UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File No. 001-35186

Spirit Airlines, Inc.

(Exact name of registrant as specified in its charter)

Delaware

38-1747023

(State or other jurisdiction of

incorporation or organization)

(I.R.S. Employer

Identification No.)

2800 Executive Way Miramar Florida

33025

(Address of principal executive offices) (Zip Code)

(954) 447-7920

(Registrant’s telephone number, including area code)

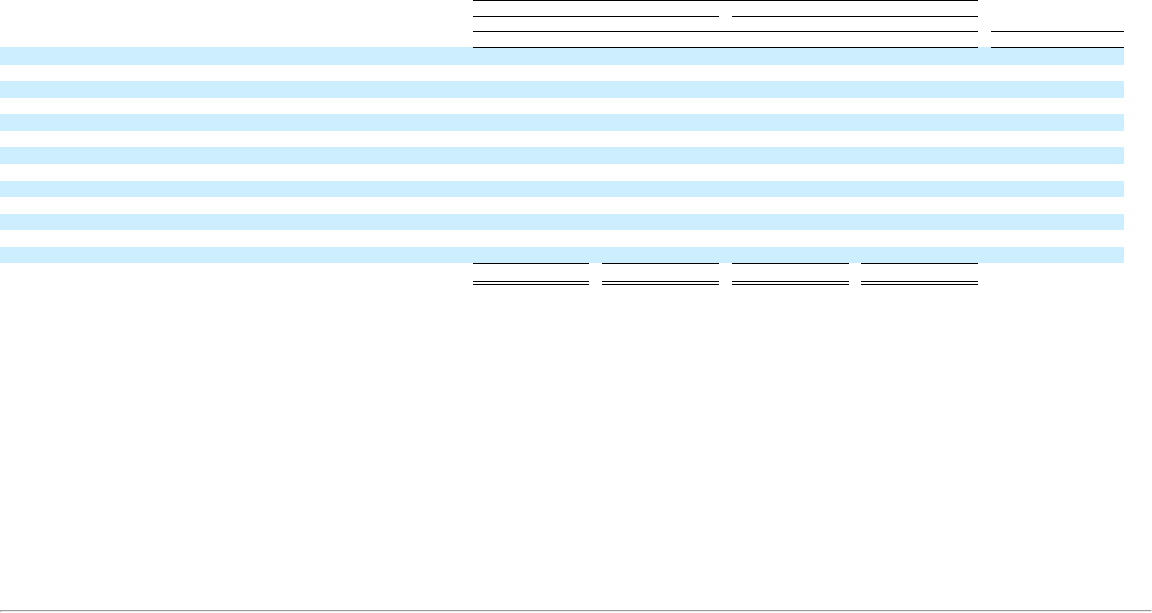

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class Trading Symbol Name of Each Exchange on Which Registered

Common Stock, $0.0001 par value SAVE New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by checkmark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to

submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer

☒

Accelerated filer

☐

Non-accelerated filer

☐

Smaller reporting company

☐

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the

registered public accounting firm that prepared or issued its audit report Yes ☒ No ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the common stock held by non-affiliates of the registrant was approximately $3.3 billion computed by reference to the last sale price of the common stock on the New York Stock Exchange on June 30, 2021, the last trading day of

the registrant’s most recently completed second fiscal quarter. Shares held by each executive officer, director and by certain persons that own 10 percent or more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates.

This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of each registrant's classes of common stock outstanding as of the close of business on February 1, 2022:

Class Number of Shares

Common Stock, $0.0001 par value per share 108,600,736

Documents Incorporated by Reference

Portions of the registrant's Proxy Statement for the registrant's 2022 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K to the extent stated herein. The Proxy Statement will be filed within 120 days of the registrant's

fiscal year ended December 31, 2021.

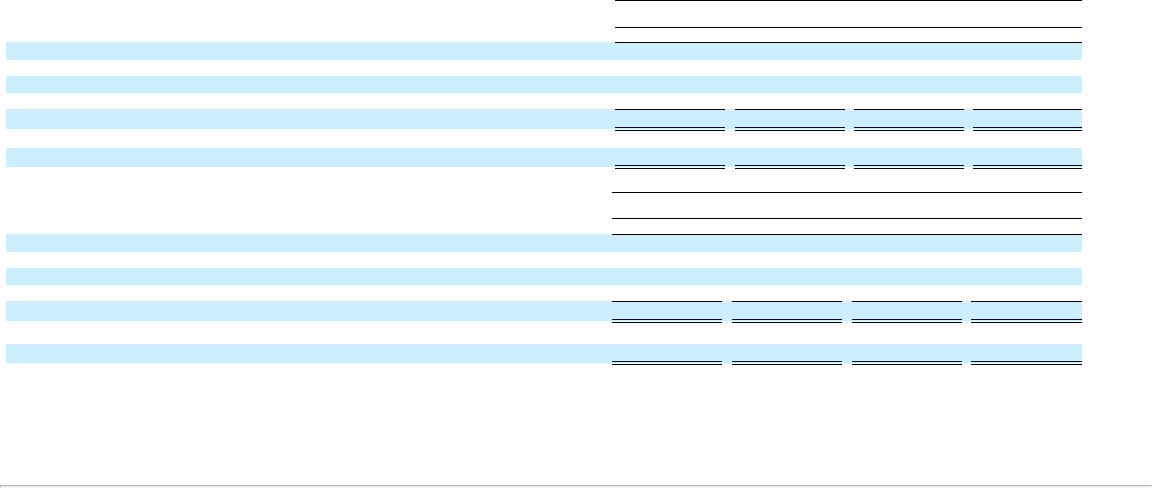

TABLE OF CONTENTS

PART I

Page

Item 1. Business 4

Item 1A. Risk Factors 16

Item 1B. Unresolved Staff Comments 45

Item 2. Properties 45

Item 3. Legal Proceedings 46

Item 4. Mine Safety Disclosures 46

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities 47

Item 6. Selected Financial Data 49

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations 50

Item 7A. Quantitative and Qualitative Disclosures About Market Risk 72

Item 8. Financial Statements and Supplementary Data 73

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure 118

Item 9A. Controls and Procedures 118

Item 9B. Other Information 118

Item 9C. Disclosures Regarding Foreign Jurisdictions that Prevent Inspections 118

PART III

Item 10. Directors, Executive Officers and Corporate Governance 119

Item 11. Executive Compensation 119

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters 119

Item 13. Certain Relationships and Related Transactions and Director Independence 119

Item 14. Principal Accountant Fees and Services 119

PART IV

Item 15. Exhibits and Financial Statement Schedules 120

Signatures 132

__________________________________________________

PART I

ITEM 1. BUSINESS

Overview

Spirit Airlines, Inc. ("Spirit Airlines"), headquartered in Miramar, Florida, offers affordable travel to value-conscious customers. Our all-Airbus fleet is one of the youngest and most fuel efficient in the United States. We

serve 85 destinations in 16 countries throughout the United States, Latin America and the Caribbean. Our stock trades under the symbol "SAVE" on the New York Stock Exchange ("NYSE").

Our ultra low-cost carrier, or ULCC, business model allows us to compete principally by offering customers unbundled base fares that remove components traditionally included in the price of an airline ticket. By offering

customers unbundled base fares, we give customers the power to save by paying only for the Á La Smarte options they choose, such as checked and carry-on bags, advance seat assignments, priority boarding and

refreshments. We record revenue related to these options as non-fare passenger revenue, which is recorded within passenger revenues in our consolidated statements of operations.

Our History

We were founded in 1964 as Clippert Trucking Company, a Michigan corporation. We began air charter operations in 1990 and renamed ourselves Spirit Airlines, Inc. in 1992. In 1994, we reincorporated in Delaware,

and in 1999 we relocated our headquarters to Miramar, Florida.

Our Corporate Information

Our mailing address and executive offices are located at 2800 Executive Way, Miramar, Florida 33025, and our telephone number at that address is (954) 447-7920. We are subject to the information and periodic

reporting requirements of the Securities Exchange Act of 1934, as amended, or Exchange Act, and, in accordance therewith, file periodic reports, proxy statements and other information with the Securities and Exchange

Commission or SEC. Such periodic reports, proxy statements and other information are available on the SEC's website at http://www.sec.gov. We also post on the Investor Relations page of our website, www.spirit.com, a link

to our filings with the SEC, our Corporate Governance Guidelines and Code of Business Conduct and Ethics, which applies to all directors and all our employees, and the charters of our Audit, Compensation, Finance, Safety,

Security and Operations and Nominating and Corporate Governance committees. Our filings with the SEC are posted as soon as reasonably practical after they are filed electronically with the SEC. Please note that information

contained on our website is not incorporated by reference in, or considered to be a part of, this report.

