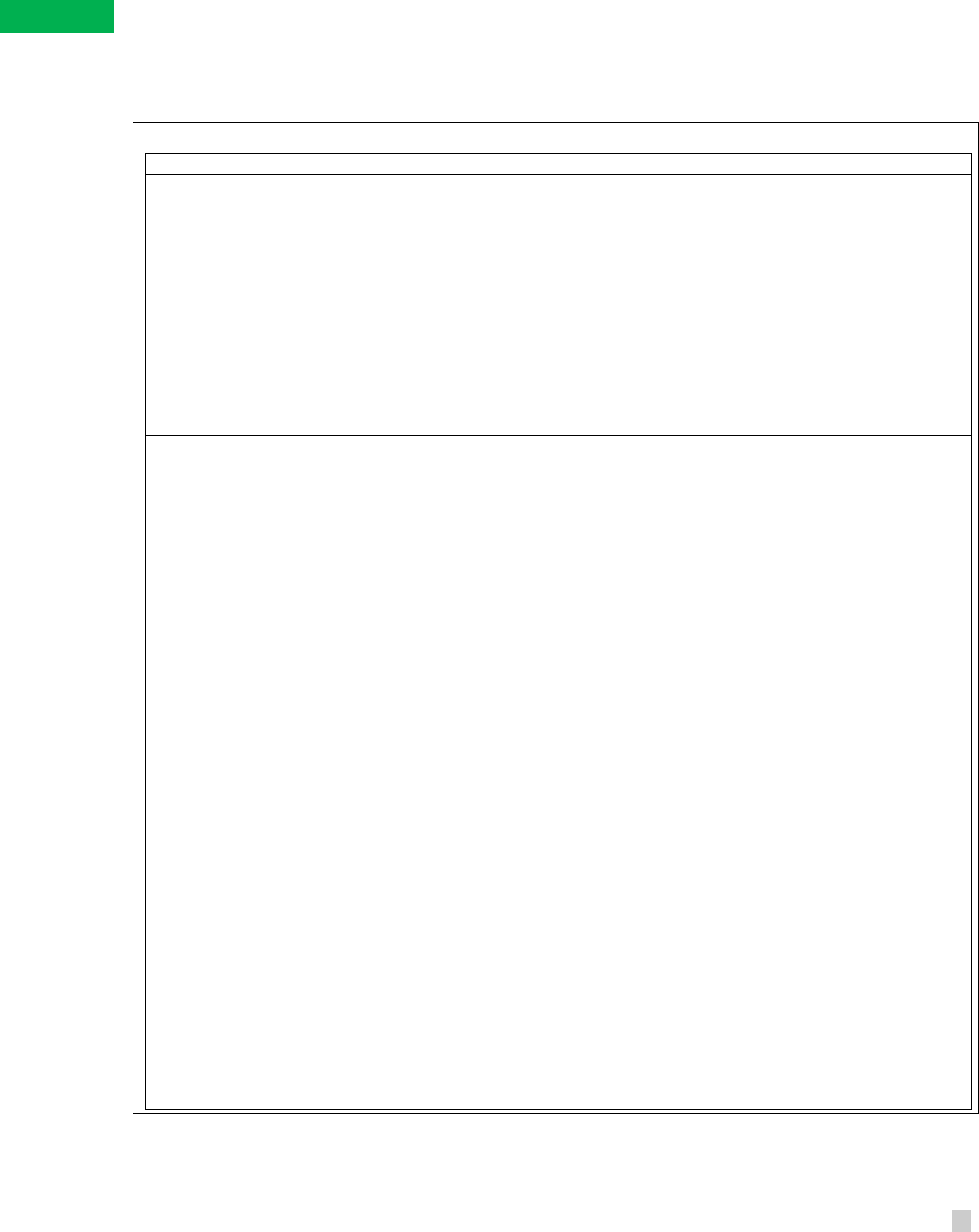

Table 1. Regression Results of Growth and Income Distribution

Source: Solt Database; World Bank; UNU-WIDER World Income Inequality Database; and IMF staff

calculations.

Note: Standard errors in parentheses, *p < 0.1; **p < 0.05; ***p < 0.01. Estimated using system GMM,

which instruments potentially endogenous right-hand-side variables using lagged values and first

differences. The regressions include country and time dummies to respectively control for time-

invariant omitted-variable bias and global shocks, which might affect aggregate growth but are not

otherwise captured by the explanatory variables.

Variables (1) (2) (3) (4) (5) (6)

Lagged GDP Growth 0.145*** 0.112*** 0.118*** 0.113*** 0.097*** 0.114***

(0.033) (0.030) (0.031) (0.031) (0.030) (0.031)

GDP Per Capita Level (in logs) -1.440*** -2.198*** -2.247*** -2.223*** -2.122*** -2.222***

(0.361) (0.302) (0.307) (0.308) (0.304) (0.307)

N

et Gini -0.0666*

(0.034)

1st Quintile 0.381**

(0.165)

2nd Quintile 0.325**

(0.146)

3rd Quintile 0.266*

(0.152)

4th Quintile 0.0596

(0.180)

5th Quintile -0.0837*

(0.044)

Constan

t

17.34*** 18.82*** 18.12*** 17.45*** 19.41*** 25.32***

(3.225) (2.579) (2.713) (3.058) (4.203) (3.496)

Country Fixed Effects Yes Yes Yes Yes Yes Yes

Time Dummies Yes Yes Yes Yes Yes Yes

#. of Observations 733 455 455 455 455 455

#. of Countries 159 156 156 156 156 156

Dependent Variable: GDP Growth

CAUSES AND CONSEQUENCE OF INEQUALITY

8 INTERNATIONAL MONETARY FUND

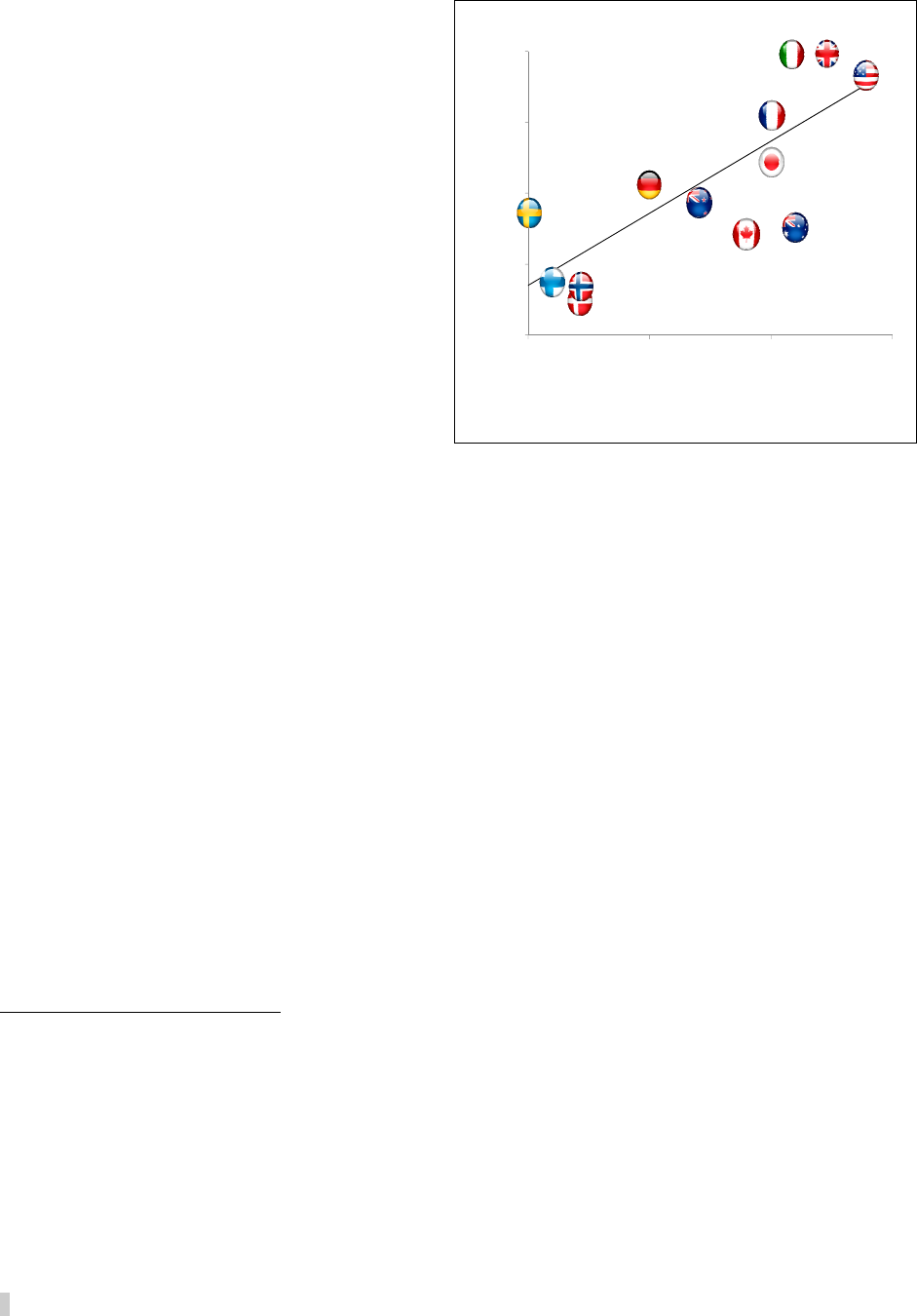

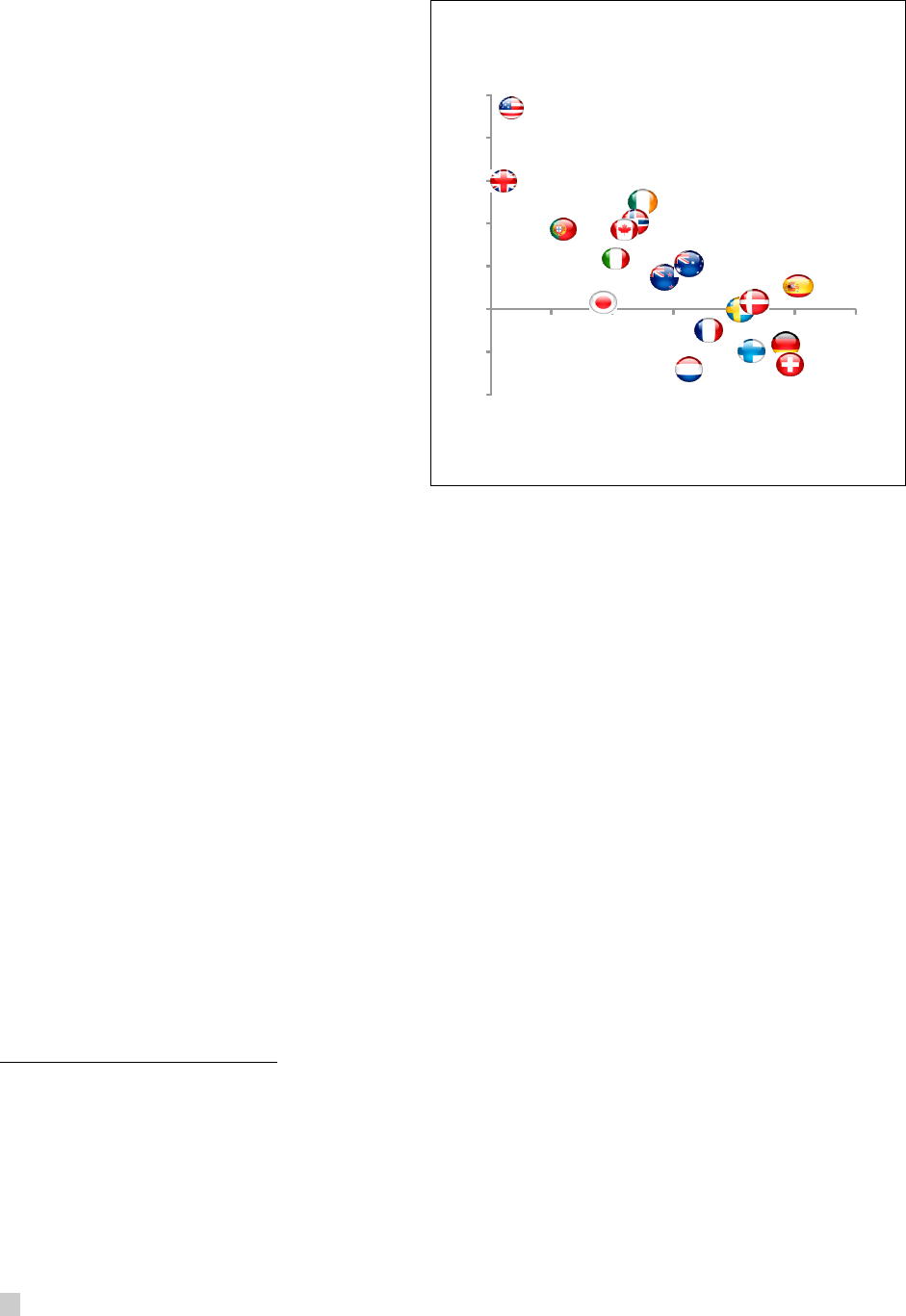

9. Inequality affects growth drivers.

Why would widening income disparities matter

for growth? Higher inequality lowers growth by

depriving the ability of lower-income

households to stay healthy and accumulate

physical and human capital (Galor and Moav

2004; Aghion, Caroli, and Garcia-Penalosa

1999). For instance, it can lead to under-

investment in education as poor children end

up in lower-quality schools and are less able to

go on to college.

3

As a result, labor productivity

could be lower than it would have been in a

more equitable world (Stiglitz 2012). In the

same vein, Corak (2013) finds that countries

with higher levels of income inequality tend to

have lower levels of mobility between

generations, with parent’s earnings being a more important determinant of children’s earnings

(Figure 1). Increasing concentration of incomes could also reduce aggregate demand and

undermine growth, because the wealthy spend a lower fraction of their incomes than middle- and

lower-income groups.

4

10. Inequality dampens investment, and hence growth, by fueling economic, financial, and

political instability.

Financial crises. A growing body of evidence suggests that rising influence of the rich and

stagnant incomes of the poor and middle class have a causal effect on crises, and thus directly

hurt short- and long-term growth.

5

In particular, studies have argued that a prolonged period of

higher inequality in advanced economies was associated with the global financial crisis by

intensifying leverage, overextension of credit, and a relaxation in mortgage-underwriting

standards (Rajan 2010), and allowing lobbyists to push for financial deregulation (Acemoglu

2011).

Global imbalances. Higher top income shares coupled with financial liberalization, which itself

could be a policy response to rising income inequality, are associated with substantially larger

3

Widening income disparities can depress skills development among individuals with poorer parental education

background, both in terms of the quantity of education attained (for example, years of schooling) and its quality (that

is, skill proficiency). Educational outcomes of individuals from richer backgrounds, however, are not affected by

inequality (Cingano 2014).

4

See Carvalho and Rezai (2014) for a discussion of the empirical and theoretical underpinnings of this assertion.

5

In a theoretical setting, Kumhof and Ranciere (2010) and Kumhof and others (2012) show that rising inequality

enables investors to increase their holding of financial assets backed by loans to workers, resulting in rising debt-to-

income ratios and thus financial fragility. The latter can eventually lead to a financial crisis.

Figure 1. Income Inequality and Social Mobility

Sources: Corak (2013); Organisation of Economic Co-

operation and Development; and IMF staff calculations.

0.1

0.2

0.3

0.4

0.5

20 25 30 35

Income Inequality, 1980s (more inequality -----> )

Intergenerational earnings elasticity,

1960s-1990s ( less mobility -----> )

INEQUALITY: CAUSES AND CONSEQUENCES

INTERNATIONAL MONETARY FUND 9

external deficits (Kumholf and others 2012). Such large global imbalances can be challenging for

macroeconomic and/or financial stability, and thus growth (Bernanke 2011).

Conflicts. Extreme inequality may damage trust and social cohesion and thus is also associated

with conflicts, which discourage investment. Conflicts are particularly prevalent in the

management of common resources where, for example, inequality makes resolving disputes

more difficult; see, for example, Bardhan (2005). More broadly, inequality affects the economics

of conflict, as it may intensify the grievances felt by certain groups or can reduce the

opportunity costs of initiating and joining a violent conflict (Lichbach 1989).

11. Inequality can lead to policies that hurt growth. In addition to affecting growth drivers,

inequality could result in poor public policy choices. For example, it can lead to a backlash against

growth-enhancing economic liberalization and fuel protectionist pressures against globalization and

market-oriented reforms (Claessens and Perotti 2007). At the same time, enhanced power by the

elite could result in a more limited provision of public goods that boost productivity and growth,

and which disproportionately benefit the poor (Putnam 2000; Bourguignon and Dessus 2009).

12. Inequality hampers poverty reduction. Income inequality affects the pace at which growth

enables poverty reduction (Ravallion 2004). Growth is less efficient in lowering poverty in countries

with high initial levels of inequality or in which the distributional pattern of growth favors the non-

poor. Moreover, to the extent that economies are periodically subject to shocks of various kinds that

undermine growth, higher inequality makes a greater proportion of the population vulnerable to

poverty.

III. STYLIZED FACTS: WHAT DO WE KNOW ABOUT

INEQUALITY OF OUTCOMES AND OPPORTUNITIES?

13. Measuring inequality. Income inequality—the most widely cited measure of inequality of

outcomes—is typically measured by the market (gross) and net (after tax and transfers from social

insurance programs) Gini, and by tracking changes in the income shares of the population (for

example, by decile/quintile). Information on the assets held by the wealthiest offers a

complementary perspective on monetary inequality. Inequality of opportunities is often measured

by tracking health, education and human development outcomes by income group, or by examining

access to basic services and opportunities. In this section, we document recent trends in both

monetary and nonmonetary indicators of inequality across a large sample of advanced and EMDCs.

Inequality of outcomes: Income

14. Global inequality remains high. Global inequality ranges from 0.55 to 0.70 depending on

the measure used (Figure 2). The high level of global inequality reflects sizeable per capita income

disparities across countries, which account for around three quarters of global inequality (Milanovic

2013). Some measures of global inequality exhibit a declining trend in the last few decades in

response to rising incomes for those living in China and India, where hundreds of millions of people

have been lifted out of poverty. However, other measures of global income inequality—adjusted for

CAUSES AND CONSEQUENCE OF INEQUALITY

10 INTERNATIONAL MONETARY FUND

top incomes which tend to be underreported in most household surveys—appear to be broadly

stable since the early 1990s.

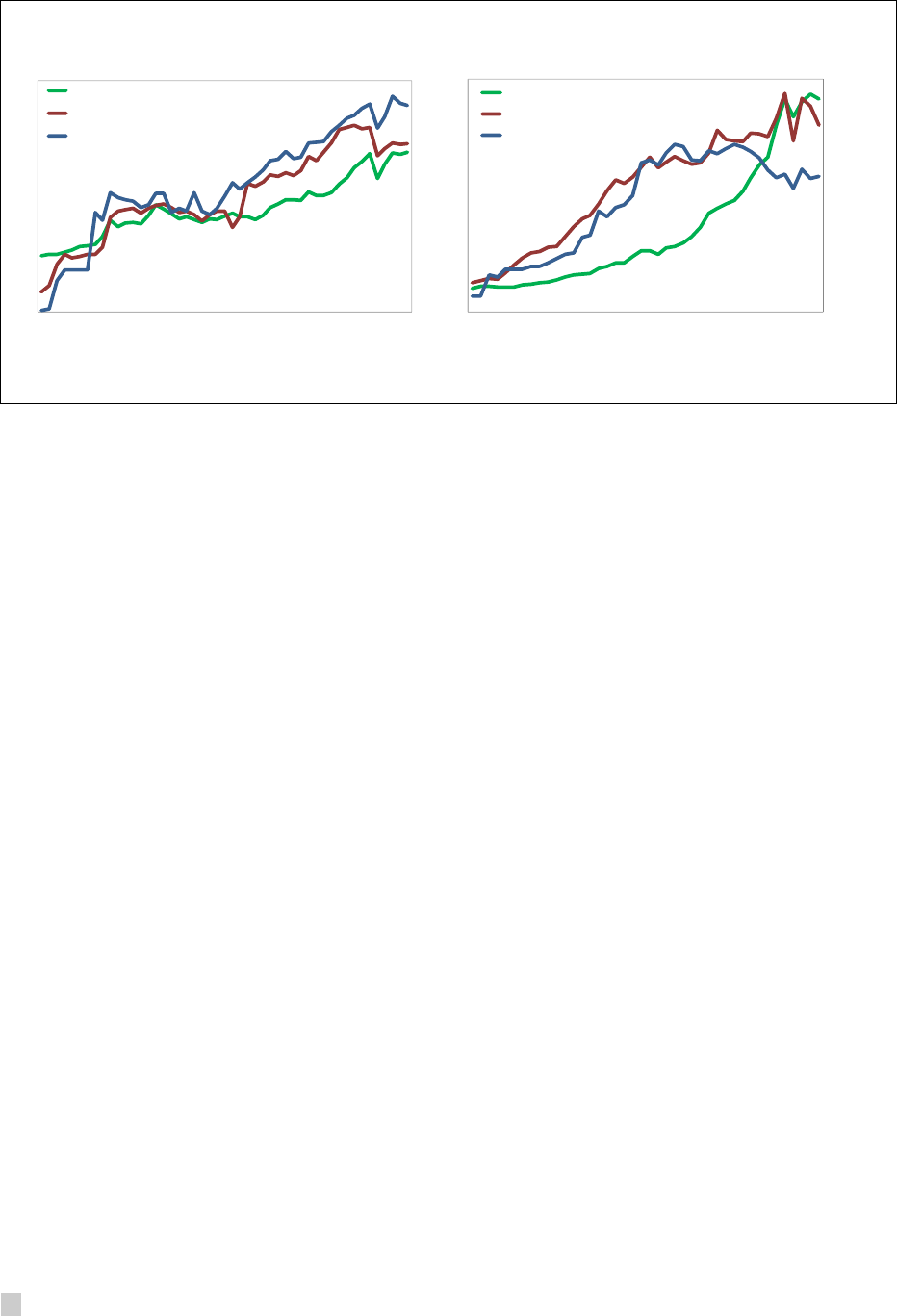

Figure 2. Global Inequality and the Distribution of Income

Sources: Lakner and Milanovic (2013); Milanovic (2013); and IMF staff calculations.

Note: Unweighted inter-country inequality (blue line) is calculated across GDPs obtained from household surveys of all

countries in the world, without population-weighting. The population-weighted inter-country inequality (red line) takes into

account population weights. Finally, the global inequality concept (green dotted line) focuses on individuals, instead of

countries. The calculation is based on household surveys with data on individual incomes or consumption.

15. Globally, the middle class and the top 1 percent have experienced the largest gains.

Examining changes in real incomes between 1998 and 2008 at various percentiles of the global

income distribution, Lakner and Milanovic (2013) show that the largest gains acrued for the global

median income (50th percentile) earners and for the top 1 percent. This coincides with the rapid

growth of the middle class in many emerging market economies, and the concentration of top

earners in advanced economies, respectively. Moreover, income gains rapidly decrease after the

50th percentile and become stagnant around the 80th–90th global percentiles before shooting up

for the global top 1 percent (Krugman 2014). In what follows, we focus on recent trends in within-

country inequality which drives these global developments.

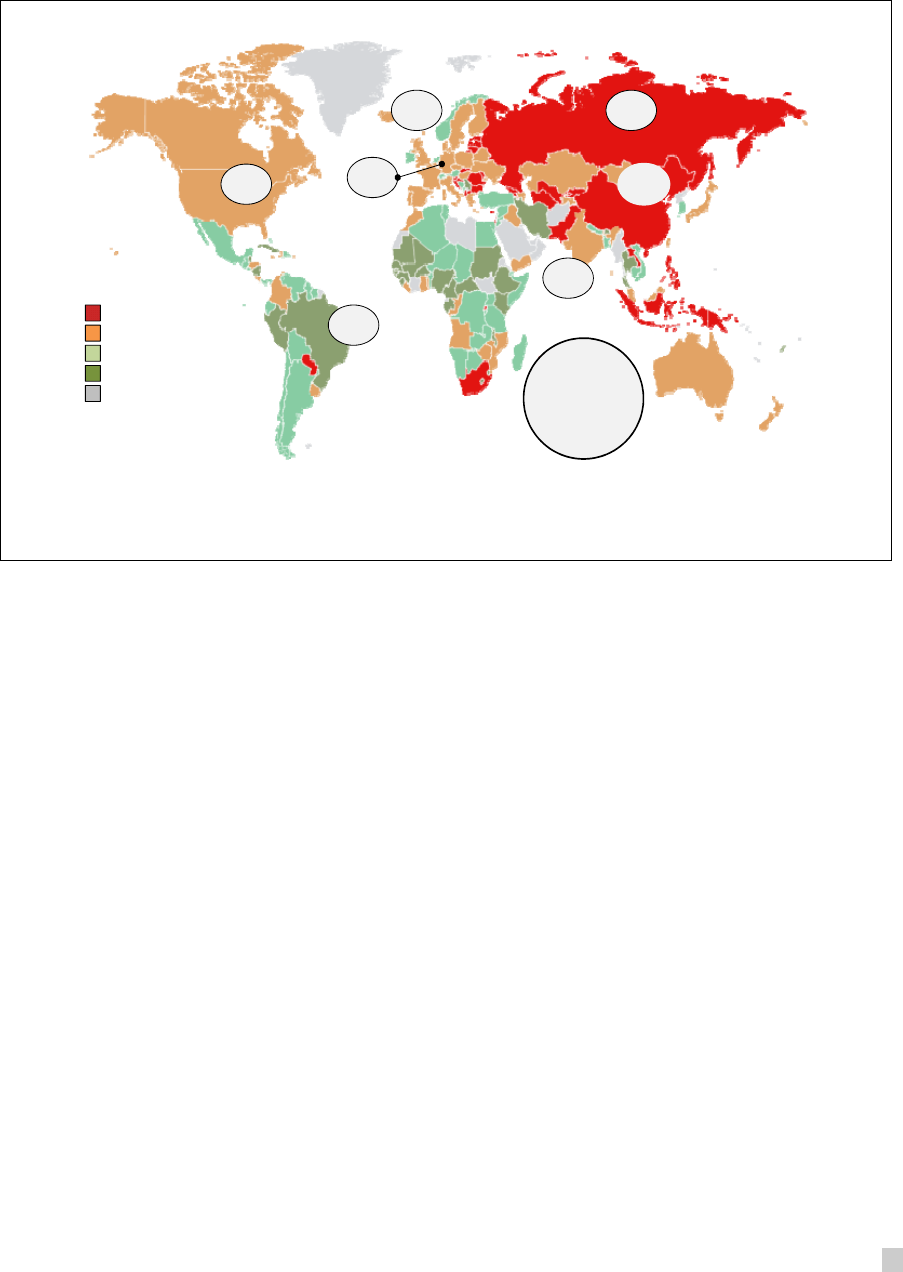

16. Widening income inequality within countries. Measures of inequality based on Gini

coefficients of gross and net incomes have increased substantially since 1990 in most of the

developed world (Figure 3). Inequality, on average, has remained stable in EMDCs, albeit at a much

higher level than observed in advanced economies. However, there are large disparities across

EMDCs, with Asia and Eastern Europe experiencing marked increases in inequality, and countries in

Latin America exhibiting notable declines (although the region remains the most unequal in the

world).