Changes to Our Corporate Structure

In August 2020, Spirit Airlines formed several new subsidiaries; Spirit Finance Cayman 1 Ltd. (“HoldCo 1”), Spirit Finance Cayman 2 Ltd. (“HoldCo 2), Spirit IP Cayman Ltd. (“Spirit IP”) and Spirit Loyalty Cayman

Ltd. (“Spirit Loyalty”). Each are Cayman Islands exempted companies incorporated with limited liability. Spirit IP and Spirit Loyalty are wholly-owned subsidiaries of HoldCo 2 (other than the special share issued to the

special shareholder, who granted a proxy to vote such share to the collateral agent for the 8.00% senior secured notes (as defined herein)). HoldCo 1 and HoldCo 2 are special purpose holding companies. HoldCo 2 is a wholly-

owned direct subsidiary of HoldCo 1 (other than the special share issued to the special shareholder, who granted a proxy to vote such share to the collateral agent for the 8.00% senior secured notes). HoldCo 1 is a wholly-

owned subsidiary of Spirit Airlines (other than the special share issued to the special shareholder, who granted a proxy to vote such share to the collateral agent for the 8.00% senior secured notes).

Recent Developments

On February 5, 2022, Spirit Airlines entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Frontier Group Holdings, Inc., a Delaware corporation (“Frontier”), and Top Gun Acquisition Corp., a

Delaware corporation and a direct, wholly owned subsidiary of Frontier (“Merger Sub”), pursuant to which and subject to the terms and conditions therein, Merger Sub will merge with and into Spirit Airlines, with Spirit

Airlines continuing as the surviving entity (the “Merger”). As a result of the Merger, each existing share of Spirit Airlines’ common stock will be converted into the right to receive (i) $2.13 in cash, without interest and (ii)

1.9126 shares of Frontier’s common stock (“Frontier Common Stock”), par value $0.001 per share. Upon consummation of the Merger, existing shareholders of Spirit Airlines will own approximately 48.5% of the outstanding

shares of Frontier on a fully diluted basis.

Completion of the Merger is subject to the satisfaction or waiver of certain closing conditions, including, among other things, (1) approval of the transactions by Spirit Airlines’ stockholders, (2) receipt of applicable

regulatory approvals, including

TM

4

approvals from the U.S. Federal Communications Commission (“FCC”), U.S. Federal Aviation Administration (“FAA”) and the U.S. Department of Transportation (“DOT”) and the expiration or early termination of the

statutory waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and other required regulatory approvals; (3) the absence of any law or order prohibiting the consummation of the

transactions; (4) the effectiveness of the registration statement to be filed by Frontier and Spirit Airlines with the SEC pursuant to the Merger Agreement; (5) the authorization and approval for listing on NASDAQ of the shares

of Frontier Common Stock to be issued to holders of Spirit Airlines’ common stock in the Merger; and (6) the absence of any material adverse effect (as defined in the Merger Agreement) on either Spirit Airlines or Frontier.

The Merger Agreement contains certain customary termination rights for Spirit Airlines and Frontier, including, without limitation, a right for either party to terminate if the Merger is not consummated on or before

February 5, 2023, subject to certain extensions if needed to obtain regulatory approvals. Upon the termination of the Merger Agreement under specified circumstances, Spirit Airlines will be required to pay Frontier a breakup

fee of $94.2 million. The Merger Agreement also provides the methodology by which certain expenses will be borne.

Summary Risk Factors

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows and

prospects. These risks are discussed more fully in Item 1A. Risk Factors herein. These risk factors include, but are not limited to, the following:

• The impact of the COVID-19 pandemic on our business, results of operations and financial condition;

• The impact on our business of the Merger and our ability to complete the Merger in a timely manner;

• The impact of the new 5G C-band service deployed by AT&T and Verizon and its potential effect on the technology we rely on to operate our aircraft;

• The competitiveness of our industry;

• Volatility in fuel costs or significant disruptions in the supply of fuel, in particular the impact on our single service provider on whom we rely to manage approximately half of our fuel supply;

• Adverse domestic or global economic conditions on our business, results of operations and financial condition, including our ability to obtain financing or access capital markets;

• Factors beyond our control, including air traffic congestion at airports, air traffic control inefficiencies, major construction or improvements at airports, adverse weather conditions, increased security measures, new

travel related taxes or the outbreak of disease;

• Increased labor costs, union disputes, employee strikes and other labor-related disruption;

• Our maintenance costs, which will increase as our fleet ages;

• The extensive regulation by the FAA, DOT, TSA and other U.S. and foreign governmental agencies to which we are subject;

• Our reliance on technology and automated systems to operate our business;

• Our reliance on third-party service providers to perform functions integral to our operations, including for ground handling, catering, passenger handing, maintenance, reservations and other services;

• Our reliance on a limited number of suppliers for our aircraft and engines;

• Reduction in demand for air transportation, or governmental reduction or limitation of operating capacity, in the domestic U.S., Caribbean or Latin American markets;

• The success of the Free Spirit Program and the Spirit Saver$ Club ; and

• Our significant amount of aircraft-related fixed obligations and additional debt that we have incurred, and may incur in the future.

Our Business Model

Our ULCC business model provides guests low, unbundled base fares with a range of optional services, allowing guests the freedom to choose only the options they value. The success of our model is driven by our low-

cost structure, which has

TM

5

historically permitted us to offer low base fares while maintaining high profit margins. During 2020 and 2021, we were unable to deliver a profit due to the impact of the COVID-19 pandemic on our airline.

We are focused on value-conscious travelers who pay for their own travel, and our business model is designed to deliver what our guests want: low fares and a great experience. We use low fares to address underserved

markets, which helps us to increase passenger volume and load factors on the flights we operate. We also have high-density seating configurations on our aircraft and a simplified onboard product designed to lower costs. High

passenger volumes and load factors help us sell more ancillary products and services, which in turn allows us to reduce the base fare we offer even further. We strive to be recognized by our guests and potential guests as the

low-fare leader in the markets we serve.

We compete based on total price. We believe that we and our guests benefit when we allow our guests to know the total price of their travel by breaking out the cost of optional products or services. We allow our guests to

see all available options and their respective prices prior to purchasing a ticket, and this full transparency illustrates that our total price, including options selected, is lower on average than other airlines.

Through branded campaigns, we educate the public on how our unbundled pricing model works and show them how it provides a choice on how they spend their money and saves them money compared to other airlines.

We show our commitment to delivering the best value in the sky by continuing to make improvements to the customer experience, including a freshly updated cabin interior with ergonomically-designed seats and self bag-

tagging in most airports to reduce check-in processing time.

Our Strengths

We believe we compete successfully in the airline industry by leveraging the following demonstrated business strengths:

Ultra Low-Cost Structure. Our unit operating costs are among the lowest of all airlines operating in the United States. We believe this unit cost advantage helps protect our market position and enables us to offer some of

the lowest base fares in our markets, sustain among the highest operating margins in our industry and support continued growth. Our operating costs per available seat mile ("CASM") of 8.07 cents in 2021 were significantly

lower than those of the major domestic network carriers and among the lowest of the domestic low-cost carriers. We achieve these low unit operating costs in large part due to:

• high aircraft utilization;

• high-density seating configurations on our aircraft along with a simplified onboard product designed to lower costs;

• minimal hub-and-spoke network inefficiencies;

• highly productive workforce;

• opportunistic outsourcing of operating functions;

• operating a single-fleet type of Airbus A320-family aircraft that is one of the youngest and most fuel efficient in the United States and operated by common flight crews;

• reduced sales, marketing and distribution costs through direct-to-consumer marketing;

• efficient flight scheduling, including minimal ground times between flights; and

• a company-wide business culture that is keenly focused on driving costs lower.

Innovative Revenue Generation. We execute our innovative, unbundled pricing strategy to generate significant non-ticket revenue, which allows us to lower base fares and enables our passengers to identify, select and

pay for only the products and services they want to use. In implementing our unbundled strategy, we have grown non-ticket revenue per passenger flight segment from approximately $5 in 2006 to $59 in 2021 generally by:

• charging for checked and carry-on baggage;

• passing through most distribution-related expenses;

• charging for premium seats and advance seat selection;

• maintaining consistent ticketing policies, including service charges for changes and cancellations;

• generating subscription revenue from our Spirit Saver$ Club (the "Spirit Saver$ Club " formerly known as the $9 Fare Club );

• deriving brand-based revenues from proprietary services, such as our FREE SPIRIT affinity credit card program;

TM TM TM

6

• offering third-party travel products (travel packages), such as hotel rooms, ground transportation (rental and hotel shuttle products) and attractions (show or theme park tickets) packaged with air travel on our website;

and

• selling third-party travel insurance through our website.

Resilient Business Model and Customer Base. By focusing on price-sensitive travelers, we have generally maintained profitability or been impacted to a lesser degree than most of our competitors during volatile

economic periods because we are not highly dependent on premium-fare business traffic. We believe our growing customer base is more resilient than the customer bases of most other airlines because our low fares and

unbundled service offering appeal to price-sensitive travelers.

Well Positioned for Growth. We have developed a substantial network of destinations in profitable U.S. domestic niche markets, targeted growth markets in the Caribbean and Latin America and high-volume routes

flown by price-sensitive travelers. In the United States, we also have grown into large markets that, due to higher fares, have priced out those more price-sensitive travelers. We seek to balance growth between large domestic

markets, large leisure destinations and opportunities in the Caribbean and Latin America according to current economic and industry conditions.