6

Redistribution, gauged by the difference between market and net inequality, played an

important, albeit partial, role in cushioning market income inequality in advanced economies. During

6

See Tsounta and Osueke (2014) and IMF (2014b) for a discussion of the declining inequality trends in Latin America

and Middle East and North Africa regions, respectively.

0.4

0.45

0.5

0.55

0.6

0.65

0.7

0.75

1950 1970 1990 2010

Gini coefficient

Global inequality

Population-weighted

inter-country inequality

Unweighted inter-

country inequality

Three concepts of inter-national income inequality

Distribution of income at different points in time, 1988-2008

INEQUALITY: CAUSES AND CONSEQUENCES

INTERNATIONAL MONETARY FUND 11

1990–2012, market inome inequality in advanced economies increased by an average of 5¼ Gini

points compared to a 3 Gini point increase in the net Gini coefficient.

Figure 3. Change in Net Gini Index, 1990–2012

Sources: Solt Database; and IMF staff calculations.

Note: LAC =Latin America and the Caribbean; MENA = Middle East and North Africa; and SSA = Sub-Saharan Africa.

1/ Change in net Gini from 1990 to 2012 is expressed as a percentage. For missing values, data for the most recent

year were used.

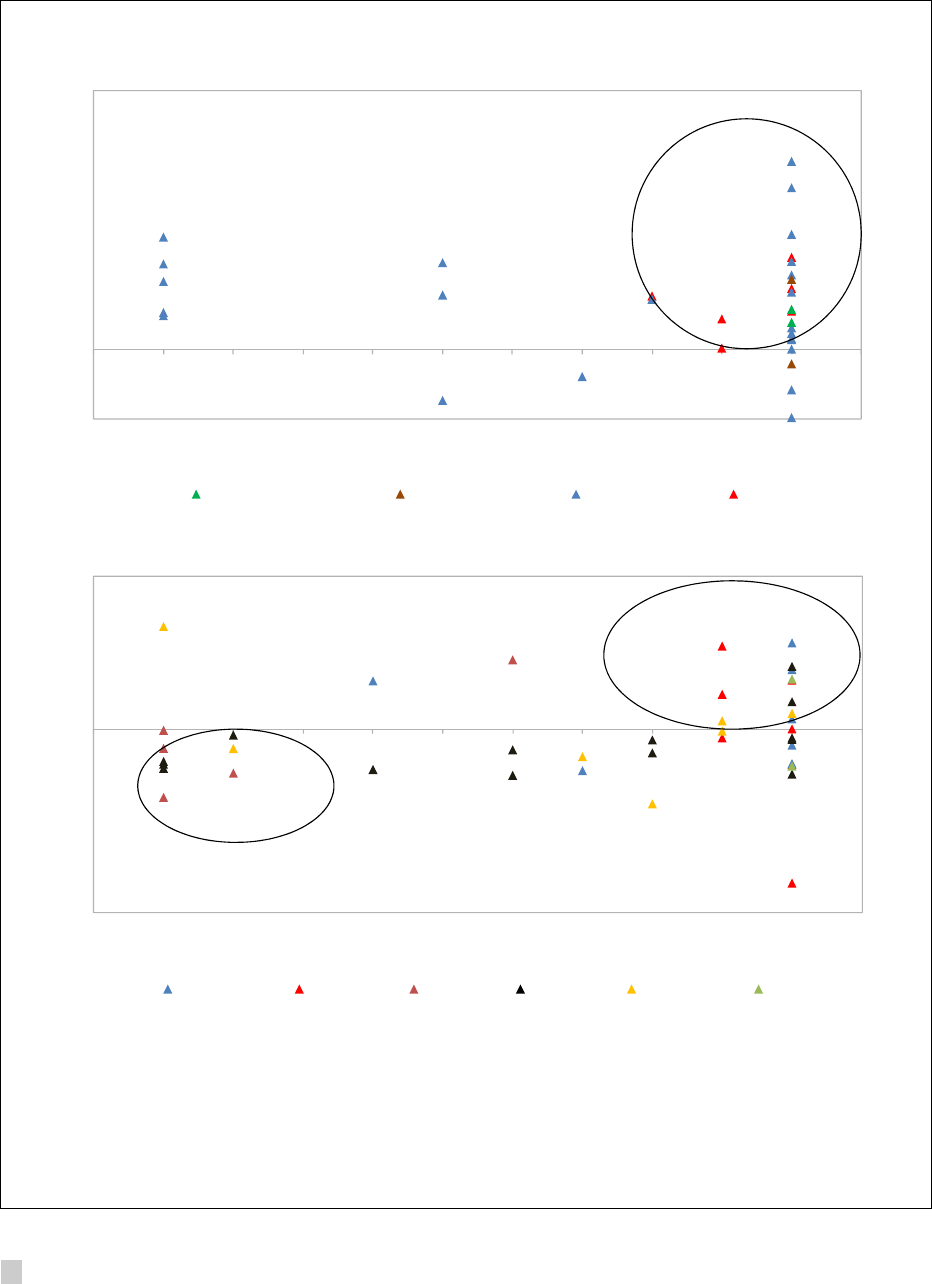

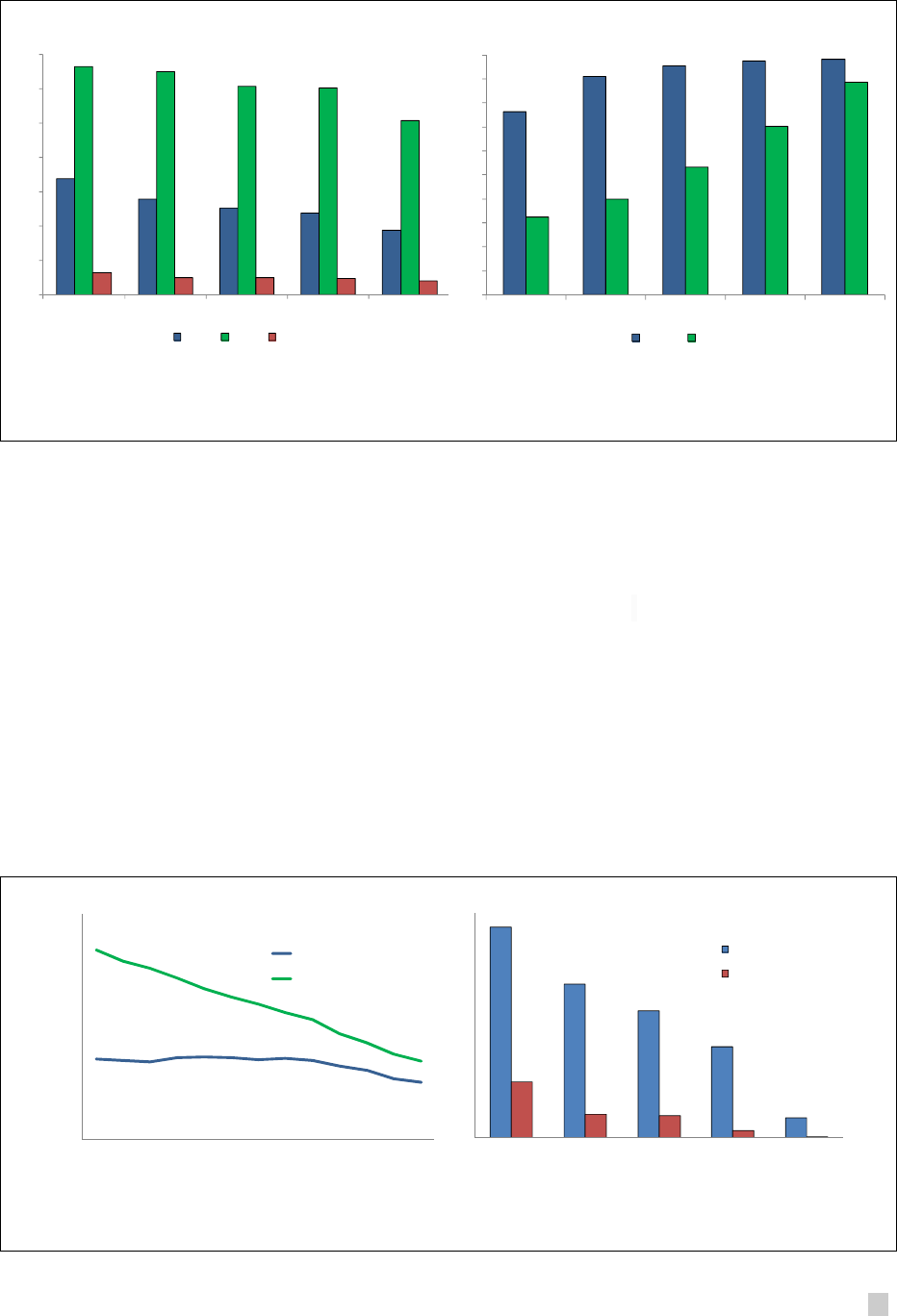

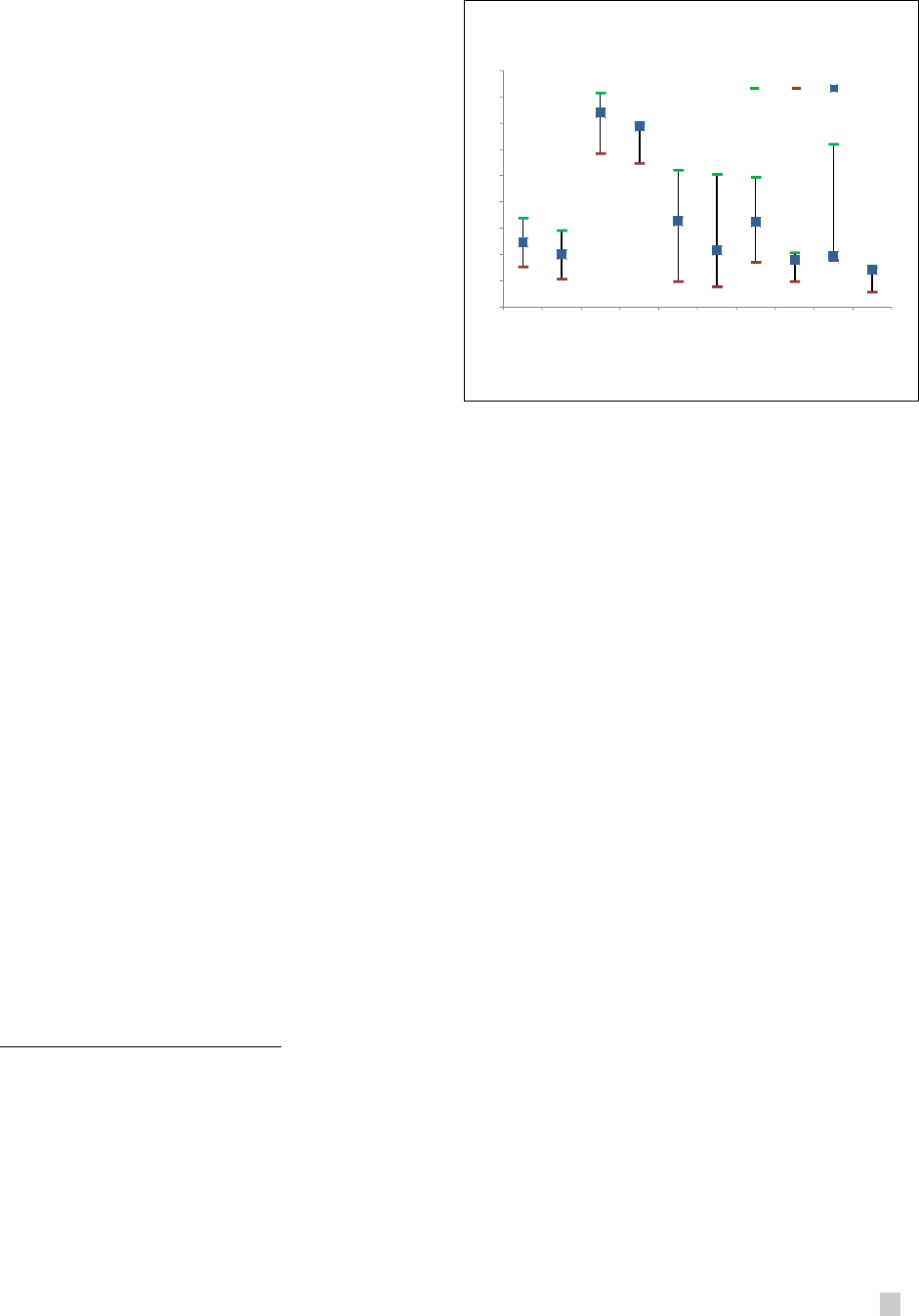

17. Income deciles under the microscope. Changes in income inequality across advanced

economies and EMDCs have been driven by different developments in income shares by deciles.