Experienced International Operator. We believe we have substantial experience in foreign aviation, security and customs regulations, local ground operations and flight crew training required for successful international

and overwater flight operations. All of our aircraft are certified for overwater operations. We believe we compete favorably against other low-cost carriers because we have been conducting international flight operations since

2003 and have developed substantial experience in complying with the various regulations and business practices in the international markets we serve. During 2021, 2020 and 2019, no revenue from any one foreign country

represented greater than 4% of our total passenger revenue. We attribute operating revenues by geographic region based upon the origin and destination of each passenger flight segment.

Financial Strength Achieved with Focus on Cost Discipline. We believe our ULCC business model has delivered strong financial results in both favorable and more difficult economic times. We have generated these

results by:

• keeping a consistent focus on maintaining low unit operating costs;

• ensuring our sourcing arrangements with key third parties are regularly benchmarked against the best industry standards;

• generating and maintaining an adequate level of liquidity to insulate against volatility in key cost inputs, such as fuel and in passenger demand that may occur as a result of changing general economic conditions.

Loyalty Programs

We operate the Spirit Saver$ Club , which is a subscription-based loyalty program that allows members access to unpublished, extra-low fares as well as discounted prices on bags, exclusive offers on hotels, rental cars

and other travel necessities. In January 2021, the benefits of the Spirit Saver$ Club were expanded to include discounts on seats, shortcut boarding and security, and "Flight Flex" flight modification product. We also operate

the Free Spirit loyalty program (the “Free Spirit Program”), which attracts members and partners and builds customer loyalty for us by offering a variety of awards, benefits and services. Free Spirit loyalty program members

earn and accrue points for our flights and services from non-air partners such as retail merchants, hotels or car rental companies or by making purchases with credit cards issued by partner banks and financial services providers.

Points earned and accrued by Free Spirit loyalty program members can be redeemed for travel awards such as free (other than taxes and government-imposed fees), discounted or upgraded travel. In January 2021, we launched

a more expansive Free Spirit Program with extended mileage expirations, additional benefits based on status tiers, and other changes.

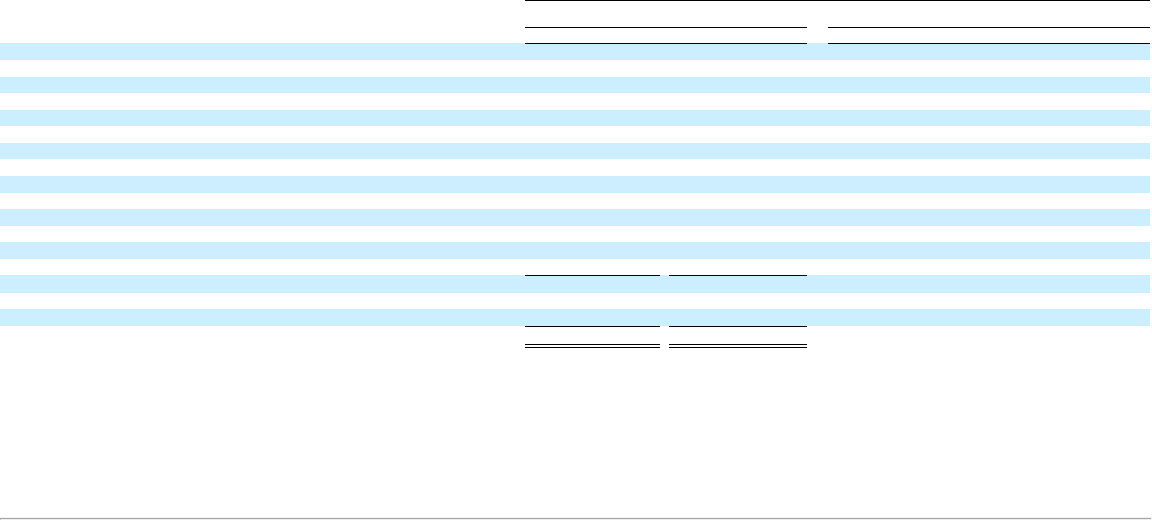

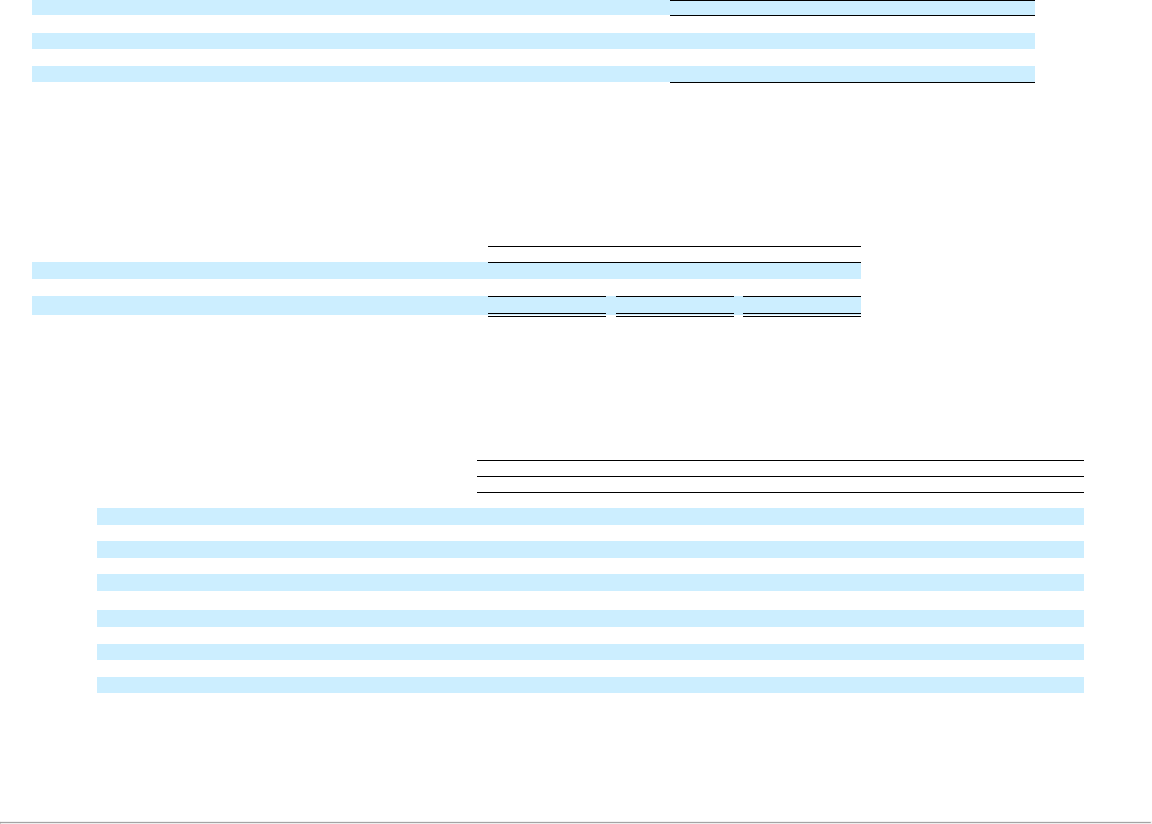

Route Network

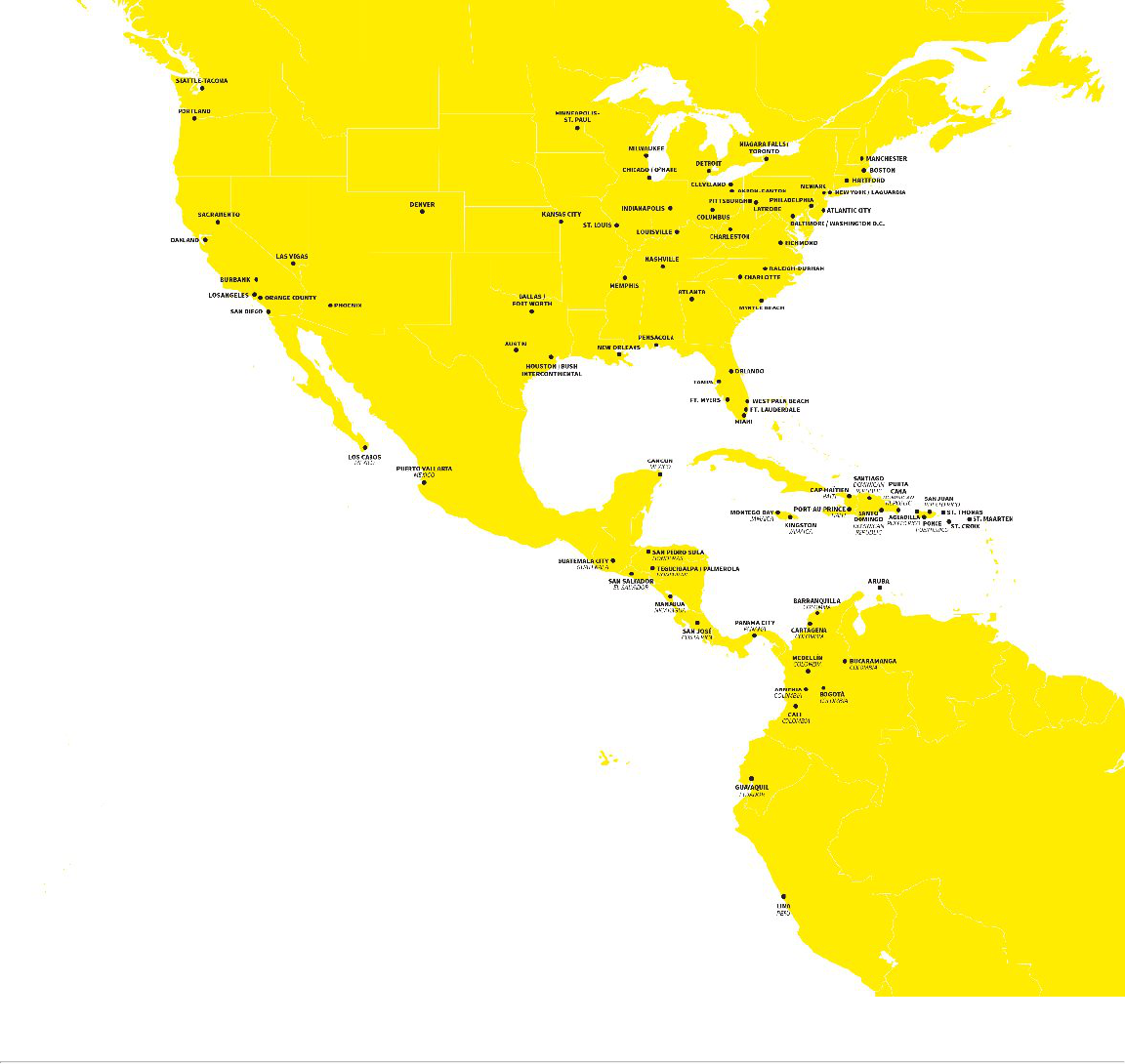

Our route network includes 360 markets served by 85 airports throughout the United States, Latin America and the Caribbean.

Below is a current map of our network, including seasonal destinations we serve:

TM

TM

7

8

Our network expansion targets underserved and/or overpriced markets. We employ a rigorous process to identify opportunities to deploy new aircraft where we believe they will be most profitable. To monitor the profitability

of each route, we analyze weekly and monthly profitability reports as well as near-term forecasting.

Competition

The airline industry is highly competitive. The principal competitive factors in the airline industry are fare pricing, total price, flight schedules, aircraft type, passenger amenities, number of routes served from a city,

customer service, safety record and reputation, code-sharing relationships and frequent flyer programs and redemption opportunities. We typically compete in markets served by traditional network airlines, and other low-cost

carriers and ULCCs, and, to a lesser extent, regional airlines.

As of December 31, 2021, our top three largest network overlaps are with Southwest Airlines, American Airlines and Frontier Airlines. Our principal competitive advantage is our relative cost advantage which allows us

to offer low base fares profitably. In 2021, our unit operating costs were among the lowest in the U.S. airline industry. We believe our low unit costs coupled with our relatively stable non-ticket revenues allow us to price our

fares at levels where we can be profitable while our primary competitors cannot.

The airline industry is particularly susceptible to price discounting because, once a flight is scheduled, airlines incur only nominal incremental costs to provide service to passengers occupying otherwise unsold seats. The

expenses of a scheduled aircraft flight do not vary significantly with the number of passengers carried and, as a result, a relatively small change in the number of passengers or in pricing could have a disproportionate effect on

an airline’s operating and financial results. Price competition occurs on a market-by-market basis through price discounts, changes in pricing structures, fare matching, target promotions and frequent flyer initiatives. Airlines

typically use discount fares and other promotions to stimulate traffic during normally slower travel periods to generate cash flow and to maximize TRASM. The prevalence of discount fares can be particularly acute when a

competitor has excess capacity that it is unable to fill at higher rates. A key element to our competitive strategy is to maintain very low unit costs in order to permit us to compete successfully in price-sensitive markets.

Seasonality

Our business is subject to significant seasonal fluctuations. We generally expect demand to be greater in the second and third quarters each year due to more vacation travel during these periods, as compared to the rest of

the year. The air transportation business is also volatile and highly affected by economic cycles and trends.

Distribution

The majority of our tickets are sold through direct channels, including online via www.spirit.com, our call center and our airport ticket counters, with www.spirit.com being the primary channel. We also partner with a

number of third parties to distribute our tickets, including online and traditional travel agents and electronic global distribution systems.

Customers

We believe our customers are primarily leisure travelers who are paying for their own ticket and who make their purchase decision based largely on price. By maintaining a low cost structure, we have historically been

able to successfully sell tickets at low fares while maintaining a strong profit margin. During 2020 and 2021, we were unable to deliver a profit due to the impact of the COVID-19 pandemic on our airline.

Customer Service

We are committed to taking care of our customers. We believe focusing on customer service in every aspect of our operations, including personnel, flight equipment, in-flight and ancillary amenities, on-time

performance, flight completion ratios, and baggage handling will strengthen customer loyalty and attract new customers. We proactively aim to improve our operations to ensure further improvement in customer service.

Our online booking process allows our customers to see all available options and their prices prior to purchasing a ticket. We maintain a campaign that illustrates our total prices are lower, on average, than those of our

competitors, even when options are included.

Fleet

9

We fly only Airbus A320 family aircraft, which provides us significant operational and cost advantages compared to airlines that operate multiple aircraft types. By operating a single aircraft type, we avoid the

incremental costs of training crews across multiple types. Flight crews are entirely interchangeable across all of our aircraft, and maintenance, spare parts inventories and other operational support remains highly simplified

compared to those airlines with more complex fleets. Due to this commonality among Airbus single-aisle aircraft, we can retain the benefits of a fleet comprised of a single type of aircraft while still having the flexibility to

match the capacity and range of the aircraft to the demands of each route.

As of December 31, 2021, we had a fleet of 173 Airbus single-aisle aircraft, which are commonly referred to as “A320 family” aircraft. A320 family aircraft include the A319, A320 and A321 models, which have broadly

common design and equipment but differ most notably in fuselage length, service range and seat capacity. Within the A320 family of aircraft, models using existing engine technology may carry the suffix “ceo,” denoting the

“current engine option,” while models equipped with new-generation engines may carry the suffix “neo,” denoting the “new engine option.” As of December 31, 2021, our fleet consisted of 31 A319ceos, 64 A320ceos, 48

A320neos and 30 A321ceos, and the average age of the fleet was 6.8 years. As of December 31, 2021, we had 106 aircraft, of which 46 aircraft are financed through fixed-rate long-term debt with 7 to 18 year terms, 27 aircraft

are financed through enhanced equipment trust certificates ("EETCs") and 33 aircraft are currently unencumbered. Refer to “Notes to the Consolidated Financial Statements—14. Debt and Other Obligations” for information

regarding our debt financing. As of December 31, 2021, we had 67 aircraft financed under operating leases with lease term expirations between 2023 and 2039. In addition, as of December 31, 2021, we had 12 spare engines

financed under operating leases and owned 20 unencumbered spare engines.

On December 20, 2019, we entered into an A320 NEO Family Purchase Agreement with Airbus S.A.S. ("Airbus") for the purchase of 100 new Airbus A320neo family aircraft, with options to purchase up to 50 additional

aircraft. This agreement includes a mix of Airbus A319neo, A320neo and A321neo aircraft with such aircraft scheduled for delivery through 2027. As of December 31, 2021, our firm aircraft orders consisted of 120 A320

family aircraft with Airbus, including A319neos, A320neos and A321neos, with deliveries expected through 2027. As of December 31, 2021, we had secured financing for 17 aircraft, scheduled for delivery from Airbus

through 2022 which will be financed through sale leaseback transactions. In addition, as of December 31, 2021, we had 36 direct operating leases for A320neos and A321neos with third-party lessors, with deliveries expected

through 2024. During the third quarter of 2021, we entered into an Engine Purchase Support Agreement which requires us to purchase a certain number of spare engines in order to maintain a contractual ratio of spare engines

to aircraft in the fleet. As of December 31, 2021, we are committed to purchase 16 PW1100G-JM spare engines, with deliveries through 2027. The firm aircraft orders provide for capacity growth as well as the flexibility to add

to, or replace, the aircraft in our present fleet. We may elect to supplement these deliveries by additional acquisitions from the manufacturer or in the open market if demand conditions merit. We also may adjust or defer

deliveries, or change models of aircraft in our delivery stream, from time to time, as a means to match our future capacity with anticipated demand and growth trends.

Consistent with our ULCC business model, each of our aircraft is configured with a high density seating configuration, which helps us maintain a lower unit cost. Our high density seating configuration accommodates

more passengers than those of our competitors when comparing the same type of aircraft.