Figure 4 shows that rising income inequality (positive numbers on the vertical axes) in most

advanced and many emerging market economies has been driven primarily by the growing income

share of the top 10 percent (see also Piketty and Saez (2003) for the United States). Indeed, the top

10 percent now has an income close to nine times that of the bottom 10 percent. These effects have

been magnified by the crisis (OECD 2014). The story is somewhat different in EMDCs. Rising

inequality for this group of countries is primarily explained by a shift in incomes of the “upper

middle class to the upper class” (for example, in China and South Africa). Figure 4 shows that in

EMDCs with falling inequality (negative numbers on the vertical axis), the main beneficiaries (that is,

with the largest increase in their income shares, shown on the horizontal axis) were those at both

the bottom and the middle of the income distribution (for example, Peru and Brazil).

18. Top 1 percent on the rise. The top 1 percent now account for around 10 percent of total

income in advanced economies. (Figure 5; Piketty and Saez 2011; Alvadero and others, 2013). While

data on top income shares is scant for most EMDCs, available evidence suggests that the share of

top incomes has risen in China and India. The growing share of the top 1 percent in advanced

economies reflects both higher inequality in labor incomes as well as capital gains—returns from

investments (Atkinson, Piketty, and Saez 2011). Indeed, about half of the income of the top 1

percent constitutes non-labor income compared with 30 percent for the top 10 percent as a whole.

For instance, corporate profits have been translated into strikingly high executive salaries and

(-5.0) – (0)%

(0) – 5.0%

5 - 26%

% Change in Net Gini 1/

37.2

35.5 37.2

47.3

49.7

28.9

46.3

United States

United Kingdom

Germany

Brazil

India

China

Russia

(-36.0) – (-5.0)%

Not Enough Data

Current 2012

level of Gini (Net)

Asia (42.44)

Europe (30.63)

LAC (44.22)

MENA (42.22)

SSA (42.66)

CAUSES AND CONSEQUENCE OF INEQUALITY

12 INTERNATIONAL MONETARY FUND

bonuses, exacerbating income inequality (Brightman 2014), a pattern that is observed across both

advanced and large emerging market economies (Figure 6).

Figure 4. Change in Gross Gini and Income Decile

Sources: Milanovic WYD Database; Solt Database; and IMF staff calculations.

Note: The horizontal axis shows the income decile with the largest change in the income share between the latest and

earliest available data (typically 2010s versus 1980s). The vertical axis shows the change in the gross Gini for the

corresponding period. AEs = advanced economies; CIS = Commonwealth of Independent States; LAC = Latin America

and Caribbean; MENA = Middle East and North Africa; SSA = sub-Saharan Africa.

Europe Asia CIS LAC MENA SSA

CHN

IND

IDN

MYS

LKA

ALB

BIH

BGR

HUN

AZE

BLR

KAZ

TKM

UKR

ARG

BRA

CHL

COL

CRI

DOM

ECU

GTM

JAM

MEX

PAN

PER

URY

VEN

DZA

EGY

IRN

JOR

PAK

TUN

ZAF

-24

-16

-8

0

8

16

01234567891011

Change in Gross Gini

Income Decile

Emerging Markets

([1988-93] - [2005-08])

North America Other AEs Europe Asia

HKG

ISR

JPN

KOR

SGP

TWN

AUT

BEL

CYP

CZE

DNK

EST

FIN

FRA

DEU

GRC

IRL

ITA

LVA

LUX

NLD

NOR

PRT

SVK

SVN

ESP

SWE

CHE

GBR

CAN

USA

AUS

NZL

-4

-2

0

2

4

6

8

10

12

14

01234567891011

Change in Gross Gini

Income Decile

Advanced Economies

(1988-2008)

INEQUALITY: CAUSES AND CONSEQUENCES

INTERNATIONAL MONETARY FUND 13

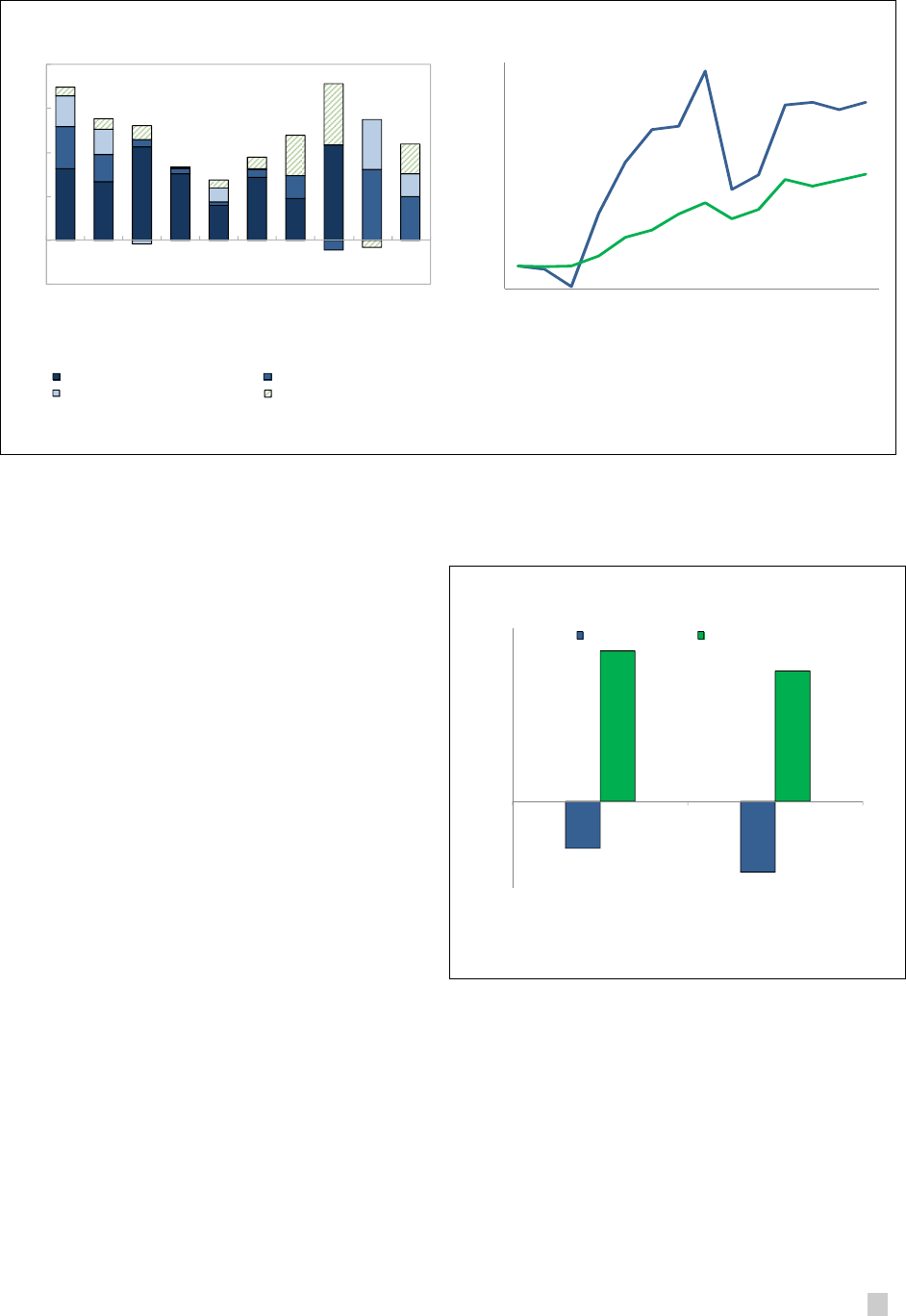

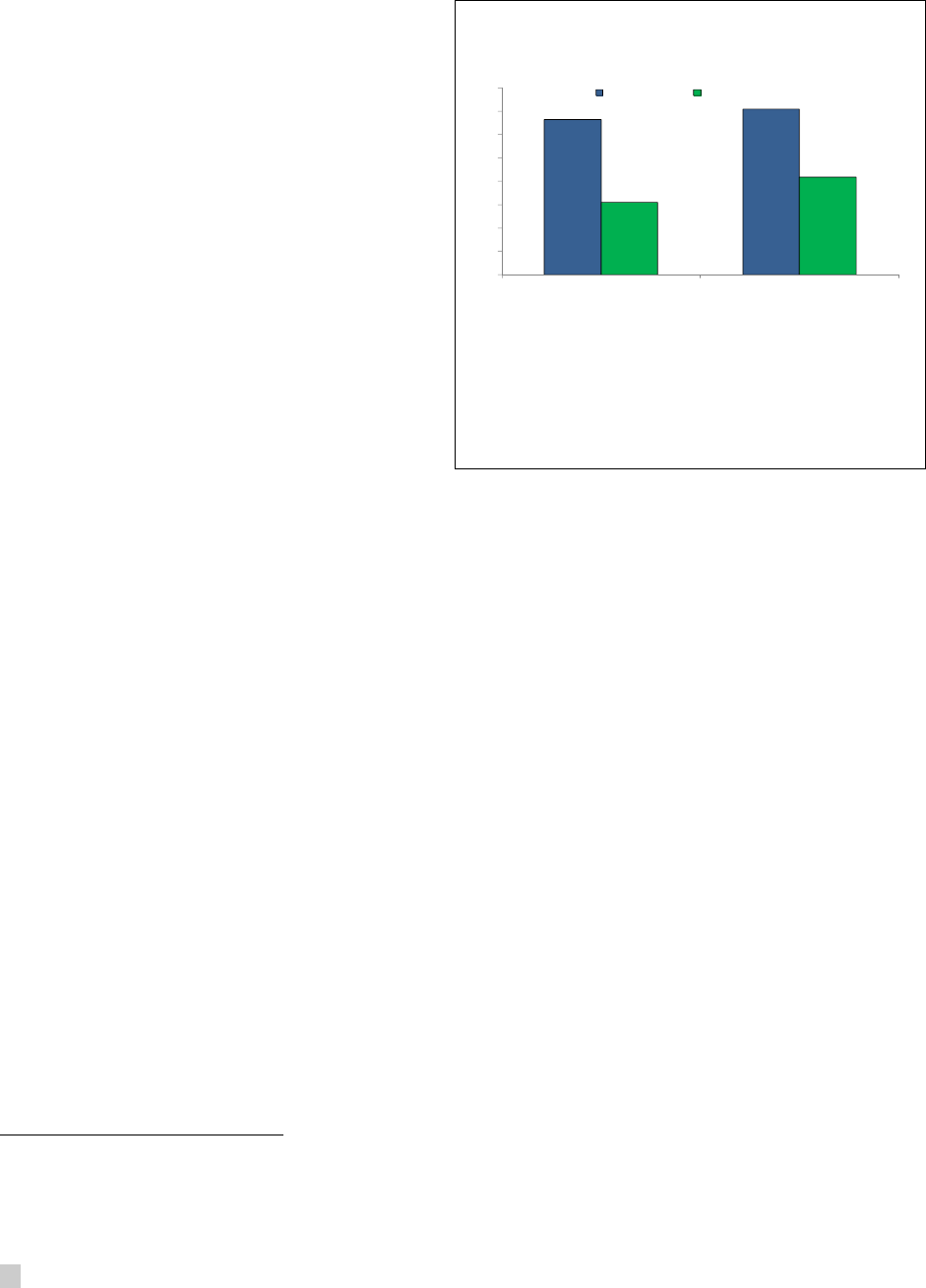

Figure 5. Top 1% Income Share

(1980–2010)

Figure 6. Estimated Corporate Profits 1/

(Index)

Sources: World Top Incomes Database; and IMF staff

calculations.

Sources: Bloomberg, L.P.; and IMF staff calculations.

1/ Corporate profits are taken as a proxy for estimated

earnings.

Note: Emerging markets include Brazil, Chile, China, India,

Indonesia, Korea, Mexico, Philippines, Russia, South Africa,

Thailand, and Turkey.

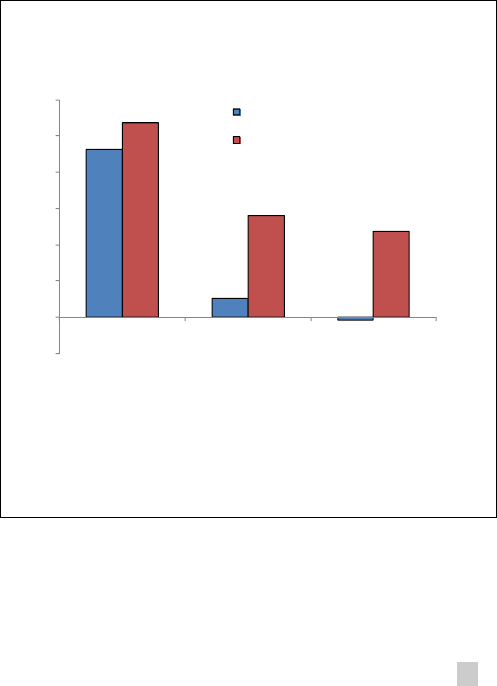

19. Middle class squeeze. A shift in the allocation of labor income towards the higher and

lower ends of the distribution has resulted in a

shrinkage of the income share accruing to the

middle 20 percent in many advanced

economies (Australia, Canada, and Sweden are

important exceptions), and some large

emerging market economies (Autor, Katz, and

Kearney 2006; Figure 7). Indeed, pretax incomes

of middle-class households in the United States,

the United Kingdom, and Japan have

experienced declining or stagnant growth rates

in recent years. Additional pressures on the

middle class reflect a declining share of labor

income—the predominant source of income for

the majority of households. Indeed, average

wages have risen at a slower pace than

productivity growth amid large economic rents

(for example, high profitability and large increase in executive compensation) accruing to the top

end of the income distribution (Figure 8).

-5

0

5

10

15

20

US

UK

Germany

France

Sweden

Japan

India

South Africa

Indonesia

China

1980 change in 1980-1990

change in 1990-2000 change in 2000-2010

0

100

200

300

400

500

600

700

800

900

1000

2000 2002 2004 2006 2008 2010 2012

Advanced Economies

Emerging Markets

Figure 7. Change in Income Share, 1990–2009

(Average change, percent)

Sources: WDI database; and IMF staff calculations.

Note: Emerging markets include Argentina, Brazil, China,

India, Russia, and South Africa.

-2

-1

0

1

2

3

4

Advanced Economies Emerging Markets

Middle 20 percent Top 20 percent

CAUSES AND CONSEQUENCE OF INEQUALITY

14 INTERNATIONAL MONETARY FUND

20. Sources behind the middle class squeeze vary. In advanced economies, the largest driver

has been the declining share of middle-skilled occupations relative to low- and high-skilled

occupations (Autor, Kerr, and Kugler 2007; Goos, Manning, and Salomons 2009). In EMDCs, the

middle class squeeze in some countries reflects income polarization (Duclos, Esteban, and Ray 2004;

Zhang and Kanbur, 2011). In China, for example, more than one-third of all wealth is concentrated in

the top 1 percent, while the majority of the population remains poor despite strong economic

growth (Hairong 2014). Widespread informality and persistently large geographical differences in

economic performance have also played a particularly important role in shaping income inequality

in EMDCs.

21. Poverty has declined in many countries, but is on the rise in advanced economies. In

many EMDCs, poverty—measured in terms of the share of population living below a pre-defined

poverty line—has declined, despite rising income inequality in some (Figure 9). In contrast, recent

data suggest that poverty rose in advanced countries since the 1990s (OECD 2011). The ratio of the

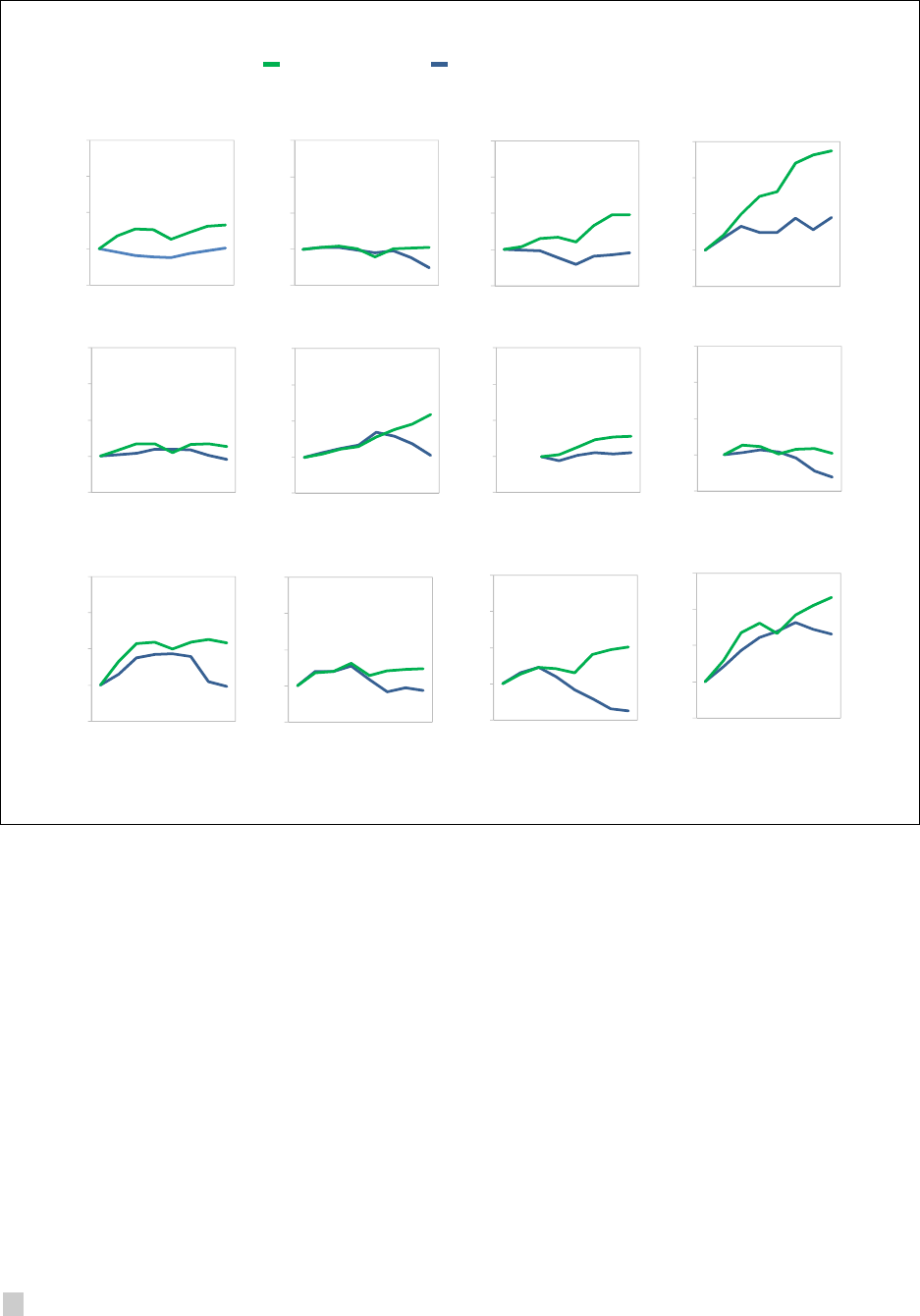

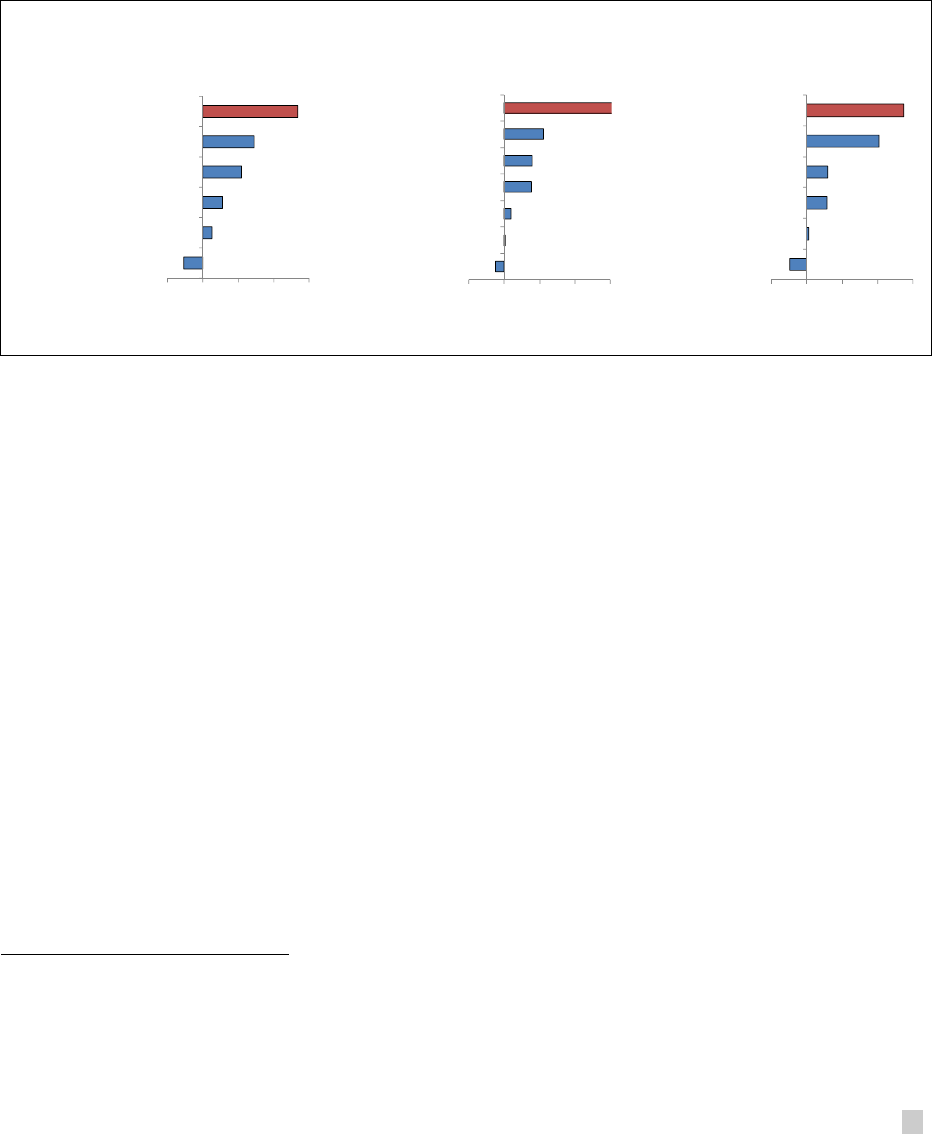

Figure 8. Disconnect: Real Average Wage and Productivity

Sources: The Conference Board; International Labour Organization; and IMF staff calculations.

Note: Earnings reflect gross remuneration—in cash and in kind—paid to employees deflated by the consumer price index.

Labor productivity represents real output per hours worked.

90

100

110

120

130

2005 2012

Hungary

90

100

110

120

130

2005 2012

Mexico

90

100

110

120

130

2005 2012

Czech Republic

90

100

110

120

130

2005 2012

Slovak Republic

90

100

110

120

130

2005 2012

Korea

90

100

110

120

130

2005 2012

United States

90

100

110

120

130

2005 2012

United Kingdom

90

100

110

120

130

2005 2012

Germany

90

100

110

120

130

2005 2012

Japan

90

100

110

120

130

2005 2012

Italy

90

100

110

120

130

2005 2012

Netherlands

90

100

110

120

130

2005 2012

Spain

Labor Productivity Real Average Wage Index

Selected Advanced Economies

Selected Emerging Markets

INEQUALITY: CAUSES AND CONSEQUENCES

INTERNATIONAL MONETARY FUND 15

earnings of the 90th percentile to the earnings of the 10th percentile—another method of

measuring inequality among the bottom 90 percent—grew in most advanced economies over the

period between 1980 and 2011 (Autor 2014), particularly in the United States and the United

Kingdom.

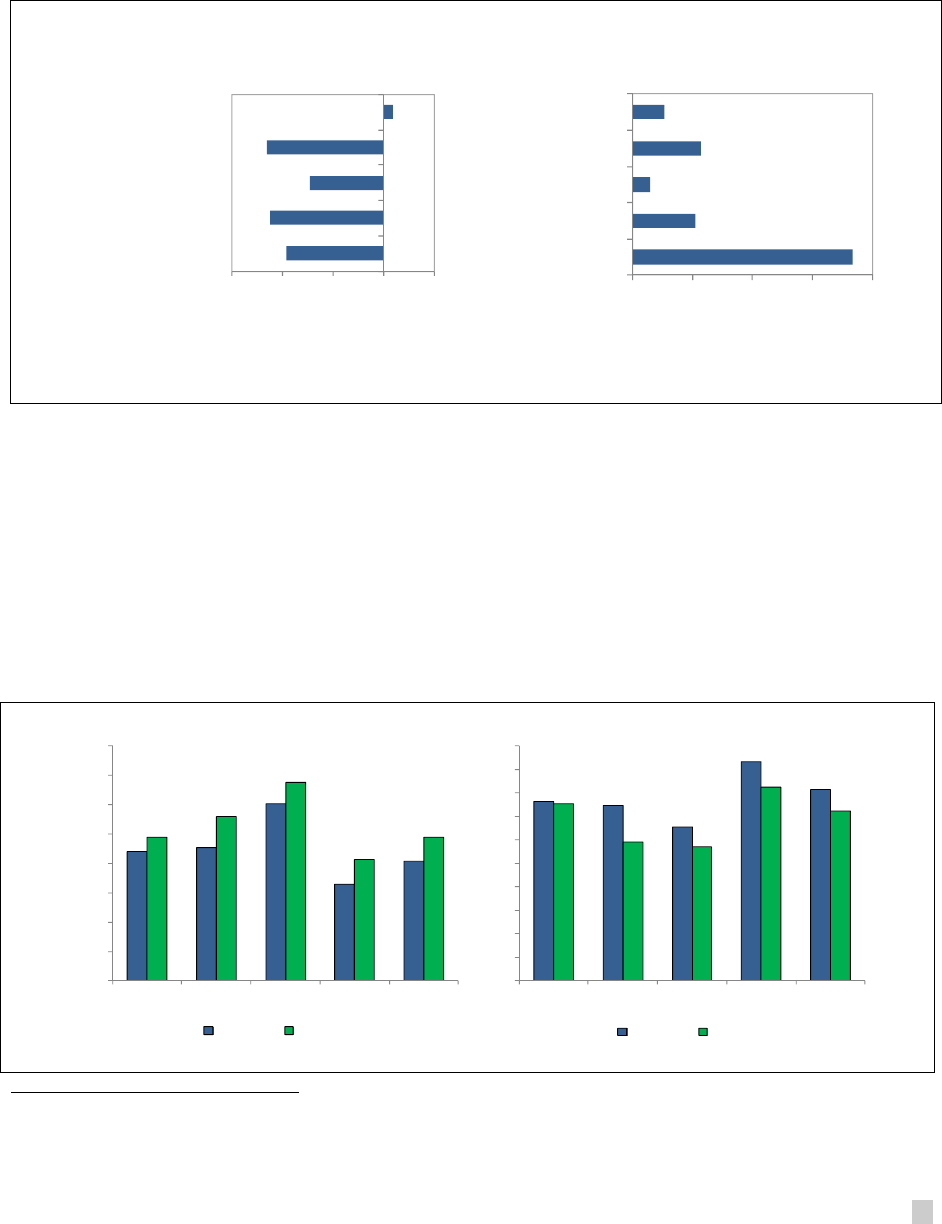

Figure 9. Poverty Rates by Regions

Source: Tsounta and Osueke (2014).