Maintenance and Repairs

We maintain our aircraft in accordance with an FAA-approved maintenance program built from the manufacturers recommended maintenance schedule and maintained by our Technical Services department. Our

maintenance technicians undergo extensive initial and recurrent training to ensure the safe operation of our aircraft. For the fourth year in a row, Spirit has achieved the FAA’s highest award for Technical Training, the

Diamond Award of Excellence. This award is only achieved if 100% of technicians receive the FAA’s Aircraft Maintenance Technician (“AMT”) Certificate of Training.

Aircraft maintenance and repair consists of routine and non-routine maintenance, and work performed is divided into three general categories: line maintenance, heavy maintenance and component service. Line

maintenance consists of routine daily and weekly scheduled maintenance checks on our aircraft, including pre-flight, daily, weekly and overnight checks, and any diagnostics and routine repairs and any unscheduled items on an

as needed basis. Additionally, maintenance program tasks that may take up to two years to fully complete are performed periodically in line maintenance at scheduled day visits or segmented into overnight work packages. Line

maintenance events are currently serviced by in-house mechanics supplemented by contract labor and are primarily completed at airports we currently serve. Heavy airframe maintenance checks consist of a series of more

complex tasks that can take from one to four weeks to accomplish and typically are required approximately every 36 months. Heavy engine maintenance is performed approximately every six years and includes a more complex

scope of work. Due to our relatively small fleet size and projected fleet growth, we believe outsourcing all of our heavy maintenance activity, such as engine servicing, heavy airframe maintenance checks, major part repair and

component service repairs is more economical. Outsourcing eliminates the substantial initial capital requirements inherent in heavy aircraft maintenance. We have entered into a long-term flight hour agreement for the majority

of our current fleet with International Aero Engines AG ("IAE")

10

and Pratt & Whitney for our engine overhaul services and with various maintenance providers on an hour-by-hour basis for component services. We outsource our heavy airframe maintenance to FAA-qualified maintenance

providers.

Our recent maintenance expenses have been lower than what we expect to incur in the future because of the relatively young age of our aircraft fleet. Our maintenance costs are expected to increase as the scope of repairs

increases with the increasing age of our fleet. As our aircraft age, scheduled scope of work and frequency of unscheduled maintenance events is likely to increase like any maturing fleet. Our aircraft utilization rate could

decrease with the increase in aircraft maintenance.

We own and operate a 126,000-square-foot maintenance hangar facility, adjacent to the airfield at the Detroit Metropolitan Wayne County Airport, which allows us to reduce our dependence on third-party facilities and

contract line maintenance. Please see “-Properties-Ground Facilities.”

Employees

Our business is labor intensive, with labor costs representing approximately 32.4%, 39.3% and 26.0% of our total operating costs for 2021, 2020 and 2019, respectively. As of December 31, 2021, we had 2,744 pilots,

4,597 flight attendants, 75 dispatchers, 268 ramp service agents, 224 passenger service agents, 900 maintenance personnel, 208 airport agents/other and 807 employees in administrative roles for a total of 9,823 active

employees compared to 8,756 active employees as of December 31, 2020. During the twelve months ended December 31, 2021, there were 1,633 employee terminations, including both voluntary and involuntary terminations,

for an overall employee turnover rate of 18.7%. As of December 31, 2021, approximately 81% of our employees were represented by five labor unions. On an average full-time equivalent basis, for the full year 2021, we had

9,218 employees, compared to 8,692 in 2020.

FAA regulations require pilots to have commercial licenses with specific ratings for the aircraft to be flown and be medically certified as physically fit to fly. FAA and medical certifications are subject to periodic renewal

requirements, including recurrent training and recent flying experience. Flight attendants must have initial and periodic competency training and qualification. For the year ended December 31, 2021, paid training hours for our

pilots and flight attendants were 147,533 and 38,149 hours, representing 12.8% and 1.6% of total crew block hours, respectively. Mechanics, quality-control inspectors and dispatchers must be certificated and qualified for

specific aircraft. Training programs are subject to approval and monitoring by the FAA. Management personnel directly involved in the supervision of flight operations, training, maintenance and aircraft inspection must also

meet experience standards prescribed by FAA regulations. All safety-sensitive employees are subject to pre-employment, random and post-accident drug testing.

Consistent with our core values, we focus on hiring highly productive and qualified personnel and ensure they have comprehensive training. Our training programs focus on and emphasize the importance of safety,

customer service, productivity, and cost control. We provide continuous training for our crew members including technical training as well as regular training focused on safety and front-line training for our customer service

teams. Our training programs include classroom learning, extensive real-world flying experience, and instruction in full flight simulators, as appropriate.

Additionally, in 2021, we launched a comprehensive Diversity, Inclusion, Equity and Belonging strategy, to drive meaningful change within the organization and the communities in which we live and work. This

includes Team Member run employee resource groups (ERGs) to ensure all Team Members have a voice in paving our path; providing education to increase awareness of systemic inequities and to reduce bias; and a new

Supplier Diversity program around a network of minority-owned business partners and diverse suppliers, as part of our strategic sourcing and procurement process.

We believe a direct relationship between Team Members and our leadership is in the best interests of our crew members, our customers, and our shareholders. Our leadership team communicates on a regular basis with all

Team Members, including crew members, in order to maintain a direct relationship and to keep them informed about news, strategy updates, and challenges affecting the airline and the industry. Effective and frequent

communication throughout the organization is fostered through various means including email messages from our CEO and other senior leaders, open forum meetings across our network, periodic leadership visits to our

stations, and annual Team Member engagement surveys. We also seek to build human rights awareness among our Team Members and Guests and we have recently implemented a Human Rights Policy.

The Railway Labor Act, or RLA, governs our relations with labor organizations. Under the RLA, our collective bargaining agreements do not expire, but instead become amendable as of a stated date, subject to standard

early opener provisions. If either party wishes to modify the terms of any such agreement, they must notify the other party in the manner agreed to by the parties. Under the RLA, after receipt of such notice, the parties must

meet for direct negotiations. If no agreement is reached, either party may request the National Mediation Board, or NMB, to appoint a federal mediator. The RLA prescribes no set timetable for the direct negotiation and

mediation process. It is not unusual for those processes to last for many months, and even several years. If no agreement is reached in mediation, the NMB in its discretion may declare at some time

11

that an impasse exists. If an impasse is declared, the NMB proffers binding arbitration to the parties. Either party may decline to submit to arbitration. If arbitration is rejected by either party, a 30-day “cooling off” period

commences. During that period (or after), a Presidential Emergency Board, or PEB, may be established, which examines the parties’ positions and recommends a solution. The PEB process lasts for 30 days and is followed by

another “cooling off” period of 30 days. At the end of a “cooling off” period, unless an agreement is reached or action is taken by Congress, the labor organization and the airline each may resort to “self-help,” including, for the

labor organization, a strike or other labor action, and for the airline, the imposition of any or all of its proposed amendments and the hiring of new employees to replace any striking workers. Congress and the President have the

authority to prevent “self-help” by enacting legislation that, among other things, imposes a settlement on the parties. The table below sets forth our employee groups and status of the collective bargaining agreements.

Employee Groups Representative Amendable Date

Pilots

Air Line Pilots Association, International (ALPA)

February 2023

Flight Attendants

Association of Flight Attendants (AFA-CWA)

September 2021

Dispatchers

Professional Airline Flight Control Association (PAFCA)

October 2023

Ramp Service Agents International Association of Machinists and Aerospace Workers (IAMAW) November 2026

Passenger Service Agents Transport Workers Union of America (TWU) NA

In March 2016, under the supervision of the NMB, we reached a tentative agreement for a five-year contract with our flight attendants. Our flight attendants ratified the agreement in May 2016. In February 2021, we

entered into a Letter of Agreement with the AFA-CWA to change the amendable date of the collective bargaining agreement from May 4, 2021 to September 1, 2021. All other terms of the collective bargaining agreement

remained the same. In June 2021, the AFA-CWA notified us, as required by the Railway Labor Act, that it intended to submit proposed changes to the collective bargaining agreement covering our flight attendants. We

commenced negotiations with the AFA-CWA on September 27, 2021. As of December 31, 2021, we continued to negotiate with the AFA-CWA.

Our dispatchers are represented by PAFCA. In October 2018, we reached a tentative agreement with PAFCA for a new five-year agreement, which was ratified by the PAFCA members in October 2018.

In July 2014, certain ramp service agents directly employed by us voted to be represented by the IAMAW. In May 2015, we entered into a five-year interim collective bargaining agreement with the IAMAW, covering

material economic terms. In June 2016, we reached an agreement on the remaining terms of the collective bargaining agreement. In February 2020, the IAMAW notified us, as required by the Railway Labor Act, that it

intended to submit proposed changes to the collective bargaining agreement covering our ramp service agents which became amendable in June 2020. On September 28, 2021, we filed an “Application for Mediation Services”

with the NMB. We were able to reach a tentative agreement with the IAMAW with the assistance of the NMB on October 16, 2021. Our ramp service agents ratified the five-year agreement in November 2021.

In June 2018, our passenger service agents voted to be represented by the TWU, but the representation only applies to our Fort Lauderdale station where we have direct employees in the passenger service

classification. We began meeting with the TWU in late October 2018 to negotiate an initial collective bargaining agreement. During February 2022, we reached a tentative agreement with the TWU, which will need to be

ratified by the passenger service agents.

Safety and Security

We are committed to the safety and security of our passengers and employees. We strive to comply with or exceed health and safety regulation standards. In pursuing these goals, we maintain an active aviation safety

program. All of our personnel are expected to participate in the program and take an active role in the identification, reduction and elimination of hazards.

Our ongoing focus on safety relies on training our employees to proper standards and providing them with the tools and equipment they require so they can perform their job functions in a safe and efficient manner.

Safety in the workplace targets several areas of our business, including: flight operations, maintenance, in-flight, dispatch and station operations. The Transportation Security Administration, or TSA, is charged with aviation

security for both airlines and airports. We maintain active, open lines of communication with the TSA at all of our locations to ensure proper standards for security of our personnel, customers, equipment and facilities are

exercised throughout our business.

Insurance

12

We maintain insurance policies we believe are customary in the airline industry and as required by the DOT. The policies principally provide liability coverage for public and passenger injury; damage to property; loss of

or damage to flight equipment; fire and extended coverage; war risk (terrorism); directors’ and officers’ liability; advertiser and media liability; cyber risk liability; fiduciary; and workers’ compensation and employer’s liability.

Renewing coverage could result in a change in premium and more restrictive terms. Although we currently believe our insurance coverage is adequate, there can be no assurance that the amount of such coverage will not be

changed or that we will not be forced to bear substantial losses from accidents.

Management Information Systems

We have continued our commitment to technology improvements to support our ongoing operations and initiatives. In 2019, we implemented a new website built on a more stable codebase which provides for a better

user experience. In addition, we invested in improving the stability of our mobile application.

In 2020, we continued to migrate critical business applications into the cloud infrastructure, allowing us to take increasing advantage of the analytics and automation functions. These improvements provide further

opportunities to increase business intelligence and flexibility, improve business continuity, mitigate disaster scenarios and enhance data security. We intend to continue to invest resources in cyber security to protect our data,

operations and our customers' privacy.

In 2021, we focused on additional modernization capabilities to enhance the travel experience of our Guests. In cooperation with the TSA, our Automated Self Service Bag Drop project is installed and functioning in

several airports. Our plan is to accelerate the deployment of this experience as well as to further enhance the customer convenience features. In addition, we have achieved a broad investment in a mobility tool for all our

workforce that enhances productivity and capabilities. Furthermore, the launch of our new Loyalty program has delivered an exceptional improvement in the Guest experience and utility. In 2021, the Azure Cloud migration of

Data and Application continued and is expected to be completed by early 2023. Lastly, our secondary Operations Control Center in Orlando went into production mid-year and will provide substantial improvements in disaster

recovery scenarios.

Foreign Ownership

Under DOT regulations and federal law, we must be controlled by U.S. citizens. In order to qualify, at least 75% of our stock must be voted by U.S. citizens, and our president and at least two-thirds of our board of

directors and senior management must be U.S. citizens.

We believe we are currently in compliance with such foreign ownership rules.

Government Regulation

Operational Regulation

The airline industry is heavily regulated, especially by the federal government. Two of the primary regulatory authorities overseeing air transportation in the United States are the DOT and the FAA. The DOT has

jurisdiction over economic and consumer issues affecting air transportation, such as competition, route authorizations, advertising and sales practices, baggage liability and disabled passenger transportation, reporting of

mishandled bags, tarmac delays and responding to customer complaints among other areas.

In July 2021, the DOT issued a Notice of Proposed Rulemaking (NRPM) requiring airlines to refund checked bag fees for delayed bags if they are not delivered to the passenger within a specified number of hours and

refunding ancillary fees for services related to air travel that passengers did not receive. As of December 31, 2021, a final rule has not been issued.

In November 2021, the DOT reopened the comment period on an NPRM regarding short-term improvements to lavatory accessibility, including new proposed requirements for onboard wheelchairs (OBWs). As of

December 31, 2021, a final rule has not been issued.

The Biden Administration issued an executive order mandating that masks be worn on commercial aircraft. This was extended in December 2021 to at least March 2022. We will continue to follow all relevant guidelines

and guidance to protect our guests and staff, but we cannot forecast what additional safety requirements may be imposed in the future or the extent of any pre-travel testing requirements (See “International Regulation”) that

may be under consideration in the United States and that may be in place, or renewed, in any foreign jurisdiction we serve, including the effect of such requirements on passenger demand or the costs or revenue impact that

would be associated with complying with such requirements.

13

Additional rules and executive orders, including those pertaining to disabled passengers, may be issued. See “Risk Factors—Restrictions on or increased taxes applicable to charges for ancillary products and services paid

by airline passengers and burdensome consumer protection regulations or laws which could harm our business, results of operations and financial condition."

The DOT has authority to issue certificates of public convenience and necessity required for airlines to provide air transportation. We hold a DOT certificate of public convenience and necessity authorizing us to engage

in scheduled air transportation of passengers, property and mail within the United States, its territories and possessions and between the United States and all countries that maintain a liberal aviation trade relationship with the

United States (known as “open skies” countries). We also hold DOT certificates to engage in air transportation to certain other countries with more restrictive aviation policies.

The FAA is responsible for regulating and overseeing matters relating to air carrier flight operations, including airline operating certificates, aircraft certification and maintenance and other matters affecting air safety,

including rest periods and work hours for all airlines certificated under Part 121 of the Federal Aviation Regulations. The FAA requires each commercial airline to obtain and hold an FAA air carrier certificate. This certificate,

in combination with operations specifications issued to the airline by the FAA, authorizes the airline to operate at specific airports using aircraft approved by the FAA. As of December 31, 2021, we had FAA airworthiness

certificates for all of our aircraft, we had obtained the necessary FAA authority to fly to all of the cities we currently serve, and all of our aircraft had been certified for overwater operations. Any new or revised operational

regulations in the future could result in further increased costs. We believe we hold all necessary operating and airworthiness authorizations, certificates and licenses and are operating in compliance with applicable DOT and

FAA regulations, interpretations and policies.

International Regulation

All international service is subject to the regulatory requirements of the foreign government involved. We generally offer international service to Aruba, Colombia, Costa Rica, Dominican Republic, Ecuador, El Salvador,

Guatemala, Haiti, Honduras, Jamaica, Mexico, Nicaragua, Panama, Peru and St. Maarten, as well as Puerto Rico and the U.S. Virgin Islands. If we decide to increase our routes to additional international destinations, we will be

required to obtain necessary authority from the DOT and the applicable foreign government. We are also required to comply with overfly regulations in countries that lay along our routes but which we do not serve.

International service is also subject to Customs and Border Protection, or CBP, immigration and agriculture requirements and the requirements of equivalent foreign governmental agencies. Like other airlines flying

international routes, from time to time we may be subject to civil fines and penalties imposed by CBP if unmanifested or illegal cargo, such as illegal narcotics, is found on our aircraft. These fines and penalties, which in the

case of narcotics are based upon the retail value of the seizure, may be substantial. We have implemented a comprehensive security program at our airports to reduce the risk of illegal cargo being placed on our aircraft, and we

seek to cooperate actively with CBP and other U.S. and foreign law enforcement agencies in investigating incidents or attempts to introduce illegal cargo.

We will continue to comply with all contagious disease requirements issued by the US and foreign governments, but we cannot forecast what additional requirements may be imposed in the future or the costs or revenue

impact that would be associated with complying with such requirements. For example, as of December 6, 2021, all air passengers 2 years or older with a flight departing to the United States from a foreign country are required

show a negative COVID-19 viral test result taken no more than 1 day before travel, or documentation of having recovered from COVID-19 in the past 90 days, before they board their flight. See, “Risk Factors—“We are

subject to extensive and increasing regulation by the FAA, DOT, TSA and other U.S. and foreign governmental agencies, compliance with which could cause us to incur increased costs and adversely affect our business and

financial results."

Security Regulation

The TSA was created in 2001 with the responsibility and authority to oversee the implementation, and ensure the adequacy of security measures at airports and other transportation facilities. Funding for passenger

security is provided in part by a per enplanement ticket tax (passenger security fee). Prior to and for the first half of 2014, this fee was $2.50 per passenger flight segment, subject to a maximum of $5 per one-way trip. Effective

July 1, 2014, the security fee was set at a flat rate of $5.60 each way. On December 19, 2014, the law was amended to limit a round-trip fee to $11.20. We cannot forecast what additional security and safety requirements may

be imposed in the future or the costs or revenue impact that would be associated with complying with such requirements.

Environmental Regulation

14

We are subject to various federal, state and local laws and regulations relating to the protection of the environment and affecting matters such as aircraft engine emissions, aircraft noise emissions and the discharge or

disposal of materials and chemicals, which laws and regulations are administered by numerous state and federal agencies. The Environmental Protection Agency, or EPA, regulates operations, including air carrier operations,

which affect the quality of air in the United States. We believe the aircraft in our fleet meet all emission standards issued by the EPA. Concern about climate change and greenhouse gases may result in additional regulation or

taxation of aircraft emissions in the United States and abroad.