Note: EM = Emerging market economies.

1/ National coverage of poverty headcount (percent of population living in households with consumption or income per

person below the poverty line of $76 per month or $2.5 per day).

Inequality of outcomes: Wealth

22. Rising concentration of global wealth. Estimates suggest that almost half of the world’s

wealth is now owned by just 1 percent of the population, amounting to $110 trillion—65 times the

total wealth of the bottom half of the world’s population (Fuentes Nieva and Galasso 2014).

7

For

instance, a third of the total wealth in the United States is held by 1 percent of the population

(Figure 10, left panel). In most countries with available data, the share held by the 1 percent

wealthiest population is rising at the expense of the bottom 90 percent population (Figure 10, right

panel).

7

Wealth or net worth is defined as the value of financial assets plus real assets (principally housing) owned by

households, less their debts.

Poverty rate

1

, 2010

(Percent of population)

Change in Poverty Rate (since 2000)

(Percent of population)

0 20406080

Sub-Sahara Africa

Latin America

EM Europe

EM Asia

Advanced Economies

-15 -10 -5 0 5

Sub-Sahara Africa

Latin America

EM Europe

EM Asia

Advanced Economies

Figure 10. Top 1% and Bottom 90% Wealth Distribution, 1980–2010

Sources: Piketty (2014); and IMF staff calculations.

0

0.05

0.1

0.15

0.2

0.25

0.3

0.35

0.4

France United

Kingdom

United

States

Sweden Europe

1980 2010

0

0.05

0.1

0.15

0.2

0.25

0.3

0.35

0.4

0.45

0.5

France United

Kingdom

United

States

Sweden Europe

1980 2010

Top 1 percent Bottom 90 percent

CAUSES AND CONSEQUENCE OF INEQUALITY

16 INTERNATIONAL MONETARY FUND

23. Inequality is more extreme in wealth

than income. In both advanced economies and

EMDCs, income Ginis, on average, are half the

size of wealth Ginis (Figure 11). Possible

explanations for the higher wealth Ginis include

stagnant wage growth, which makes it difficult

for middle- and lower-income workers to set

aside money for saving, and a lower propensity

to consume by the rich.

8

While many studies

suggest that growing wealth inequality in

advanced economies is largely driven by rising

wealth concentration at the top (Piketty 2014;

Saez 2014), various explanations have been

posited for the rise in EMDCs, ranging from

wealth polarization between urban and rural

areas in China to inequality among class and

caste in India (Zhong and others 2010; Credit

Suisse 2013).

Inequality of Opportunity: Health Services

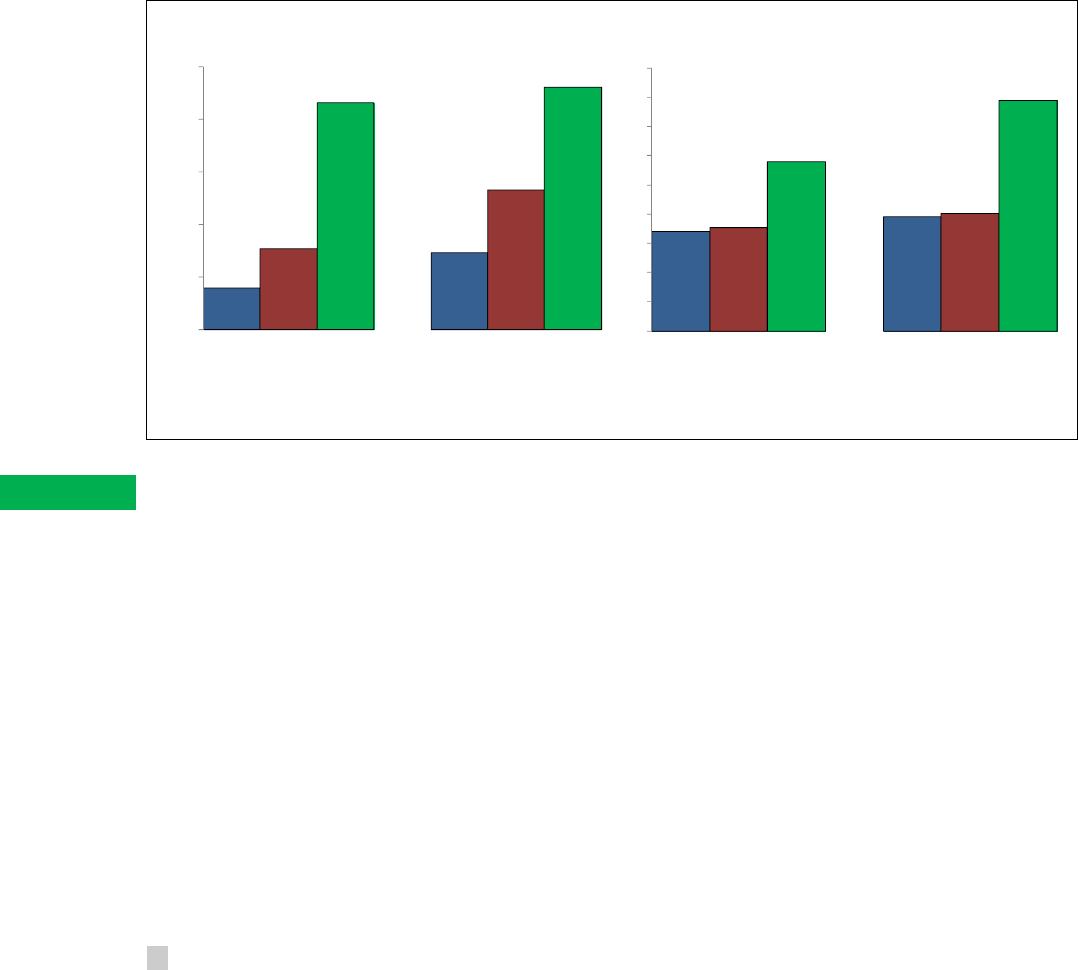

24. Inequality in health outcomes is widespread in developing economies. While health

outcomes are broadly similar across income groups in advanced countries, large disparities exist in

EMDCs (Figure 12, left panel). For example, the infant mortality rate is twice as high in the poor than

in the rich households (in terms of wealth) in emerging market economies. Similarly, female

mortality rates tend to be disproportionately higher for lower-income groups.

25. Inequality in health care access and use is more pervasive in developing countries.

Commonly used indicators to gauge access and use of health care are generally favorable in

advanced countries, irrespective of the income level of the population. For EMDCs, however, data on

access to skilled health personnel for births suggest that there are large disparities in health access

across income levels within developing countries, and to a lesser extent in emerging market

countries (Figure 12, right panel). However, even in advanced economies, income inequality is

increasingly being reflected in lower life expectancy. This is particularly striking in the United States,

where income today is a stronger predictor of life expectancy than it was a generation ago (Murray,

Lopez, and Alvarado 2013).

8

Based on national balance sheets in nine advanced economies, Piketty and Zucman (2014) find that wealth-income

ratios have doubled over the past 40 years.

Figure 11. Wealth and Income Inequality in

Advanced and Emerging Market Economies,

2000

Sources: Davies and others (2008); Luxembourg Income

Study Database; Organisation for Economic Co-operation

and Development; Socio-Economic Database for Latin

America and the Caribbean; World Bank; and IMF staff

calculations.

Note: Emerging markets include China, India, Pakistan,

Thailand, Turkey, Argentina, Mexico, Indonesia, and Brazil.

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

Advanced Economies Emerging Markets

Wealth Gini Income Gini

INEQUALITY: CAUSES AND CONSEQUENCES

INTERNATIONAL MONETARY FUND 17

Figure 12. Inequalities in Health by Quintile, 2010–12

Sources: WHO, Global Health Observatory Data Repository; and IMF staff calculations.

Note: AEs = advanced economies; DCs = developing countries; EMs = emerging market economies.

1/ Numbers are median values of income groups based on the latest data available (2010–12).

2/ AEs only include data for Canada in 1996.

Inequality of opportunity: Education

26. Declining education inequality in EMDCs. The education Gini—a measure of the variation

of average years of education for different income levels—has declined significantly in EMDCs, over

the last 60 years (Figure 13, left panel). This is largely driven by improvements in access at the lower-

end of the income distribution (Castello-Climent and Domenech 2014). Despite this improvement,

education outcomes remain much worse for disadvantaged groups, partly because of pro-rich

biases in the incidence of public spending (Dabla-Norris and Gradstein 2004). Indeed, almost 60

percent of the poorest youth population (aged 20–24 years) in sub-Sahara Africa has fewer than 4

years of schooling compared to 15 percent in the richest quintile (Figure 13, right panel). In contrast,

education inequality, on average, is unchanged in most advanced economies over the last decade,

although rising university costs have contributed to lower access to education by the poor in some

countries. In the United States, for instance, college costs grew must faster than most households’

income since 2001 (Federal Reserve 2014).

Figure 13. Education Gini and Outcomes by Income Decile

Sources: Castelló-Climent and Doménech (2014); World Inequality Database on Education; and IMF staff calculations.

Note: EM = emerging market economies.

1/ Latest available data (2000–12).

0

10

20

30

40

50

60

70

Q1 (poorest) Q2 Q3 Q4 Q5 (richest)

EMs DCs AEs 2/

InfantMortality Rate per 1000 1/

0

10

20

30

40

50

60

70

80

90

100

Q1 (poorest) Q2 Q3 Q4 Q5 (richest)

EMs DCs

Births Attended by Skilled Health Personnel,

percent (median)

0

0.1

0.2

0.3

0.4

0.5

0.6

1950 1960 1970 1980 1990 2000 2010

Advanced Economies

Emerging Markets

Education Gini (percent)

0

10

20

30

40

50

60

Sub-Sahara

Africa

Arab States EM Asia Latin America

and

Caribbean

EM Europe

Poorest Quintile

Richest Quintile

Percentage of population (aged 20-24) with less than

four years of education 1/

CAUSES AND CONSEQUENCE OF INEQUALITY

18 INTERNATIONAL MONETARY FUND

Inequality of opportunities: Financial services

27. Disparities in financial services access. There are large disparities in the use of financial

services between advanced economies and EMDCs and across income levels within a country (Figure

14). More than 80 percent of adults in advanced economies have an account at a formal financial

institution—twice more than in EMDCs. Within EMDCs, the share of adults with an account or a loan

at a formal financial institution is largely skewed toward the top income earners. The rest rely on

their own limited savings to invest in education or become entrepreneurs, suggesting that financial

inequality and income inequality go hand in hand. In many EMDCs, low-income households and

small-scale firms often face challenges in accessing financial services due to lack of financial

knowledge, complicated processes, onerous paperwork, and other market failures. Moreover,

available financial products tend to be more limited and relatively costly.

Figure 14. Financial Inclusion in Advanced and Developing Countries

(Percent of total, 2011)

Sources: World Bank, Global Financial Inclusion Database; and IMF staff calculations.

Note: AEs = advanced economies; DCs = developing countries; EMs = emerging market economies.

IV. INEQUALITY DRIVERS

A. Factors Driving Higher Income Inequality

28. Global trends: the good side of the story. Over the past four decades, technology has

reduced the costs of transportation, improved automation, and communication dramatically. New

markets have opened, bringing growth opportunities in countries rich and poor alike, and hundreds

of millions of people have been lifted out of poverty. However, inequality has also risen, possibly

reflecting the fact that growth has been accompanied by skill-biased technological change, or

because other aspects of the growth process have generated higher inequality. In this section, we

discuss potential global and country-specific drivers of income inequality across countries.