Federal law recognizes the right of airport operators with special noise problems to implement local noise abatement procedures so long as those procedures do not interfere unreasonably with interstate and foreign

commerce and the national air transportation system. These restrictions can include limiting nighttime operations, directing specific aircraft operational procedures during takeoff and initial climb, and limiting the overall

number of flights at an airport.

Other Regulations

We are subject to certain provisions of the Communications Act of 1934, as amended, and are required to obtain an aeronautical radio license from the Federal Communications Commission, or FCC. To the extent we are

subject to FCC requirements, we will take all necessary steps to comply with those requirements. We are also subject to state and local laws and regulations at locations where we operate and the regulations of various local

authorities that operate the airports we serve. In addition, we are subject to the deployment of new 5G C-band service by wireless communications providers. The DOT and the FAA are currently working with AT&T and

Verizon to create appropriate safeguards in the deployment of their new 5G C-band service, including a potential delay in its overall deployment, the installation of buffer zones around airports and other measures to be

announced.

Future Regulations

The U.S. and foreign governments may consider and adopt new laws, regulations, interpretations and policies regarding a wide variety of matters that could directly or indirectly affect our results of operations. We cannot

predict what laws, regulations, interpretations and policies might be considered in the future, nor can we judge what impact, if any, the implementation of any of these proposals or changes might have on our business.

Corporate Responsibility and Sustainability

We are committed to integrating environmental, social, and governance (“ESG”) practices into and within our business practices and commit to sustainable operations which support the long-term success of our business,

shareholders, Team Members, Guests and business partners. We have established four strategic focus areas of our ESG initiatives, practices, and commitments: environment, social, workforce and governance. Recognizing the

fundamental importance of ESG matters, Spirit’s Board and its committees provide guidance and oversight. The Nominating and Corporate Governance Committee is responsible for oversight of our ESG strategy and practices

and periodically reports on these matters to the Board.

We recognize aviation’s impact on climate and our responsibility to help reduce the carbon footprint of air travel. Fuel burn is our greatest environmental and financial impact, and our greatest source of carbon emissions.

To address the impact of our flights and operations over the short-term and long-term, our climate and emissions approach focuses on reducing emissions through both fleet and operational efficiencies that conserve fuel and

improve overall fuel burn. Our all-Airbus fleet is one of the youngest in the United States and our dense seating configuration, along with our consistent focus on weight-saving measures, has made us consistently one of the

most fuel-efficient carriers in the United States.

Further illustrating our commitment, we issued our 2020 Sustainability Report, showing results of our longstanding commitment to meaningful advancements in environmental sustainability, Guest and community

service, Team Member support, and governance. The report highlights our plan for continued progress in broadening ESG initiatives and improving communities. Refer to “Spirit’s 2020 Sustainability Report” on the Investor

Relations section of our website at.www.spirit.com.

15

ITEM 1A. RISK FACTORS

Cautionary Statement Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of

1934, as amended (the "Exchange Act") which are subject to the “safe harbor” created by those sections. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently

available to our management. All statements other than statements of historical facts are “forward-looking statements” for purposes of these provisions. In some cases, you can identify forward-looking statements by terms

such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential,” and similar expressions intended to identify forward-looking statements. Such

forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such

forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those identified below. Furthermore, such forward-looking statements speak only as of the date of this

report. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. Additional risks or uncertainties (i) that are not

currently known to us, (ii) that we currently deem to be immaterial, or (iii) that could apply to any company, could also materially adversely affect our business, financial condition, or future results. You should carefully

consider the risks described below and the other information in this report. If any of the following risks materialize, our business could be materially harmed, and our financial condition and results of operations could be

materially and adversely affected. References in this report to “Spirit,” “we,” “us,” “our,” or the “Company” shall mean Spirit Airlines, Inc., unless the context indicates otherwise.

Risks Related to Recent Events

The COVID-19 pandemic and measures to reduce its spread have had, and will likely continue to have, a material adverse impact on our business, results of operations and financial condition.

The outbreak of COVID-19 and implementation of measures to reduce its spread have adversely impacted our business and continue to adversely impact our business in a number of ways. Multiple governments in

countries we serve, principally the United States, have responded to the virus with air travel restrictions and closures, testing requirements or recommendations against air travel, and certain countries we serve have required

airlines to limit or completely stop operations. The COVID-19 pandemic and its effects continue to evolve, with developments including fluctuations in the rate of infections during 2021, the emergency use authorization issued

by the U.S. Food and Drug Administration for COVID-19 vaccines, the requirement, effective January 26, 2021, that all U.S. inbound international travelers provide a negative COVID-19 test prior to flying and recent

increases in the availability of COVID-19 vaccines resulting in expanded eligibility to more groups of people to receive the vaccine. While we currently estimate that air travel demand will continue to be volatile and will

fluctuate in the upcoming months as the lingering effects of COVID-19 continue to develop, it expects that air travel demand will continue to recover in 2022. However, the situation continues to be fluid and actual capacity

adjustments may be different than what we currently expect.

Additionally, we also outsource certain critical business activities to third parties, including our dependence on a limited number of suppliers for our aircraft and engines. As a result, we rely upon the successful

implementation and execution of the business continuity planning of such entities in the current environment. The successful implementation and execution of these third parties’ business continuity strategies are largely outside

our control. If one or more of such third parties experience operational failures as a result of the impacts from the spread of COVID-19, or claim that they cannot perform due to a force majeure, it may have a material adverse

impact on our business, results of operations and financial condition.

The extent of the impact of COVID-19 on our business, results of operations and financial condition will depend on future developments, including the currently unknowable duration of the COVID-19 pandemic and the

impacts of any variants; the efficacy of, ability to administer and extent of adoption of any COVID-19 vaccines domestically and globally; the impact of existing and future governmental regulations, travel advisories and

restrictions that are imposed in response to the pandemic, including pursuant to executive orders, such as mask mandates; additional reductions to our flight capacity, or a voluntary temporary cessation of all flights, that we

implement in response to the pandemic; and the impact of COVID-19 on consumer behavior, such as a reduction in the demand for air travel, especially in our destination cities. The total potential economic

16

impact brought on by the COVID-19 pandemic is difficult to assess or predict, and it has already caused, and is likely to result in further, significant disruptions of global financial markets, which may reduce our ability to

access capital on favorable terms or at all, and increase the cost of capital. In addition, a recession, depression or other sustained adverse economic event resulting from the spread of COVID-19 would materially adversely

impact our business and the value of our common stock. The impact of the COVID-19 pandemic on global financial markets has negatively impacted the value of our common stock to date as well as our debt ratings, and could

continue to negatively affect our liquidity. Our credit rating was downgraded by Fitch to BB- in April 2020 and by S&P Global to B in June 2020. In May 2020, the credit rating of our Spirit Airlines Pass Through Trust

Certificates Series 2015-1 Class C and our Spirit Airlines Pass Through Trust Certificates Series 2017-1 Class C was downgraded by Fitch from BBB- to BB+. In June 2020, the credit ratings of our Spirit Airlines Pass Through

Trust Certificates Series 2017-1 Class A and B were downgraded by S&P Global to BBB and BB-, respectively. In November 2020, the credit ratings of our Spirit Airlines Pass Through Trust Certificates Series 2017-1 Class

AA and C were downgraded by S&P Global to AA- and BB, respectively. The downgrades of our ratings were based on our increased level of credit risk as a result of the financial impacts of the COVID-19 pandemic. If our

credit ratings were to be further downgraded, or general market conditions were to ascribe higher risk to our ratings levels, the airline industry, or the Company, our business, financial condition and results of operations would

be adversely affected. These developments are highly uncertain and cannot be predicted. There are limitations on our ability to mitigate the adverse financial impact of these items, including as a result of our significant aircraft-

related fixed obligations. COVID-19 also makes it more challenging for management to estimate future performance of our business, particularly over the near to medium term. A further significant decline in demand for our

flights could have a materially adverse impact on our business, results of operations and financial condition.

On March 27, 2020, the CARES Act was signed into law, and on April 20, 2020 we reached an agreement with the United States Department of the Treasury (“Treasury”) to receive funding through the Payroll Support

Program (“PSP”) over the second and third quarters of 2020. On December 27, 2020, the Consolidated Appropriations Act, 2021 was signed into law which extended the PSP portion of the CARES Act through March 31, 2021

(“PSP2”) and in January 2021, we reached an agreement with the Treasury to receive additional funding in early 2021. The funding we received subjects us to restrictions and limitations, as described below.

American Rescue Plan Act of 2021 (“ARP”), enacted on March 11, 2021, also authorized the Treasury to provide additional assistance to passenger air carriers that received financial assistance under PSP2 (“PSP3”).

Under the ARP, the Treasury provided approximately $14 billion to fund the PSP3 for employees of passenger air carriers during the second quarter of 2021.

The COVID-19 pandemic may also exacerbate other risks described in this “Risk Factors” section, including, but not limited to, our competitiveness, demand for our services, shifting consumer preferences and our

substantial amount of outstanding indebtedness.