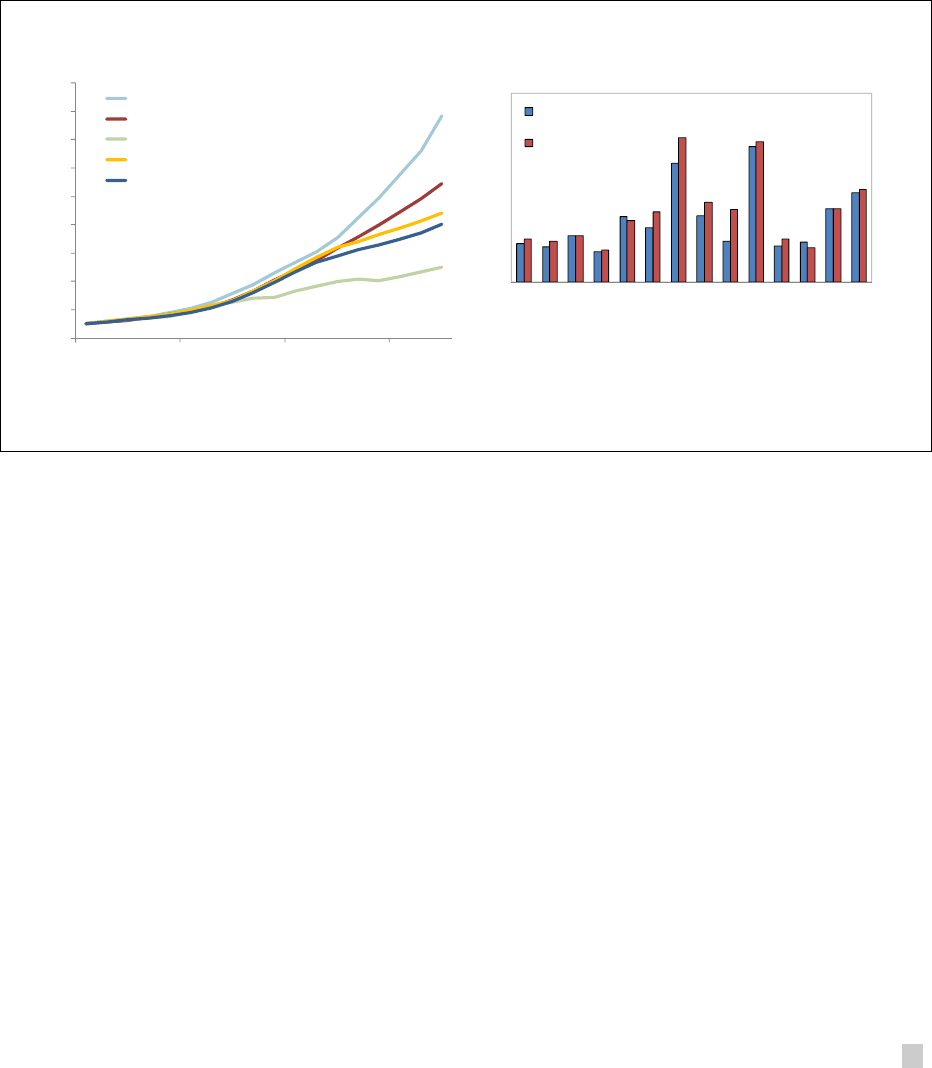

29. Technological change. New information technology has led to improvements in

productivity and well-being by leaps and bounds, but has also played a central role in driving up the

0

20

40

60

80

100

DCs EMs AEs DCs EMs AEs

Bottom 40% income Top 60% income

Adults with an account at a

formal financial institution

0

2

4

6

8

10

12

14

16

18

DCs EMs AEs DCs EMs AEs

Bottom 40% income Top 60% income

Adults borrowed from a financial institution

in the past year

INEQUALITY: CAUSES AND CONSEQUENCES

INTERNATIONAL MONETARY FUND 19

skill premium, resulting in increased labor income inequality (Figure 15). This is because

technological changes can disproportionately raise the demand for capital and skilled labor over

low-skilled and unskilled labor by eliminating many jobs through automation or upgrading the skill

level required to attain or keep those jobs (Card and Dinardo 2002; Acemoglu 1998). Indeed,

technological advances have been found to have contributed the most to rising income inequality in

OECD countries, accounting for nearly a third of the widening gap between the 90th and the 10th

percentile earners over the last 25 years (OECD 2011). Evidence from larger emerging market

economies also shows a similar trend of a growing earnings gap between high- and low-skilled

workers despite a large rise in the supply of highly educated labor (which should reduce the gap).

30. Trade globalization: two sides of a coin. Trade has been an engine for growth in many

countries by promoting competitiveness and enhancing efficiency. Nonetheless, high trade and

financial flows between countries, partly enabled by technological advances, are commonly cited as

driving income inequality (Figure 16). In advanced economies, the ability of firms to adopt labor-

saving technologies and offshoring has been cited as an important driver of the decline in

manufacturing and rising skill premium (Feenstra and Hanson 1996, 1999, 2003). Trade openness

could potentially have mixed effects on the wages of unskilled labor in advanced countries. It raises

the skill premium, but could also increase real wages by lowering (import) prices (Munch and

Skaksen 2009). At the same time, increased trade flows could lower income inequality in EMDCs by

increasing demand and wages for abundant lower-skilled workers. Thus, disentangling the impact of

trade on inequality is challenging as it depends on relative factor abundance and productivity

differences across countries, and the extent to which individuals obtain income from wages or

capital.

Figure 15. Technological Progress and Skill Premium in OECD Countries

Source: Organisation of Economic Co-operation and Development.

1/ Skill premium measures the relative earnings from employment after completing tertiary education compared to the

earnings after completing upper- and post-secondary non-tertiary education.

0

200

400

600

800

1000

1200

1400

1600

1800

1990 1995 2000 2005

Australia

Euro (PPP weighted)

Korea

UK

USA

100

125

150

175

200

225

250

100

125

150

175

200

225

250

Australia

Belgium

Canada

Denmark

Finland

Germany

Hungary

Ireland

Italy

Korea

Spain

Sweden

UK

US

1997-2001

2002-2007

Use of Information and Communication Technology (ICT)

ICT capital services per hour worked, 1990 = 100

Skill Premium in Selected Economies 1/

Uppersecondary or post-secondary non-tertiary education = 100

CAUSES AND CONSEQUENCE OF INEQUALITY

20 INTERNATIONAL MONETARY FUND

31. Financial globalization. Financial globalization can facilitate efficient international

allocation of capital and promote international risk sharing. At the same time, increased financial

flows, particularly foreign direct investment (FDI) and portfolio flows have been shown to increase

income inequality in both advanced and emerging market economies (Freeman 2010). One potential

explanation is the concentration of foreign assets and liabilities in relatively higher skill- and

technology-intensive sectors, which pushes up the demand for and wages of higher skilled workers.

In addition, FDI could induce skill-specific technological change, be associated with skill-specific

wage bargaining, and result in more training for skilled than unskilled workers (Willem te Velde

2003). Moreover, low-skill, outward FDI from advanced economies may in effect be relatively high-

skilled, inward FDI in developing economies (Figini and Görg 2011), thus exacerbating the demand

for high-skilled workers in recipient countries. Financial deregulation and globalization have also

been cited as factors underlying the increase in financial wealth, relative skill intensity, and wages in

the finance industry, one of the fastest growing sectors in advanced economies (Phillipon and

Reshef 2012; Furceri and Loungani 2013).

32. Financial deepening. Financial deepening can provide households and firms with greater

access to resources to meet their financial needs, such as saving for retirement, investing in

education, capitalizing on business opportunities, and confronting shocks. Financial deepening

accompanied by more inclusive financial systems can thus lower income inequality, while improving

the allocation of resources (Dabla-Norris and others 2015). Theory, however, suggests that financial

development could benefit the rich in the early stages of development, but the benefits become

more broadly shared as economies develop (Greenwood and Jovanovic 1990). Indeed, some studies

have found that financial development, measured as the relative share of the banking and stock

market sectors in the economy, boosts top incomes the most in the early stages of development

(Roine, Vlachos, and Waldenström 2009). Moreover, inequality can increase as those with higher

incomes and assets have a disproportionately larger share of access to finance, serving to further

increase the skill premium, and potentially the return to capital (Claessens and Perotti 2007).

Figure 16. Trade and Financial Openness

(Percent of GDP)

Sources: IMF, International Financial Statistics; IMF, World Economic Outlook database; and IMF staff calculations.

1/ Trade openness is measured by total imports and exports as a percentage of GDP.

2/ Financial openness is measured by total assets and liabilities as a percentage of GDP.

0

10

20

30

40

50

60

70

80

90

1965 1970 1975 1980 1985 1990 1995 2000 2005 2010

Trade Openness 1/

Advanced Economies

Emerging Markets

Developing Economies

0

20

40

60

80

100

120

140

160

180

0

50

100

150

200

250

300

350

400

450

500

1970 1975 1980 1985 1990 1995 2000 2005 2010

Financial Openness 2/

Advanced Economies (LHS)

Emerging Markets (LHS)

Developing Economies (RHS)

INEQUALITY: CAUSES AND CONSEQUENCES

INTERNATIONAL MONETARY FUND 21

33. Changes in labor market institutions.

More flexible labor market institutions can foster

economic dynamism by reallocating resources to

more productive firms and enabling firm

restructuring. However, greater flexibility can

pose challenges for workers, especially those

with low skills, and hence play an important role

in explaining inequality developments (Alvadero

and others 2013). A decline in trade union

membership (union rate) could reduce the

relative bargaining power of labor, exacerbating

wage inequality (Frederiksen and Poulsen 2010;

Wilkinson and Pickett 2010; Figure 17).

9

Jaumotte

and Osorio-Buitron (2015) and forthcoming IMF

work finds that a reduction in the minimum wage

relative to the median wage is associated with higher inequality in advanced economies, while a

decline in unionization rate is strongly associated with the rise of top income shares. Moreover,

some studies have pointed to the role of wage dispersion and a higher share of part-time and

temporary employment in driving inequality in labor earnings in some advanced economies (OECD

2012). For many labor market policies, such as reforms to employment protection legislation, the

impact on inequality is less clear cut as they affect both the dispersion of earnings and the level of

employment in sometimes conflicting ways.

10

In many EMDCs, the combination of rigid hiring and

firing and employment protection regulations and weak income protection systems often

encourages informality, fueling wage inequality. However, evidence from a large sample of countries

suggests that de facto labor market regulations (such as minimum wages, unionization, and social

security contributions), on average, tend to improve the income distribution (Calderón and Chong

2009; OECD 2011).

34. Redistributive policies. Governments in advanced economies have historically mitigated

inequality through public policy—primarily progressive taxes and social transfers such as public

retirement benefits (CBO 2011). However, many advanced countries have now seen an increase in

net income inequality, indicating gaps in existing tax-and-transfer systems to counteract rising

market inequality. The progressivity of tax systems has declined in some advanced economies over

the past few decades, with the result being that high-income households and corporations now face

9

There is a difference between coverage rate of collective bargaining agreement and union density because in many

advanced economies multi-employer bargaining and public policies extending the negotiated contract to

nonorganized firms guarantee coverage rates in excess of density rates.

10

Stronger labor market institutions could increase unemployment rates, reduce the wage differential between high-

skill and low-skill workers, and affect the labor share of income. The overall impact on income inequality, however,

can be ambiguous: they increase unemployment, which tends to raise inequality, they can reduce wage dispersion,

which tends to lower it, and they increase the wage share, which can have an ambiguous effect on inequality.

Figure 17. Union Rate by Country Group

(Percent)

Sources: Organisation of Economic Co-operation and

Development; and IMF staff calculations.

0

10

20

30

40

50

60

70

80

90

Max Min Median

1990

1990

1990

1990

1990

2012 2012 2012 2012

2012

North

America

Nordic

Countries

Europe

East Asia

Pacific

Emerging

Markets

CAUSES AND CONSEQUENCE OF INEQUALITY

22 INTERNATIONAL MONETARY FUND

lower effective tax rates (Hungerford 2013).

11

Indeed, Figure 18 indicates that rising pre-tax

income concentration at the top of the

distribution in many advanced economies has

also coincided with declining top marginal tax

rates (from 59 percent in 1980 to 30 percent

in 2009). Conditional cash transfers have

become an important policy tool for directing

resources towards the lower end of the

distribution in EMDCs (IMF 2014a), but their

redistributive impact varies widely across

countries, reflecting both differences in the

size and progressivity of these transfers.

35. Education. Education can play an

important role in reducing income inequality,

as it determines occupational choice, access

to jobs, and the level of pay, and plays a

pivotal role as a signal of ability and productivity in the job market. From a theoretical perspective,

the human capital model of income distribution (Mincer, 1958; Becker and Chiswick, 1966) suggests

that while there is an unambiguously positive association between educational and income

inequality, the effect of increased educational attainment on income inequality could be either

positive or negative depending on the evolution of rates of return to education (that is, the skill

premium). Moreover, there can be opposing forces at play stemming from “composition” (that is,

increasing the share of high-wage earners) and “wage compression” (that is, decline in the returns to

higher education relative to lower levels) effects.

Overall, the evidence suggests that the inequality

impact of education depends on various factors, such as the size of education investments by

individuals and governments and the rate of return on these investments. It is in this spirit that Rajan

(2015) notes that “prosperity seems increasingly unreachable for many, because a good education,

which seems to be today’s passport to riches, is unaffordable for many in the middle class.”

B. Empirical Analysis

36. This section investigates the drivers of income inequality.

12

The discussion above

suggests that a variety of inter-related factors can impact inequality and have potentially differential

effects across countries and income groups. In

this section, using a simple panel econometric

11

Tax regimes can influence the mix of compensation, tilting it towards lower taxed forms of compensation, and

thereby boost disposable income, particularly at the top. For example, capital gains are often taxed at a lower rate

than other income and, in a few countries, they are not taxed at all. Stock options also benefit from preferential tax

treatment in many advanced economies.

12

We are unable to also investigate the drivers of wealth inequality due to data unavailability for a broad sample of

advanced economies and EMDCs.

Figure 18. Change in Top Tax Rate and Top 1

Percent Income Share

(1960–04 to 2005–09)

Sources: World Top Incomes Database; and IMF staff

calculations.

-4

-2

0

2

4

6

8

10

-50 -40 -30 -20 -10 0 10

Change in Top 1% Income Share (points)

Change in Top Marginal Tax Rate (points)

INEQUALITY: CAUSES AND CONSEQUENCES

INTERNATIONAL MONETARY FUND 23

approach with year and country fixed effects, we investigate the drivers of within country changes in

income inequality for a sample of almost 100 advanced economies and EMDCs over the period

1980–2012 (see Box 1 for empirical specification). In contrast to other studies, we focus on a large

group of countries to assess whether the determinants of inequality vary across advanced, emerging

markets and developing economies, and across different measures of inequality. In addition to the

Gini coefficients of both market and net inequality, we build on our earlier result that the income

distribution itself matters for growth by examining the determinants of the disposable income

shares (after tax) of the poor (bottom 10 percent), the middle-class (fifth decile), and the rich (top 10

percent). This allows us to focus on the factors driving income concentration in recent years,

especially changes in the income shares of the poor and the middle class.

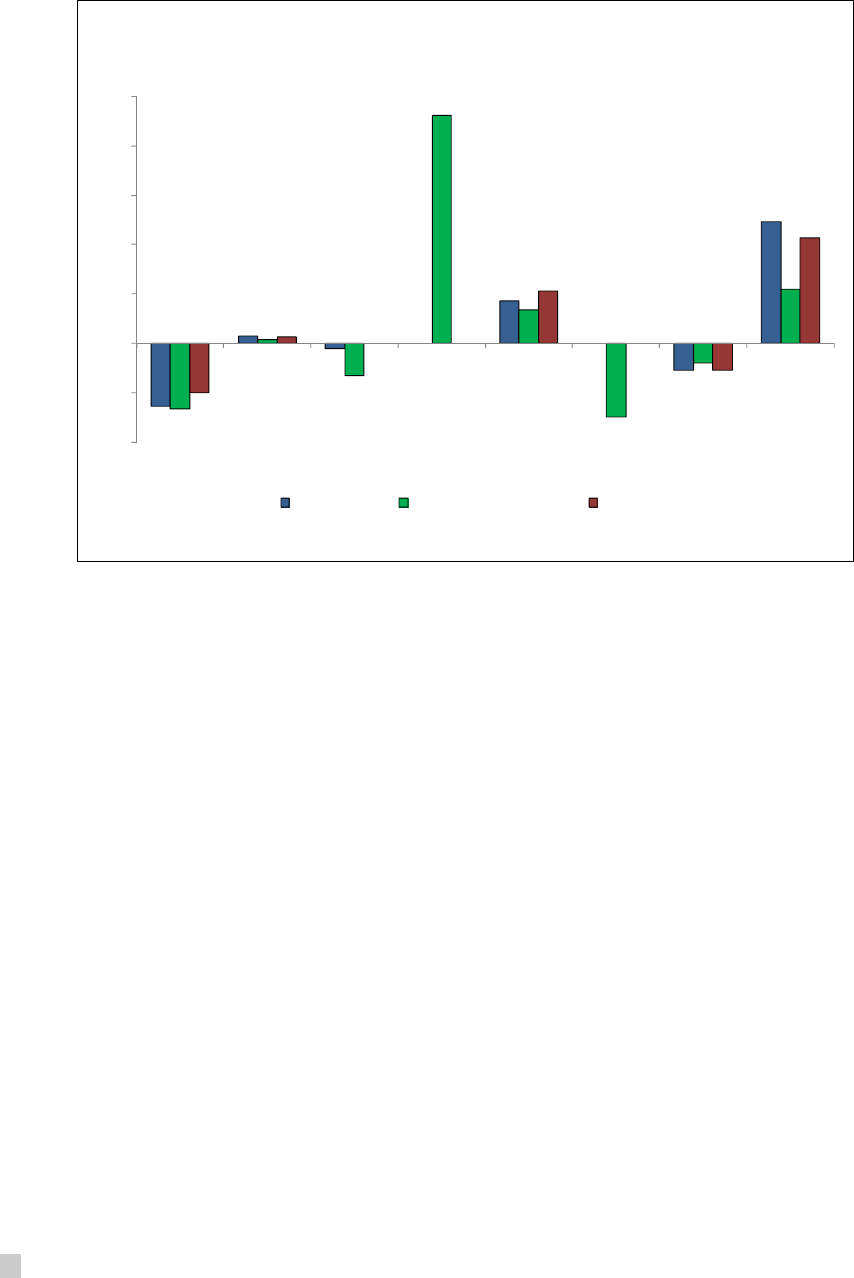

37. Drivers of gross and net inequality. Table 2 (Columns 1 and 2) presents the results of the

regression analysis for gross and net inequality. Our results on the role of globalization and

technological progress in driving inequality are broadly in line with the findings in the literature. In

particular, trade openness is associated with lower inequality (albeit not in a statistically significant

way), while greater financial openness and technological progress are associated with rising income

inequality, likely reflecting the fact these disproportionately benefit high-tech and labor-skilled

sectors. Indeed, we find that financial globalization and technological progress are associated with an

increase in the top 10 percent disposable income share across all countries (Column 3).

38. Differential impacts of financial deepening across country groups. The impact of

financial deepening, as proxied by the ratio of private credit to GDP, on both market and net

inequality varies across advanced economies and EMDCs, in line with Roine, Vlachos, and

Waldenström 2009. In particular, our results

suggest that financial deepening is associated

with higher income inequality in EMDCs. This

likely reflects the fact that while financial

deepening has accelerated over the past two

decades, the record on financial inclusion

may not have kept apace in these countries.

Indeed, Figure 19 indicates that financial

deepening was associated with higher market

and net income inequality in countries with

low levels of financial inclusion (typically

EMDCs), possibly reflecting that large

amounts of credit are often concentrated

among the largest firms and wealthier

households. By contrast, financial deepening

is associated with less of an increase in

market inequality (and lower net inequality)

in advanced economies, reflecting easier

access to credit for households and firms.

Figure 19. Impact of Change in Financial

Deepening on Inequality

(Average in percentage points, 1990s–2011)

Source: World Bank, Global Financial Inclusion Database; World

Bank, World Development Indicators; and IMF staff

calculations.

Note: High (low) inclusion refers to countries above (below)

the median value of the sample in terms of the proportion of

the population with an account at a formal financial institution.

-0.1

0

0.1

0.2

0.3

0.4

0.5

0.6

Market Gini Net Gini Top 10% Income

Share

High inclusion countries

Low inclusion countries

CAUSES AND CONSEQUENCE OF INEQUALITY

24 INTERNATIONAL MONETARY FUND

∗

∗

Box 1. Assessing the Drivers of Income Inequality Around the World

Our empirical approach is based on a simple model of within-country variation in inequality, controlling

for differences in levels across countries using five-year panels over the period 1980–2012. Specifically,

the analysis builds on Jaumotte, Lall, and Papageorgiou (2013) and is based on the following

specification:

in which

refers to the relevant inequality measure used for country i at time t, trade proxies

for trade globalization, measured as the sum of exports and imports as a share of a country’s GDP,

financial captures financial globalization, measured as the sum of foreign assets and liabilities relative to

GDP, and technology measures the share of information and communication technology (ICT) capital in

the total capital stock. Credit captures domestic financial market development, and is proxied by the ratio

of private credit to GDP. Since the effect of financial development could vary across advanced economies

and EMDCs, we also include an interaction term between the credit variable and a dummy variable which

takes the value of 1 for advanced economies, and zero otherwise. Given data limitations, and in line with

Mincer’s (1958) wage specification, we use the average years of education in the population aged 15 and

older as a proxy for the skill premium. As noted in the literature, the effect of skill-biased technological

change could vary across advanced economies and EMDCs. To capture this, we also include an

interaction term between the skill premium variable and a dummy variable that takes the value of 1 for

advanced economies, and zero otherwise. We also include a measure of labor market flexibility from the

World Economic Forum that measures the extent by which regulations govern firing and hiring, collective

bargaining, and minimum wages.

Additional control variables attempt to capture aspects of inequality of opportunities, including the

beginning of period education Gini (a proxy for access to education);

the quality and availability of health

system is measured by the beginning of period female mortality (aged 15–60) rate. Given data limitations,

as a proxy for redistributive policies, we include the beginning of period Fraser Institute index that

measures total government spending as a share of GDP (see also Perotti [1992]).

,

The terms

and

represent a full set of time and country dummies, respectively, and ε

it

captures all the omitted factors.

Country fixed effects allow us to focus on within-country changes instead of cross-country level

differences. In addition, time dummies are included to capture the impact of common global shocks such

as business cycles or growth spurts. All specifications include lagged GDP growth and share of

employment in agriculture and industry as additional controls. Lagged GDP growth is included in the

specifications as there could be a two way causality between output growth and inequality.

While causality is difficult to establish with full confidence, the results survive a variety of robustness

checks for omitted variables, endogeneity problems, and estimation methods and are broadly in line with

findings from the literature that focus on smaller country samples. For example, we checked the

robustness of our results by including dummies for financial crises, GDP per capita, and alternative

measures of the skill premium, trade, and financial openness. For some Organisation for Economic Co-

operation and Development (OECD) countries with available tax and benefits data, we also considered

alternative measures for redistributive policies as well as top marginal personal income-tax rates. The

results, not reported here but available upon request, suggest that lower marginal tax rates are

associated with higher market and net inequality and a higher income share of the top 10 percent.

INEQUALITY: CAUSES AND CONSEQUENCES

INTERNATIONAL MONETARY FUND 25

39. Higher skill premium is associated with widening inequality in advanced economies. In

advanced economies, increases in the skill premium exacerbate market income inequality, reflecting

the fact that education gains accrue disproportionately at the higher end of the income

distribution.

13

The statistically insignificant effect of the skill premium in driving net income

inequality, however, could reflect the fact that the net Gini is underestimating increases in inequality

at the top of the distribution (Kakwani 1980). Indeed, an increase in the skill premium is associated

13

Our specification uses the average years of education in the population as a proxy for skills; see also Card and

DiNardo (2000), essentially implying that the skill premium is determined solely by the supply of skills. Similar results

were obtained using alternative measures, such the ratio of earnings from employment after completing tertiary

education compared to the earnings after completing upper- and post-secondary education for a smaller sample of

OECD countries (available upon request).

Table 2. Regression Results of Inequality Drivers

Sources: Fraser Institute; IMF, World Economic Outlook; Solt Database; UNU-WIDER World Income Inequality

Database; World Bank; World Economic Forum; and IMF staff calculations.

Note: Standard errors in parentheses, *p < 0.1; **p < 0.05; and ***p < 0.01. Estimated using fixed-effects panel

regressions with robust standard errors clustered at the country level. Additional controls include lagged GDP

growth and share of employment in agriculture and industry. Income shares represent disposable (after tax)

incomes or consumption based on household data. AEs = advanced economies.

Variables

Market Gini

(1)

Net Gini

(2)

Top 10%

(3)

5th Income Decile

(4)

Bottom 10%

(5)

Trade openness -0.025 -0.008 -0.011 0.002 0.005

(0.017) (0.014) (0.014) (0.003) (0.005)

Financial openness 0.098*** 0.047** 0.026** -0.002 -0.008*

(0.016) (0.019) (0.011) (0.002) (0.004)

Technology 56.85* 15.03 31.11* -3.775 -11.51***

(31.01) (30.01) (15.81) (3.572) (3.587)

Financial deepening 0.050** 0.026** 0.022*** -0.004 -0.002

(0.021) (0.011) (0.007) (0.001) (0.002)

AEs * Financial deepening -0.049** -0.033** -0.03*** 0.007*** 0.004*

(0.021) (0.014) (0.008) (0.002) (0.002)

Skill Premium -0.413 -1.351 -0.475 0.063 -0.083

(0.726) (0.859) (0.670) (0.110) (0.139)

AEs * Skill Premium 1.165** 0.555 1.184*** -0.131** 0.024

(0.521) (0.556) (0.346) (0.064) (0.057)

Education Gini 6.085 -3.245 12.52 -1.906 -3.370*

(10.94) (11.39) (8.104) (1.364) (1.721)

Labor Market Institutions 0.803*** 0.497 0.338* -0.045 -0.140**

(0.291) (0.320) (0.195) (0.036) (0.063)

Female Mortality 0.021** 0.015* 0.026 -0.005*** 0.001

(0.009) (0.009) (0.032) (0.002) (0.002)

Government Spending -0.26 -0.426*** -0.349*** 0.046*** 0.0332

(0.162) (0.145) (0.103) (0.017) (0.023)

Country Fixed Effects Yes Yes Yes Yes Yes

Time Dummies Yes Yes Yes Yes Yes

#. of Observations 361 361 220 220 220

#. of countries 97 97 67 67 67

Adjusted R-squared 0.386 0.246 0.491 0.412 0.225

CAUSES AND CONSEQUENCE OF INEQUALITY

26 INTERNATIONAL MONETARY FUND

with a significantly higher disposable income share of the top 10 percent. This effect is found to be

statistically insignificant in EMDCs, and is in line with studies that find an absence of a correlation

between income differentials and the quantity of skills in these countries, likely reflecting large

differences in factor endowments and capacity to absorb new technologies across EMDCs (Behar

2013).

40. Easing of labor market regulations is associated with higher market inequality and

income share of the top 10 percent. In particular, a decline in organized labor institutions and the

resultant easing of labor markets measured by an increase in labor market flexibilities index by 8½

percent—from the median to 60

th

percentile—is associated with rising market inequality by 1.1

percent. The relationship between the top 10

th

percentile income share and easing of labor market

regulations is also positive and statistically significant (Column 3) for our sample of countries, likely

reflecting the fact that labor market flexibility benefits the rich and reduces the bargaining power of

lower-income workers. This result confirms Jaumotte and Osorio-Buitron (2015) and forthcoming

IMF work which find that weakening of unions is associated with a higher top 10 percent income

share for a smaller sample of advanced economies.

14

Indeed, empirical estimations using more

detailed data for OECD countries (not reported here, but available upon request) suggest that, in

line with Jaumotte and Osorio-Buitron (2015) and forthcoming IMF work, more lax hiring and firing

regulations, lower minimum wages relative to the median wage, and less prevalent collective