We have agreed to certain restrictions on our business by accepting financing under the legislation enacted in response to the COVID-19 pandemic.

On March 27, 2020, the CARES Act was signed into law. The CARES Act provided liquidity in the form of loans, loan guarantees, and other investments to air carriers, such as us, that incurred, or are expected to incur,

covered losses such that the continued operations of the business are jeopardized, as determined by the Treasury.

On April 20, 2020, we entered into a PSP agreement with the Treasury, pursuant to which we received a total of $344.4 million used exclusively to pay for salaries, wages and benefits for our employees through

September 30, 2020. Of that amount, $73.3 million is in the form of a low-interest 10-year loan. In addition, in connection with its participation in the PSP, we issued to the Treasury warrants pursuant to a warrant agreement to

purchase up to 520,797 shares of our common stock, at a strike price of $14.08 per share (the closing price for the shares of our common stock on April 9, 2020) with a fair value of $3.9 million. We registered the resale of the

warrants pursuant to the warrant agreement with the Treasury in September and October 2020. The remaining amount of $267.2 million is in the form of a grant and was recognized in special credits in our consolidated

statement of operations for the year ended December 31, 2020.

The warrants expire in five years from the date of issuance, are transferable, have no voting rights and contain customary terms regarding anti-dilution. If the Treasury or any subsequent warrant holder exercises the

warrants, the interest of our holders of common stock would be diluted and we would be partially owned by the U.S. government, which could have a negative impact on our common stock price, and which could require

increased resources and attention by our management.

On December 27, 2020, PSP2 was signed into law and provided an additional $15 billion to fund PSP2 for employees of passenger air carriers. We entered into a new payroll support program agreement with the Treasury

on January 15, 2021.During

17

the first and second quarters of 2021, we received a total of $212.1 million through PSP2, used exclusively to pay for salaries, wages and benefits for our Team Members through March 31, 2021. Of that amount, $33.6 million

is in the form of a low-interest 10-year loan. In addition, in connection with its participation in PSP2, we issued to the Treasury warrants pursuant to a warrant agreement to purchase up to 137,753 shares of our common stock

at a strike price of $24.42 per share (the closing price for the shares of our common stock on December 24, 2020) with a fair value of $2.8 million. The remaining amount of $175.6 million is in the form of a grant and was

recognized in special credits in our consolidated statement of operations for the year ended December 31, 2021.

Airlines participating in the PSP2 program are required to, among other things:

• Continue restrictions on payment of dividends and stock buybacks through March 31, 2022;

• Continue limits on executive compensation through October 1, 2022;

• Continue requirements to maintain certain levels of scheduled services through March 1, 2022; and

• Continue reporting requirements.

These restrictions and requirements could materially adversely impact our business, results of operations and financial condition by, among other things, requiring us to change certain of our business practices and to

maintain or increase cost levels to maintain scheduled service with little or no offsetting revenue, affecting retention of key personnel and limiting our ability to effectively compete with others in our industry who may not be

receiving funding and may not be subject to similar limitations.

ARP also authorized Treasury to provide additional assistance in the form of the PSP3. Under the ARP, Treasury provided approximately $14 billion to fund PSP3 for employees of passenger air carriers. During the

second quarter of 2021, we received $197.9 million under PSP3. Of that amount, $29.4 million is in the form of a low-interest 10-year loan. In addition, in connection with its participation in PSP3, we issued to the Treasury

warrants pursuant to a warrant agreement to purchase up to 80,539 shares of our common stock at a strike price of $36.45 per share (the closing price for the shares of our common stock on March 10, 2021) with a fair value of

$1.5 million. The remaining amount of $167.0 million is in the form of a grant and was recognized in special credits in our consolidated statement of operations for the year ended December 31, 2021. Total warrants issued in

connection with the PSP, PSP2 and PSP3 represent less than 1% of the outstanding shares of our common stock as of December 31, 2021.

In connection with our participation in PSP3, we are subject to certain restrictions and limitations, including, but not limited to:

• Restrictions on payment of dividends and stock buybacks through September 30, 2022;

• Limits on executive compensation through April 1, 2023; and

• Reporting requirements.

The CARES Act also provided an employee retention credit (“CARES Employee Retention credit”) which was a refundable tax credit against certain employment taxes. We qualified for the credit beginning on April 1,

2020 and received additional credits for qualified wages through December 31, 2020. The Consolidated Appropriations Act extended and expanded the availability of the CARES Employee Retention credit through June 30,

2021. Subsequently, the ARP extended and expanded the availability of the CARES Employee Retention credit through December 31, 2021, however, certain provisions apply only after December 31, 2020. During the first and

second quarters of 2021, we recorded $37.5 million related to the CARES Employee Retention credit within special credits on our condensed consolidated statements of operations and within accounts receivable, net on our

condensed consolidated balance sheet. We did not qualify for the employee retention credit for the third and fourth quarter of 2021. As of December 31, 2021, $40.8 million remained in accounts receivable, net on our

consolidated balance sheet related to the CARES employee retention credit for the fourth quarter of 2020 and first and second quarters of 2021.

Finally, the CARES Act also provided for deferred payment of the employer portion of social security taxes through the end of 2020, with 50% of the deferred amount due December 31, 2021 and the remaining 50% due

December 31, 2022. During 2020, we deferred $23.2 million in social security tax payments. As of December 31, 2021, $11.7 million of deferred social security tax payments remains within other current liabilities on our

consolidated balance sheet.

18

We cannot predict whether the assistance from the Treasury through the PSP, PSP2 or PSP3 will be adequate to continue to pay our employees for the duration of the COVID-19 pandemic or whether additional assistance

will be required or available in the future. We previously applied to the Treasury for a secured loan through the CARES Act but we determined not to move forward with such loan in September 2020. There can be no assurance

that loans or other assistance will be available through the CARES Act or any future legislation, or whether we will be eligible to receive any additional assistance, if needed.

The deployment of new 5G C-band service by wireless communications service providers could have a material adverse effect on our operations, which in turn could negatively impact our business, results of

operations and financial condition.

On January 17, 2022, various executives of U.S. passenger airlines and cargo carriers, and airline industry associations, warned the U.S. federal government of the potential adverse impact the imminent deployment of

AT&T and Verizon’s new 5G C-band service would have on U.S. aviation operations. According to aviation leaders, the deployment of the new 5G C-band service could cause, among other consequences, operational and

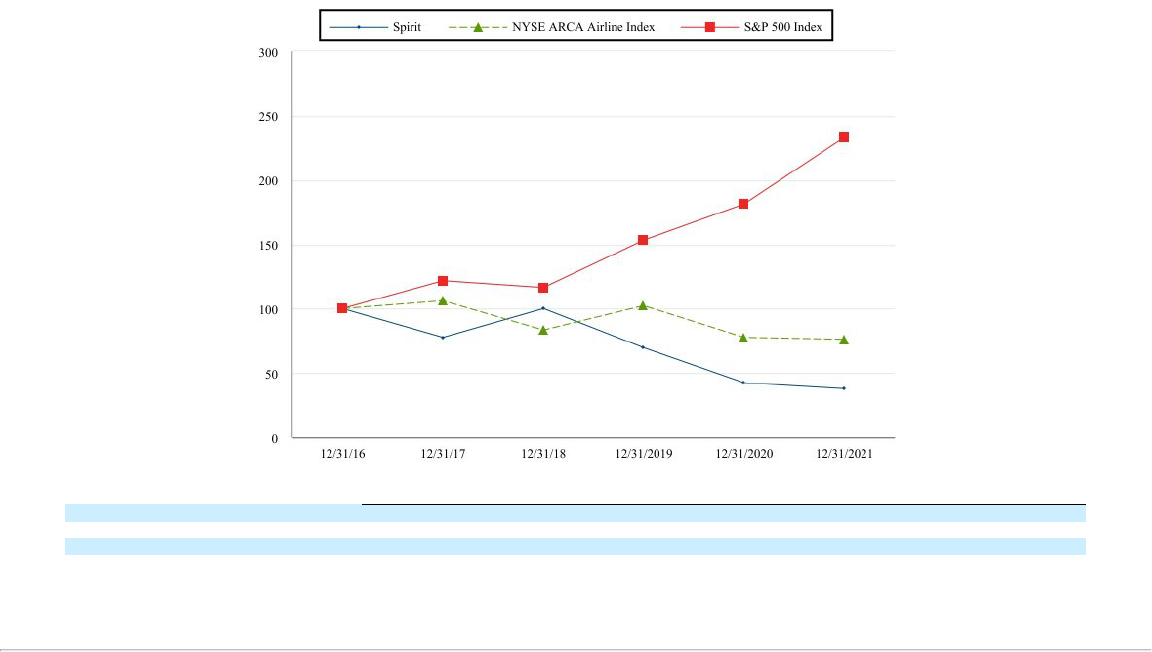

security issues, interference with critical aircraft instruments and adverse impact to low-visibility operations. Any of these consequences could potentially cause flight cancellations, diversions and delays, or could result in